Increasing Demand for Natural Gas

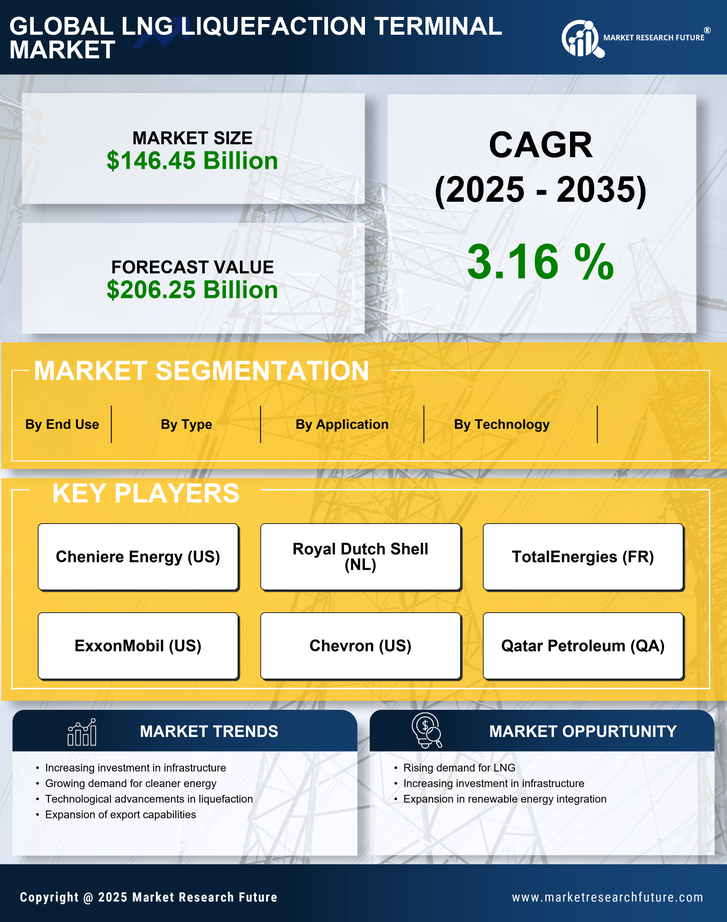

The LNG Liquefaction Terminal Market is experiencing a surge in demand for natural gas, driven by the transition towards cleaner energy sources. As countries strive to reduce carbon emissions, natural gas is increasingly viewed as a bridge fuel. According to recent data, the demand for LNG is projected to grow at a compound annual growth rate of approximately 5% over the next decade. This growth is likely to be fueled by the rising consumption of natural gas in power generation and industrial applications. Consequently, the expansion of LNG liquefaction terminals is essential to meet this burgeoning demand, as they play a critical role in the supply chain by converting natural gas into a liquid form for easier transportation and storage.

Regulatory Support for Cleaner Fuels

The LNG Liquefaction Terminal Market is benefiting from regulatory support aimed at promoting cleaner fuels. Governments worldwide are implementing policies and incentives to encourage the adoption of LNG as a cleaner alternative to coal and oil. This regulatory environment is fostering the growth of LNG liquefaction terminals, as they are essential for processing and exporting LNG. For instance, various countries have set ambitious targets for reducing greenhouse gas emissions, which is likely to increase the demand for LNG. As regulatory frameworks continue to evolve, they are expected to create a favorable landscape for the LNG liquefaction terminal market, driving further investments and development.

Rising Global Energy Security Concerns

The LNG Liquefaction Terminal Market is also being propelled by rising concerns over energy security. Nations are increasingly seeking to diversify their energy sources to mitigate risks associated with geopolitical tensions and supply disruptions. The strategic importance of LNG as a reliable energy source is becoming more pronounced, leading to investments in liquefaction terminals to ensure stable supply chains. Recent trends suggest that countries are prioritizing the establishment of LNG infrastructure to enhance their energy independence. This focus on energy security is likely to drive the expansion of the LNG liquefaction terminal market as nations strive to secure their energy futures.

Investment in Infrastructure Development

The LNG Liquefaction Terminal Market is witnessing substantial investments in infrastructure development. Governments and private entities are increasingly allocating funds to enhance terminal capacities and modernize existing facilities. For instance, recent reports indicate that investments in LNG infrastructure could exceed USD 100 billion by 2030. This influx of capital is likely to facilitate the construction of new liquefaction terminals, thereby increasing the overall capacity to process and export LNG. Enhanced infrastructure not only supports the growing demand for LNG but also improves the efficiency and reliability of supply chains, making it a pivotal driver for the LNG liquefaction terminal market.

Technological Innovations in Liquefaction Processes

Technological advancements in liquefaction processes are significantly influencing the LNG Liquefaction Terminal Market. Innovations such as the development of more efficient heat exchangers and advanced cryogenic technologies are enhancing the efficiency of LNG production. These improvements can lead to reduced operational costs and increased output, making liquefaction terminals more competitive. Furthermore, the integration of digital technologies, such as automation and data analytics, is optimizing terminal operations. As a result, companies are likely to invest in upgrading their facilities to leverage these advancements, thereby driving growth in the LNG liquefaction terminal market.