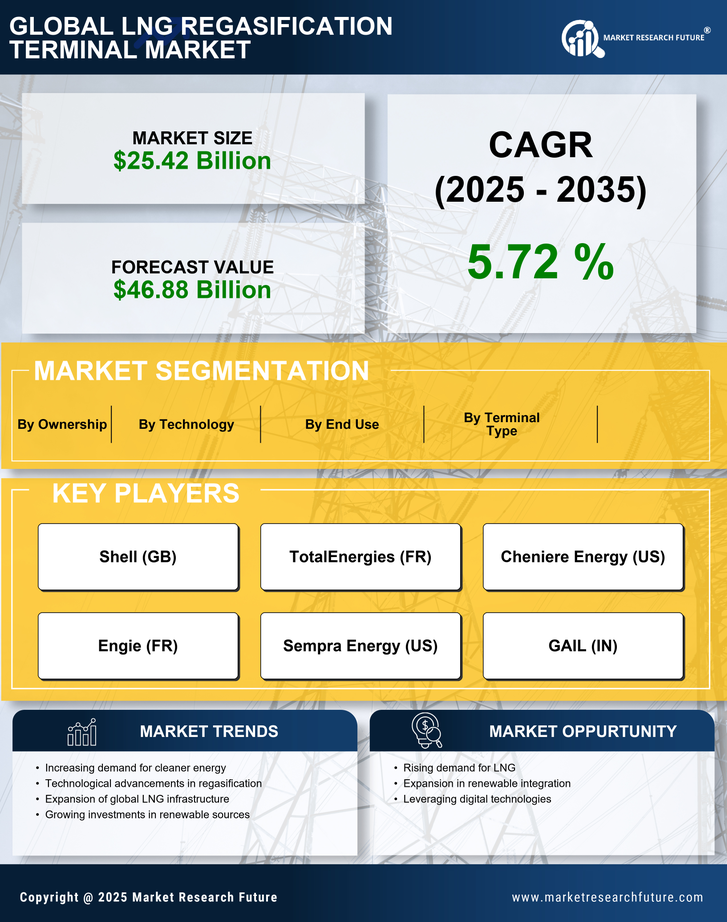

Increasing Demand for Natural Gas

The LNG Regasification Terminal Market is experiencing a surge in demand for natural gas as a cleaner alternative to coal and oil. This shift is driven by the need for energy security and the transition towards sustainable energy sources. According to recent data, natural gas consumption is projected to grow by approximately 1.5% annually, indicating a robust market for LNG regasification terminals. As countries aim to reduce carbon emissions, the reliance on LNG is likely to increase, necessitating the expansion of regasification infrastructure. This trend suggests that investments in LNG regasification terminals will be crucial to meet the rising demand for natural gas, thereby enhancing the overall market landscape.

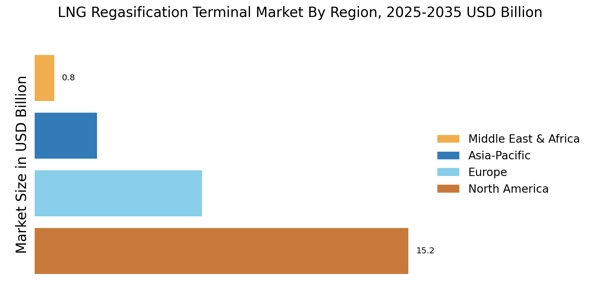

Infrastructure Development Initiatives

The LNG Regasification Terminal Market is significantly influenced by ongoing infrastructure development initiatives across various regions. Governments and private entities are investing heavily in the construction and expansion of LNG terminals to facilitate the import and regasification of liquefied natural gas. For instance, several countries have announced plans to enhance their LNG infrastructure, with investments exceeding billions of dollars. This development is expected to bolster the capacity of regasification terminals, thereby supporting the growing demand for LNG. Furthermore, the establishment of new terminals is likely to create job opportunities and stimulate economic growth, reinforcing the importance of infrastructure in the LNG regasification sector.

Regulatory Support and Policy Frameworks

The LNG Regasification Terminal Market is benefiting from favorable regulatory support and policy frameworks that promote the use of liquefied natural gas. Governments are implementing policies aimed at encouraging investments in LNG infrastructure, which includes tax incentives and streamlined permitting processes. Such regulatory environments are essential for attracting private investments, which are crucial for the development of new regasification terminals. Additionally, international agreements aimed at reducing greenhouse gas emissions are further incentivizing the shift towards LNG. This supportive regulatory landscape is likely to enhance the operational efficiency and competitiveness of the LNG regasification market, fostering growth in the sector.

Rising Investment in Renewable Energy Integration

The LNG Regasification Terminal Market is increasingly intersecting with the renewable energy sector as investments in renewable energy integration rise. The growing emphasis on energy diversification is prompting stakeholders to explore synergies between LNG and renewable sources. This trend is particularly evident in regions where LNG is being utilized as a backup energy source for intermittent renewable energy generation. The integration of LNG regasification terminals with renewable energy projects is likely to enhance energy reliability and stability, making it an attractive proposition for investors. As such, this convergence may lead to increased investments in LNG regasification infrastructure, further propelling market growth.

Technological Innovations in Regasification Processes

The LNG Regasification Terminal Market is witnessing advancements in technology that enhance the efficiency and effectiveness of regasification processes. Innovations such as improved heat exchangers and advanced control systems are being integrated into terminal operations, leading to reduced energy consumption and operational costs. These technological improvements not only optimize the regasification process but also contribute to the overall sustainability of LNG operations. As the industry continues to evolve, the adoption of cutting-edge technologies is expected to play a pivotal role in increasing the competitiveness of LNG regasification terminals, thereby driving market growth.