Increasing Energy Demand

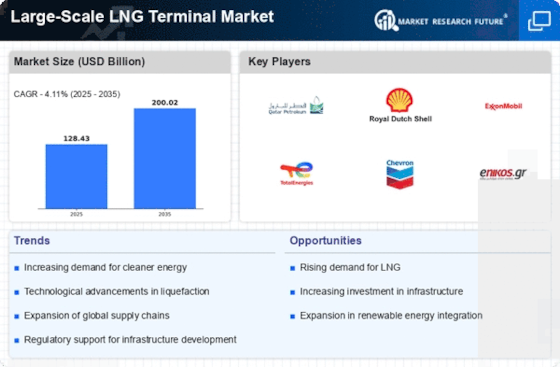

The Large-Scale LNG Terminal Market is experiencing a surge in energy demand, driven by industrial growth and urbanization. As economies expand, the need for reliable and cleaner energy sources becomes paramount. LNG is increasingly viewed as a transitional fuel, facilitating the shift from coal and oil to more sustainable energy solutions. According to recent data, the demand for LNG is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade. This growth is likely to be fueled by the rising consumption in emerging markets, where energy infrastructure is rapidly developing. Consequently, the expansion of LNG terminals is essential to meet this burgeoning demand, ensuring that supply chains are robust and capable of supporting future energy needs.

Technological Innovations

Technological innovations are reshaping the Large-Scale LNG Terminal Market, enhancing operational efficiency and safety. Advances in liquefaction and regasification technologies are enabling terminals to process larger volumes of LNG with reduced environmental impact. Innovations such as floating LNG terminals and automated systems are becoming more prevalent, allowing for greater flexibility in operations. Furthermore, the integration of digital technologies, including IoT and AI, is optimizing terminal management and maintenance. These advancements are expected to lower operational costs and improve the overall competitiveness of LNG as an energy source. As technology continues to evolve, it is likely that the market will see a proliferation of state-of-the-art LNG terminals, further solidifying LNG's role in the global energy landscape.

Investment in Infrastructure

Investment in infrastructure is a critical driver for the Large-Scale LNG Terminal Market. Governments and private entities are increasingly allocating funds to develop and enhance LNG terminal facilities. This trend is particularly evident in regions where energy security is a priority. For instance, investments in LNG infrastructure have been observed to exceed USD 100 billion in recent years, reflecting a commitment to expanding capacity and improving efficiency. Enhanced infrastructure not only facilitates the import and export of LNG but also supports the integration of renewable energy sources. As countries strive to diversify their energy portfolios, the establishment of advanced LNG terminals becomes vital for ensuring a stable and flexible energy supply.

Regulatory Support for Cleaner Fuels

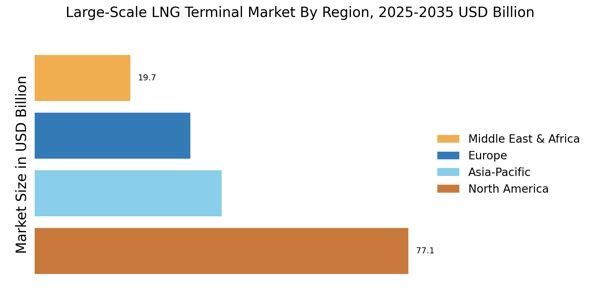

Regulatory support for cleaner fuels is significantly influencing the Large-Scale LNG Terminal Market. Governments worldwide are implementing policies that favor the use of LNG as a cleaner alternative to traditional fossil fuels. This regulatory landscape is characterized by incentives for LNG infrastructure development and stringent emissions standards for conventional fuels. For example, several countries have introduced tax breaks and subsidies for LNG projects, which can enhance the economic viability of terminal construction. As a result, the market is likely to witness an increase in LNG terminal projects, driven by favorable regulations that promote cleaner energy solutions. This shift not only aligns with global climate goals but also positions LNG as a key player in the transition to a low-carbon economy.

Geopolitical Stability and Trade Agreements

Geopolitical stability and trade agreements are pivotal factors influencing the Large-Scale LNG Terminal Market. The establishment of favorable trade agreements between countries can facilitate the flow of LNG, enhancing market accessibility. For instance, recent agreements between major LNG producers and importing nations have led to increased trade volumes, thereby necessitating the expansion of terminal capacities. Additionally, geopolitical stability in key producing regions ensures a consistent supply of LNG, which is crucial for meeting the energy needs of importing countries. As nations seek to secure their energy supplies amidst fluctuating global dynamics, the role of LNG terminals becomes increasingly vital in fostering energy security and promoting international trade.