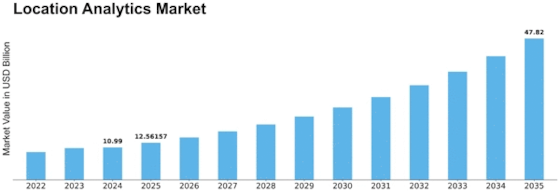

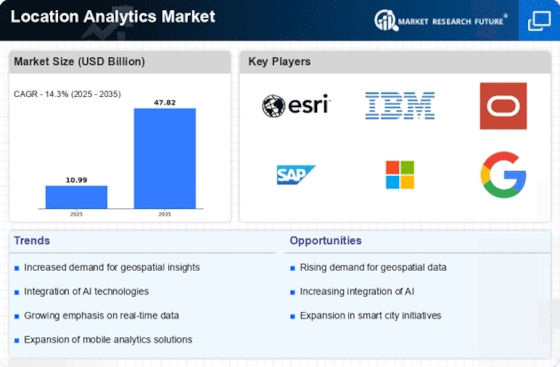

Location Analytics Size

Location Analytics Market Growth Projections and Opportunities

The Location Analytics market, however is facing a palette of intricate influences that are mainly responsible for putting the future of the market. In general, local|location-based services are the key component to lead to rise of implementation across different businesses. Organizations are understanding the fact of location in which they are able to target the customers, promoting their store networks, and other needs to be data driven. Therefore, the market chances of location analytics schemes have flourished and, thereafter, the market growth followed.

On the one hand, the multiplication of cell phones and the rapid growth of GPS technology variation play a big role in evolving the Location Intelligence market. During a time when cell phones have turned into a main feature of every day life, the adaption from mobile devices from simple telephones to smartphones has brought in the constant flow of location information vital for researchers. Marketing or businesses gather usefulness of this information so to understand customer inclinations, to achieve target marketing and to enhance their overall performance. As the geospatial data goes thru the process of market’s strong growth, the everlasting accessibility remains to be a significant contributor.

Along with other changes in the administration scene, such as the increasing position of central government and advent of cross-border ties, the market Location Analytics is heavily affected. Many authorities and undertakings required the rules on how to store and use the location information, the reasons concern security and privacy issues. Until these standards are adopted by companies working in the Location Analytics space it will be impossible to make the right decisions, concerning product development, as well company processes. Unfortunately, not holding oneself to protection standards leads to the loss of integrity and confidence within the customer and stakeholder base..

Furthermore, fundamentally it is the increasing practicality which is being widely used in all areas of business such as retail, health care and transportation, that influence the user uptake in the market. Businesses have been able to witness the revolutionary potentialities of location analytics in elevating functional processes, further developing customer encounters, and thus gaining an advantage. As market competitiveness elevates, these mindsets create new commercial opportunities that organizations actively try to find breakthrough services to stay in front in their respective fields.

The conversion to creative breakthroughs and the adoption of new technologies to create a future-oriented location analytics industry is just a core component of this scenario. In merging information from location data with computerized intelligence, AI and the Internet of Things (IoT), investigations and predictions can be made more powerful and precise. Employers could purposely switch individual experience from location information, thus establishing a qualitative pattern of interacting experience. The ongoing development of such innovations guarantees that the Location Analytics market braces itself for a future with dynamic organizations and emerging technologies.

Leave a Comment