Low speed vehicle Market Summary

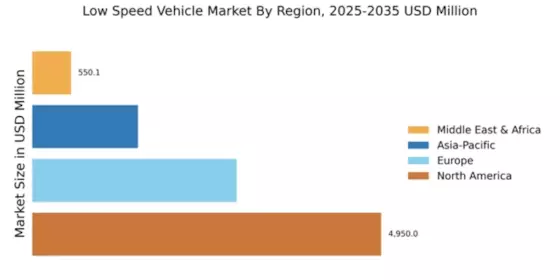

As per MRFR analysis, the Low Speed Vehicle Market Size was estimated at 9900.08 USD Million in 2024. The Low speed vehicle industry is projected to grow from 10377.46 USD Million in 2025 to 16619.45 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.82% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Low Speed Vehicle Market is experiencing a transformative shift towards sustainability and urban mobility solutions.

- The market is increasingly driven by a focus on sustainability, with consumers prioritizing eco-friendly transportation options.

- North America remains the largest market for low speed vehicles, while the Asia-Pacific region is recognized as the fastest-growing area.

- Personal transportation continues to dominate the market, whereas commercial use is emerging as the fastest-growing segment.

- Key market drivers include the rising demand for eco-friendly transportation and urbanization, which are shaping consumer preferences.

Market Size & Forecast

| 2024 Market Size | 9900.08 (USD Million) |

| 2035 Market Size | 16619.45 (USD Million) |

| CAGR (2025 - 2035) | 4.82% |

Major Players

Polaris Industries (US), Club Car (US), E-Z-GO (US), Garia (DK), Yamaha Motor (JP), Textron (US), Cushman (US), Star EV (US)