Regulatory Support for Safety Standards

The Global LPG Hose Market Industry benefits from stringent regulatory frameworks that promote safety in the handling and transportation of LPG. Governments worldwide are implementing and enforcing safety standards that require the use of high-quality hoses to prevent leaks and accidents. For example, regulations in the European Union mandate specific certifications for LPG hoses, which enhances market growth. As the industry evolves, compliance with these regulations is likely to drive innovation and improve product quality, ensuring that the market continues to expand towards the projected value of 5500 USD Million by 2035.

Expansion of LPG Distribution Infrastructure

The expansion of LPG distribution infrastructure plays a crucial role in the growth of the Global LPG Hose Market Industry. Investments in pipelines, storage facilities, and distribution networks are essential for ensuring the efficient delivery of LPG to end-users. Governments and private entities are collaborating to enhance infrastructure, particularly in regions with high growth potential. This development not only facilitates increased LPG consumption but also drives the demand for high-quality hoses that can withstand the rigors of transportation. As infrastructure improves, the market is poised for growth, aligning with the projected figures for 2024 and beyond.

Growing Demand for LPG in Emerging Economies

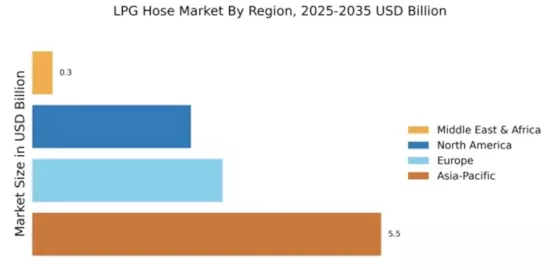

The Global LPG Hose Market Industry is experiencing a surge in demand driven by the increasing adoption of liquefied petroleum gas in emerging economies. Countries in Asia-Pacific and Africa are witnessing a rise in LPG consumption due to urbanization and the need for cleaner energy sources. For instance, the LPG market in India is projected to grow significantly, contributing to the overall market value expected to reach 3250 USD Million in 2024. This trend indicates a shift towards LPG as a preferred energy source, thereby bolstering the demand for LPG hoses that ensure safe and efficient transportation.

Rising Awareness of Environmental Sustainability

The Global LPG Hose Market Industry is influenced by the growing awareness of environmental sustainability among consumers and businesses. As LPG is considered a cleaner alternative to traditional fossil fuels, its adoption is increasing in various sectors, including residential, commercial, and industrial applications. This shift is prompting manufacturers to focus on producing eco-friendly hoses that meet sustainability criteria. The increasing preference for environmentally responsible products is likely to contribute to the market's expansion, as evidenced by the anticipated growth in market value to 5500 USD Million by 2035.

Technological Advancements in Hose Manufacturing

Technological innovations in the manufacturing processes of LPG hoses are significantly impacting the Global LPG Hose Market Industry. Advanced materials and production techniques are leading to the development of hoses that are more durable, flexible, and resistant to extreme temperatures and pressures. For instance, the introduction of thermoplastic elastomers has improved the performance of LPG hoses, making them safer and more reliable. This trend not only enhances product offerings but also aligns with the projected CAGR of 4.9% from 2025 to 2035, indicating a robust growth trajectory driven by technological enhancements.