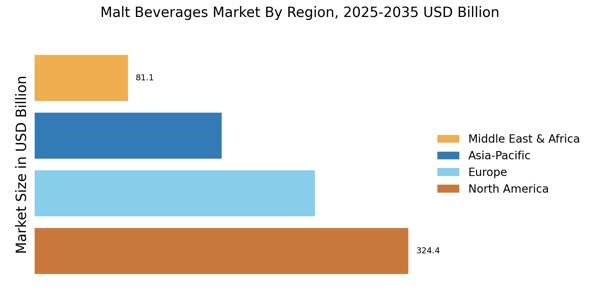

North America : Market Leader in Consumption

North America is the largest market for malt beverages, holding approximately 40% of the global market share. The region's growth is driven by increasing consumer preference for craft beers and innovative flavors, alongside a robust distribution network. Regulatory support for alcohol production and sales has further catalyzed market expansion, with a focus on sustainability and local sourcing.

The United States is the leading country in this region, with significant contributions from Canada. Major players like Anheuser-Busch InBev and Molson Coors dominate the landscape, leveraging their extensive portfolios and marketing strategies. The competitive environment is characterized by a mix of large corporations and emerging craft breweries, fostering innovation and diversity in product offerings.

Europe : Cultural Hub for Malt Beverages

Europe is the second-largest market for malt beverages, accounting for around 30% of the global share. The region's growth is fueled by a rich cultural heritage of brewing, increasing demand for premium and organic products, and favorable regulations promoting local breweries. Countries like Germany and the UK are at the forefront, with a strong inclination towards craft and specialty beers.

Germany leads the market, followed closely by the UK, where traditional brewing methods meet modern consumer preferences. Key players such as Heineken and Carlsberg are well-established, while numerous craft breweries are emerging, enhancing competition. The European market is characterized by a diverse range of flavors and styles, appealing to a broad consumer base.

Asia-Pacific : Emerging Market with Potential

Asia-Pacific is an emerging powerhouse in the malt beverages market, holding approximately 20% of the global share. The region's growth is driven by increasing disposable incomes, urbanization, and a shift in consumer preferences towards alcoholic beverages. Countries like China and Japan are leading this trend, with a growing interest in craft beers and international brands.

China is the largest market in the region, followed by Japan, where traditional brewing techniques are being revitalized. The competitive landscape features both local and international players, including Asahi and Kirin, who are expanding their product lines to cater to evolving consumer tastes. The region's market dynamics are influenced by changing regulations and a focus on quality and innovation.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa represent a resource-rich frontier for the malt beverages market, holding about 10% of the global share. The region's growth is driven by a young population, increasing urbanization, and a gradual shift in cultural attitudes towards alcohol consumption. Countries like South Africa and Nigeria are leading the charge, with a rising demand for both local and imported malt beverages.

South Africa is the largest market in this region, with a diverse range of products available. The competitive landscape is evolving, with both established brands and new entrants vying for market share. Key players like Diageo and SABMiller are focusing on innovation and local partnerships to enhance their presence in this burgeoning market.