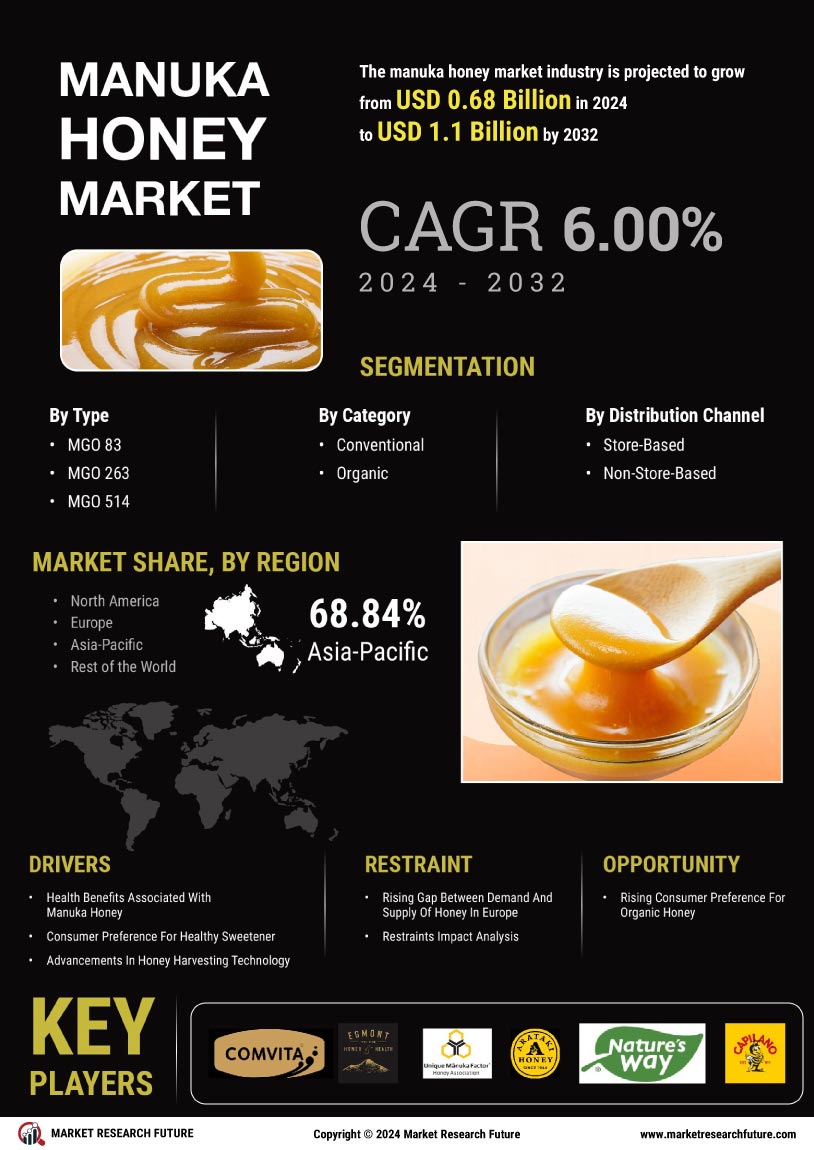

The Manuka Honey Market is currently experiencing a notable evolution across the global manuka honey market, driven by increasing consumer awareness regarding health benefits and natural remedies. This honey, derived from the nectar of the Manuka tree, is recognized for its unique properties, particularly its antibacterial qualities. As consumers gravitate towards organic and natural products, the demand for Manuka honey appears to be on the rise. Retailers are responding by expanding their offerings, which may lead to greater accessibility for consumers. Furthermore, the trend towards sustainable sourcing practices is becoming more pronounced, as brands seek to align with environmentally conscious consumers. In addition to health benefits, the Manuka Honey Market is witnessing a surge in interest from the culinary sector. Chefs and food enthusiasts are increasingly incorporating this honey into gourmet dishes, which could enhance its appeal beyond traditional uses. traditional uses. The market landscape reflects growing market dominance of mgo-rated manuka honey, particularly among premium product offerings with certified potency levels. This competition may foster innovation in product offerings, such as flavored varieties or unique packaging solutions. Overall, the Manuka Honey Market seems poised for continued growth, driven by evolving consumer preferences and a commitment to quality and sustainability.

Rising Health Consciousness

Manuka honey benefits are widely recognized due to its natural antibacterial, anti-inflammatory, and antioxidant properties, making it popular for supporting digestive health, soothing sore throats, boosting immunity, and aiding skin care and wound healing. The manuka honey market US continues to grow as consumers increasingly prefer natural and functional foods, with strong demand across health stores, specialty retailers, and online platforms. A key quality indicator is manuka honey MGO ratings explained, where MGO measures the level of methylglyoxal responsible for antibacterial activity, and higher ratings indicate stronger potency and therapeutic value. Because of its limited supply and certified grading systems, manuka honey price per oz is typically higher than regular honey, especially for products with elevated MGO or UMF levels. When comparing UMF vs MGO manuka honey, UMF represents a broader certification that verifies authenticity and multiple bioactive markers, while MGO focuses specifically on antibacterial strength, helping consumers choose the right Manuka honey based on quality, potency, and intended use.

There is a growing trend among consumers towards health and wellness, which is influencing their purchasing decisions. Manuka honey, known for its potential health benefits, is increasingly favored as a natural remedy. This shift suggests that consumers are more inclined to seek out products that align with their health goals.

Culinary Innovation

The culinary sector is embracing Manuka honey, integrating it into various gourmet dishes and beverages. This trend indicates a broader acceptance of the product beyond traditional uses, potentially attracting a new demographic of consumers who appreciate unique flavors and high-quality ingredients.

Sustainability Focus

Sustainability is becoming a key consideration for consumers, prompting brands in the Manuka Honey Market to adopt environmentally friendly practices. This trend reflects a growing awareness of ecological issues, suggesting that consumers are more likely to support brands that prioritize sustainable sourcing and production methods.