Meat Market Summary

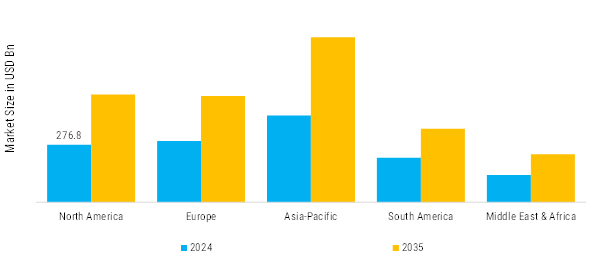

As per Market Research Future analysis, The Meat Market Size Was Valued at USD 1,337.11 Billion In 2024. The Meat Market Industry Is Projected to grow from USD 1,409.98 Billion in 2025 to USD 2,413.28 Billion by 2035, Exhibiting A Compound Annual Growth Rate (CAGR) of 5.45% during the Forecast Period (2025 – 2035).

Key Market Trends & Highlights

The Meat Market is witnessing transformative shifts driven by consumer preferences, technological advances, and sustainability pressures.

- Urban consumers favor ready-to-eat (RTE), ready-to-cook (RTC), marinated, and heat-and-serve meats, boosted by time scarcity. Innovations like high-pressure processing (HPP), vacuum skin packaging (VSP), and modified atmosphere packaging (MAP) extend shelf life and cut waste.

- Trade surges in bovine meat, with Brazil setting export records via demand and exchange rates; Australia benefits from pricing, while China cuts imports on domestic strength.

- E-commerce explodes with D2C platforms, subscription boxes, and cold-chain logistics for traceable fresh meat. AI optimizes shopping and processing; smart packaging with QR traceability enhances trust.

- Hybrid products blend meat with plant-based elements, appealing to flexitarians via health and ethics. These address welfare and chain efficiency, starting in premium channels before mainstreaming as costs drop.

Market Size & Forecast

| 2024 Market Size | 1,337.11 (USD Billion) |

| 2035 Market Size | 1,409.98 (USD Billion) |

| CAGR (2025 - 2035) | 5.45% |

Major Players

Scandi Standard AB, MHP, Gruppo Veronesi, Animex, Plukon Food Group, Galliance, Avara Foods Ltd, Amadori, Hubers Landhendl, Wipasz S.A, SuperDrob S.A, Drosed Holding S.A, Grupa Cedrob, Landgeflügel FG Vertriebsgesellschaft mbH, PHW Group.