Medical Robotics Market Summary

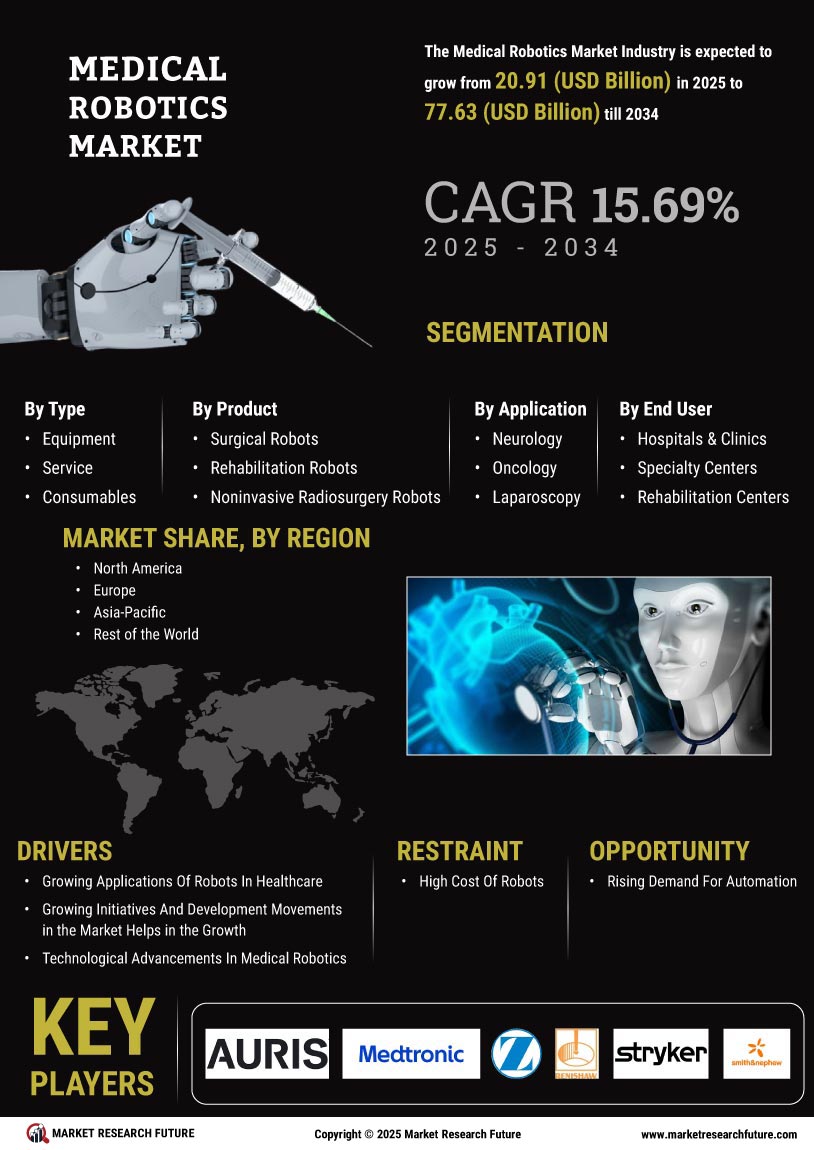

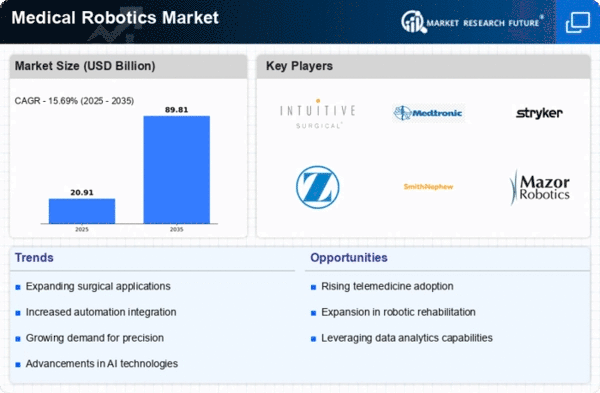

As per MRFR analysis, the Medical Robotics Market was estimated at 18.07 Billion USD in 2024. The Medical Robotics industry is projected to grow from 20.91 Billion USD in 2025 to 89.81 Billion USD by 2035, exhibiting a compound annual growth rate (CAGR) of 15.69% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Medical Robotics Market is poised for substantial growth driven by technological advancements and increasing demand for minimally invasive procedures.

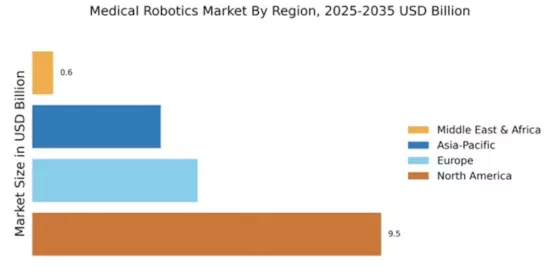

- The market experiences increased adoption of robotic surgery, particularly in North America, which remains the largest market.

- Integration of AI and machine learning is transforming surgical robotics, enhancing precision and outcomes.

- Rehabilitation robotics is expanding rapidly, especially in the Asia-Pacific region, which is the fastest-growing market.

- Key drivers include the rising demand for minimally invasive procedures and technological advancements in robotics, particularly in hospitals and ambulatory surgical centers.

Market Size & Forecast

| 2024 Market Size | 18.07 (USD Billion) |

| 2035 Market Size | 89.81 (USD Billion) |

| CAGR (2025 - 2035) | 15.69% |

Major Players

Intuitive Surgical (US), Medtronic (US), Stryker (US), Zimmer Biomet (US), Smith & Nephew (GB), Mazor Robotics (IL), Accuray (US), Corindus Vascular Robotics (US), TransEnterix (US)