Increased Healthcare Expenditure

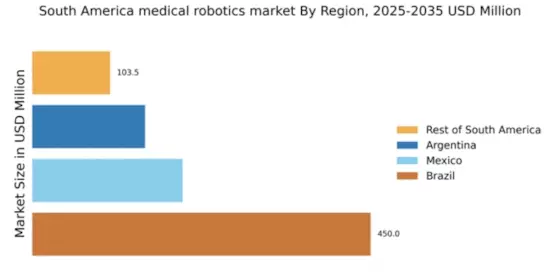

In South America, there is a marked increase in healthcare expenditure, which is positively influencing the medical robotics market. Governments and private sectors are allocating more funds towards healthcare infrastructure, including the acquisition of advanced medical technologies. For instance, Brazil's healthcare spending is projected to rise by 10% annually, facilitating the purchase of robotic surgical systems. This financial commitment enables hospitals to enhance their surgical capabilities and improve patient care. As healthcare budgets expand, the medical robotics market is likely to benefit from increased investments in robotic technologies, fostering innovation and growth.

Aging Population and Chronic Diseases

The aging population in South America is a critical driver for the medical robotics market. As the demographic shifts towards an older population, the prevalence of chronic diseases such as cardiovascular conditions and orthopedic issues is rising. This demographic trend necessitates advanced surgical interventions, which robotic systems can provide. The World Health Organization estimates that by 2030, the number of people aged 60 and older in South America will reach 200 million, creating a substantial market for robotic-assisted surgeries. Consequently, healthcare providers are increasingly adopting robotic technologies to cater to this growing patient base, thereby propelling the medical robotics market.

Technological Advancements in Robotics

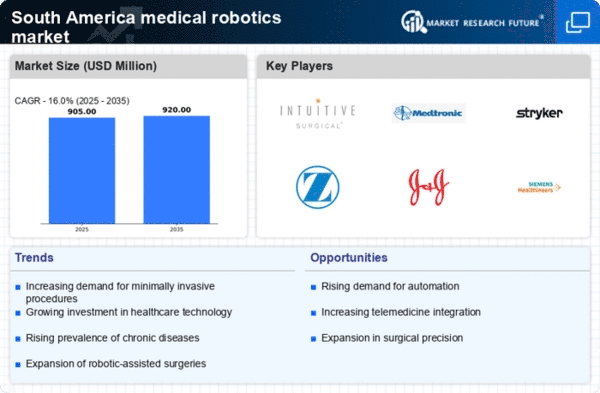

The medical robotics market in South America is experiencing a surge due to rapid technological advancements. Innovations in robotic systems, such as enhanced precision and minimally invasive techniques, are transforming surgical procedures. For instance, robotic-assisted surgeries have shown to reduce recovery times by up to 30%, which is appealing to both healthcare providers and patients. Furthermore, the integration of artificial intelligence and machine learning into robotic systems is expected to improve surgical outcomes significantly. As hospitals and clinics invest in these advanced technologies, the medical robotics market is projected to grow at a CAGR of 15% over the next five years, indicating a robust demand for sophisticated robotic solutions.

Growing Awareness and Acceptance of Robotics

The growing awareness and acceptance of robotic technologies among healthcare professionals and patients are driving the medical robotics market in South America. Educational initiatives and successful case studies are helping to demystify robotic surgeries, leading to greater trust and willingness to adopt these advanced methods. As more surgeons become trained in robotic techniques, the utilization of these systems is expected to rise. Surveys indicate that over 70% of patients are open to robotic-assisted surgeries when informed about their benefits. This shift in perception is likely to enhance the market's growth trajectory, as acceptance translates into increased demand for robotic solutions.

Rising Demand for Minimally Invasive Procedures

There is a notable increase in the demand for minimally invasive procedures within the medical robotics market in South America. Patients are increasingly opting for surgeries that promise reduced pain, shorter hospital stays, and quicker recoveries. This trend is supported by a growing body of evidence suggesting that robotic-assisted surgeries can lead to fewer complications and improved patient satisfaction. As a result, healthcare facilities are investing in robotic systems to meet this demand. The market for robotic surgical systems is expected to reach approximately $1.5 billion by 2026, reflecting a significant opportunity for growth in the medical robotics market.