Expansion of Electronics Industry

The expansion of the electronics industry is significantly influencing the Metal And Ceramic Injection Molding Market. With the proliferation of smart devices and consumer electronics, there is a growing need for precision-engineered components. Injection molding offers the capability to produce complex shapes and fine details that are essential for electronic applications. Recent market analysis suggests that the electronics sector is projected to contribute approximately 25% to the overall market growth in the coming years. This demand is likely to drive further investments in research and development, fostering innovation within the industry.

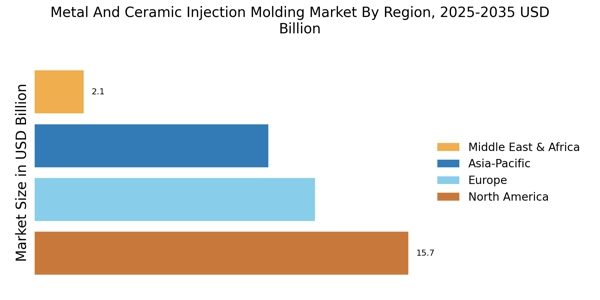

Growing Demand from Automotive Sector

The automotive sector is a major contributor to the Metal And Ceramic Injection Molding Market, with an increasing demand for lightweight and durable components. As manufacturers strive to enhance fuel efficiency and reduce emissions, the need for advanced materials is paramount. Injection molding allows for the production of intricate parts that meet stringent safety and performance standards. Recent statistics indicate that the automotive industry accounts for nearly 30% of the total market share in metal and ceramic injection molding. This trend is expected to continue, as automakers increasingly adopt these technologies to innovate and improve vehicle performance.

Rising Applications in Medical Devices

The Metal And Ceramic Injection Molding Market is witnessing a rising application in the medical devices sector. The need for high-precision components that meet stringent regulatory standards is driving manufacturers to adopt injection molding techniques. This method allows for the production of intricate parts with high dimensional accuracy, essential for medical applications. Recent data indicates that the medical devices segment is expected to grow at a CAGR of 10% over the next five years, reflecting the increasing reliance on advanced manufacturing processes. As healthcare technology evolves, the demand for metal and ceramic components is likely to expand, further propelling market growth.

Sustainability Initiatives in Manufacturing

Sustainability initiatives are becoming a pivotal driver in the Metal And Ceramic Injection Molding Market. Manufacturers are increasingly focusing on eco-friendly practices, such as reducing energy consumption and minimizing waste during production. The adoption of recyclable materials and the implementation of closed-loop systems are gaining traction. This shift not only meets regulatory requirements but also aligns with consumer preferences for sustainable products. According to recent data, companies that prioritize sustainability report a 20% increase in customer loyalty. As environmental concerns continue to rise, the market is likely to see a significant transformation, with sustainability becoming a core aspect of business strategies.

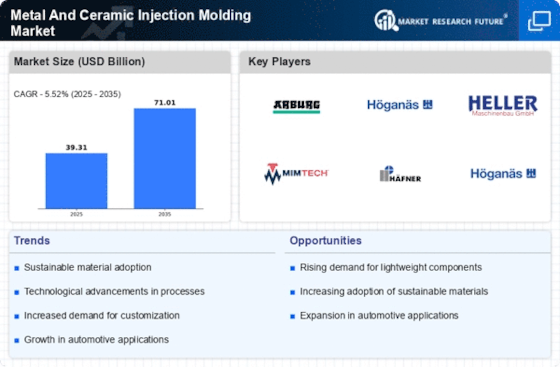

Technological Advancements in Metal and Ceramic Injection Molding

The Metal And Ceramic Injection Molding Market is experiencing a surge in technological advancements that enhance production efficiency and product quality. Innovations such as improved molding techniques and advanced materials are being integrated into manufacturing processes. For instance, the introduction of high-performance polymers and metal alloys allows for the creation of complex geometries that were previously unattainable. This evolution not only reduces waste but also shortens production cycles, making it more cost-effective. As a result, companies are increasingly adopting these technologies to remain competitive. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these advancements.