Innovations in Material Science

Advancements in material science are propelling the Metal Injection Molding (MIM) in Medical Applications Market forward. The development of new alloys and composite materials enhances the performance characteristics of MIM-produced components, making them suitable for a wider range of medical applications. For instance, the introduction of bio-compatible materials allows for the production of implants that integrate seamlessly with human tissue. This innovation is likely to expand the scope of MIM in the medical field, as manufacturers seek to leverage these materials to create devices that meet specific clinical needs. The ongoing research in material properties could lead to breakthroughs that further enhance the capabilities of MIM technology.

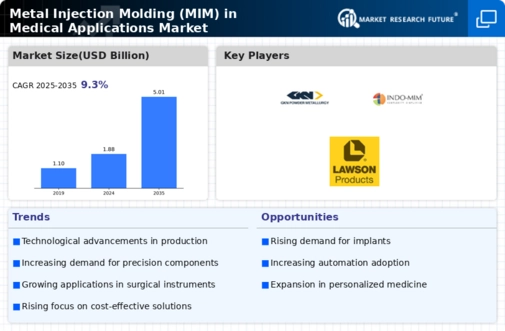

Cost Efficiency and Material Utilization

Cost efficiency remains a critical factor driving the Metal Injection Molding (MIM) in Medical Applications Market. MIM technology allows for the mass production of complex metal parts with minimal waste, which is particularly advantageous in the medical field where precision is paramount. The process can reduce production costs by up to 30% compared to traditional manufacturing methods. Furthermore, the ability to utilize a variety of materials, including stainless steel and titanium, enhances the versatility of MIM in producing medical devices. As healthcare organizations seek to optimize budgets while maintaining quality, the cost-effectiveness of MIM is likely to attract more investments and applications in the medical sector.

Regulatory Compliance and Quality Standards

The stringent regulatory environment surrounding medical devices is a significant driver for the Metal Injection Molding (MIM) in Medical Applications Market. Manufacturers are required to adhere to rigorous quality standards, which MIM processes can meet effectively. The ability to produce components that comply with ISO and FDA regulations enhances the credibility of MIM-produced medical devices. As the industry continues to evolve, the emphasis on quality assurance and traceability is expected to grow, further solidifying MIM's role in the production of reliable medical components. This compliance not only ensures patient safety but also fosters trust among healthcare providers and patients alike.

Growing Aging Population and Chronic Diseases

The increasing aging population and the prevalence of chronic diseases are driving the Metal Injection Molding (MIM) in Medical Applications Market. As the demographic shifts towards an older population, the demand for medical devices, including orthopedic implants and surgical instruments, is expected to rise. MIM technology is well-suited to meet this demand due to its ability to produce high-quality, durable components that are essential for effective treatment. Reports indicate that the global burden of chronic diseases is escalating, necessitating innovative solutions in medical manufacturing. MIM's capacity to deliver precision-engineered parts could play a pivotal role in addressing these healthcare challenges.

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive surgical techniques is a notable driver in the Metal Injection Molding (MIM) in Medical Applications Market. These procedures often require precision-engineered components that MIM can provide, such as intricate surgical instruments and implants. As healthcare providers aim to reduce patient recovery times and improve surgical outcomes, the demand for MIM-produced parts is likely to rise. According to industry estimates, the market for minimally invasive surgeries is projected to grow significantly, which in turn could bolster the MIM sector. The ability of MIM to produce complex geometries with high accuracy aligns well with the needs of this evolving medical landscape.