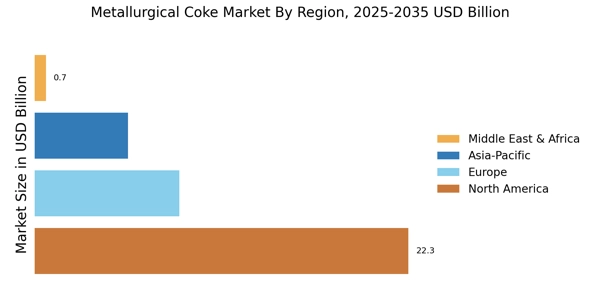

Emerging Economies

Emerging economies are becoming increasingly significant players in the Metallurgical Coke Market. Countries such as India and Brazil are witnessing rapid industrialization and urbanization, leading to heightened demand for steel and, consequently, metallurgical coke. Recent statistics suggest that these regions are expected to contribute substantially to global steel production growth, with projections indicating a rise of over 5% in the coming years. This trend is likely to create new opportunities for metallurgical coke suppliers, as they seek to establish partnerships with steel manufacturers in these burgeoning markets. The dynamics of emerging economies could reshape the landscape of the metallurgical coke market, fostering competition and innovation.

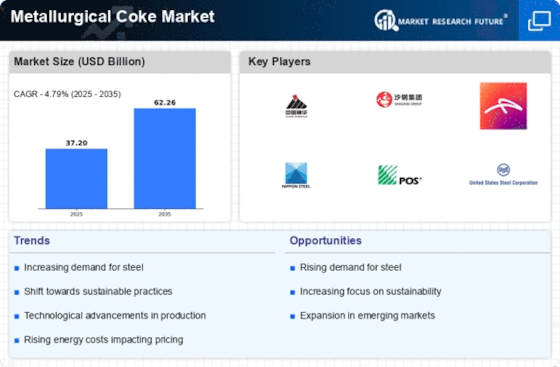

Rising Steel Production

The Metallurgical Coke Market is experiencing a surge in demand due to the increasing production of steel. As steel remains a fundamental material in construction and manufacturing, the need for metallurgical coke, a key ingredient in the steel-making process, is likely to rise. Recent data indicates that steel production has been on an upward trajectory, with estimates suggesting a growth rate of approximately 3% annually. This trend is expected to continue, driven by infrastructure projects and industrial activities across various regions. Consequently, the metallurgical coke market is poised to benefit from this robust demand, as steel manufacturers seek reliable sources of high-quality coke to enhance their production efficiency.

Environmental Regulations

The Metallurgical Coke Market is also influenced by stringent environmental regulations aimed at reducing carbon emissions. As countries implement policies to combat climate change, the steel industry faces pressure to adopt cleaner production methods. This shift may lead to increased investments in technologies that enhance the efficiency of metallurgical coke usage or develop alternative materials. For example, some steel manufacturers are exploring the use of biomass or other sustainable sources as substitutes for traditional metallurgical coke. While this transition may pose challenges, it also presents opportunities for innovation within the metallurgical coke market, as companies adapt to meet regulatory requirements and consumer preferences for greener products.

Technological Innovations

Technological innovations are reshaping the Metallurgical Coke Market by enhancing production processes and improving product quality. Advances in carbonization technology and the development of more efficient coke ovens are enabling manufacturers to produce higher-quality metallurgical coke with reduced environmental impact. Recent advancements suggest that these technologies could lead to a decrease in production costs and an increase in yield. As steel producers seek to optimize their operations, the demand for technologically advanced metallurgical coke is likely to rise. This trend indicates a shift towards more sustainable practices within the industry, as companies leverage technology to meet both economic and environmental objectives.

Infrastructure Development

Infrastructure development plays a pivotal role in driving the Metallurgical Coke Market. Governments and private sectors are increasingly investing in infrastructure projects, including roads, bridges, and buildings. This investment is anticipated to bolster steel demand, which in turn fuels the need for metallurgical coke. For instance, recent reports indicate that infrastructure spending is projected to reach trillions of dollars over the next decade. As steel is a primary material for these projects, the metallurgical coke market is likely to see a corresponding increase in demand. The interplay between infrastructure growth and metallurgical coke consumption suggests a favorable outlook for the industry, as stakeholders align their strategies to capitalize on this trend.

.png)