Growth of Remote Work Culture

The shift towards remote work in Mexico has created new challenges for network security, thereby impacting the network probe market. As more employees work from home, organizations are compelled to secure their networks against potential vulnerabilities. This trend is expected to drive a 20% increase in the adoption of network probes by 2025, as companies seek to monitor remote access points and ensure data integrity. The network probe market is thus adapting to these changes, offering solutions that cater to the unique needs of remote work environments, including enhanced visibility and control over distributed networks.

Rising Investment in IT Security

In Mexico, there is a marked increase in investment in IT security, which is positively affecting the network probe market. Organizations are allocating larger budgets to cybersecurity measures, with an expected growth of 25% in IT security spending by 2025. This trend reflects a broader recognition of the importance of protecting digital assets. The network probe market stands to gain from this investment, as businesses seek to implement comprehensive security frameworks that include advanced monitoring tools. As a result, the demand for network probes is likely to rise, driven by the need for effective threat detection and response capabilities.

Expansion of Digital Infrastructure

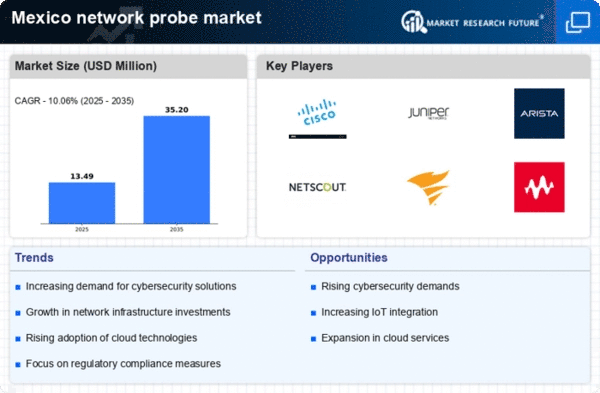

The rapid expansion of digital infrastructure in Mexico is significantly influencing the network probe market. With the increasing adoption of cloud computing and IoT devices, the complexity of network environments is rising. This complexity necessitates the deployment of advanced network probes to ensure optimal performance and security. In 2025, it is estimated that the digital infrastructure investment will reach $10 billion, further propelling the network probe market. As organizations strive to maintain seamless connectivity and protect sensitive data, the demand for sophisticated network monitoring solutions is likely to escalate.

Emergence of Compliance Requirements

The emergence of compliance requirements in Mexico is shaping the network probe market landscape. As regulatory bodies enforce stricter data protection laws, organizations are compelled to adopt network monitoring solutions to ensure compliance. By 2025, it is anticipated that compliance-related investments will account for 30% of the overall IT budget. This shift is prompting businesses to integrate network probes into their security strategies, as they seek to demonstrate adherence to regulations. The network probe market is thus positioned to thrive, as companies prioritize compliance and risk management in their operational frameworks.

Increasing Demand for Network Security Solutions

The network probe market in Mexico is experiencing a notable surge in demand for security solutions. As cyber threats become more sophisticated, organizations are increasingly investing in network probes to enhance their security posture. In 2025, the market is projected to grow by approximately 15%, driven by the need for real-time monitoring and threat detection. This trend is particularly evident among small and medium-sized enterprises (SMEs) that are recognizing the importance of safeguarding their networks. The network probe market is thus positioned to benefit from this heightened awareness, as businesses seek to mitigate risks associated with data breaches and cyberattacks.