Rising Cyber Threats

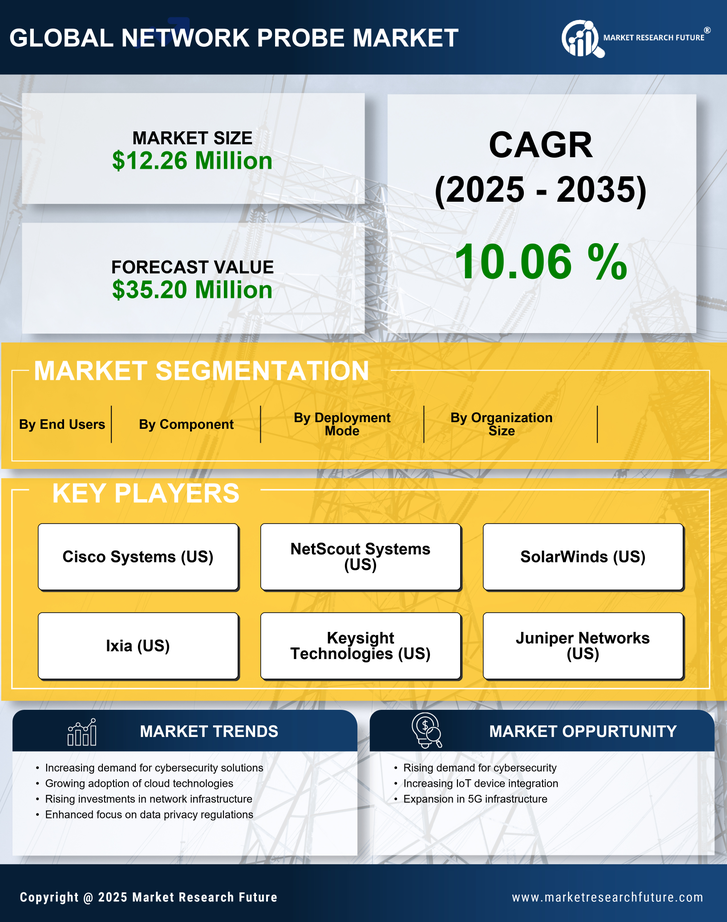

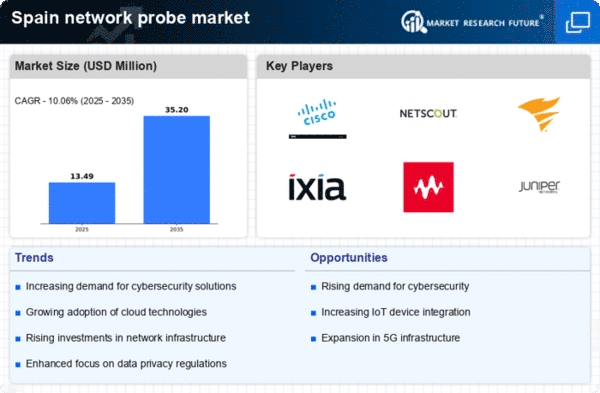

The network probe market in Spain is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to invest in advanced network monitoring solutions to safeguard their data and infrastructure. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting Spanish companies to prioritize cybersecurity. The network probe market industry is thus witnessing heightened demand as firms seek to enhance their threat detection capabilities. This trend is likely to continue as the digital landscape evolves, necessitating robust security measures to protect sensitive information. As a result, the network probe market is positioned for significant expansion, driven by the urgent need for effective cybersecurity solutions.

Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices in Spain is significantly impacting the network probe market. As more devices connect to networks, the complexity of managing and securing these connections increases. The network probe market industry is adapting to this trend by offering solutions that can effectively monitor and analyze traffic generated by IoT devices. In 2025, it is anticipated that the number of connected IoT devices in Spain will exceed 1 billion, creating a pressing need for robust network monitoring solutions. This surge in IoT adoption is likely to drive demand for network probes, as organizations seek to ensure the security and performance of their networks amidst this growing connectivity.

Shift Towards Remote Work

The shift towards remote work in Spain has transformed the landscape of network security, thereby influencing the network probe market. As organizations embrace flexible work arrangements, the need for secure remote access to corporate networks has become paramount. The network probe market industry is responding by providing solutions that enable organizations to monitor remote connections and detect potential vulnerabilities. In 2025, it is projected that remote work will account for over 30% of the workforce in Spain, necessitating enhanced security measures. This trend is likely to drive the adoption of network probes, as companies seek to protect their data and maintain operational integrity in a distributed work environment.

Regulatory Compliance Requirements

In Spain, stringent regulatory frameworks regarding data protection and privacy are influencing the network probe market. The implementation of regulations such as the General Data Protection Regulation (GDPR) mandates organizations to ensure the security of personal data. Consequently, businesses are increasingly adopting network probes to monitor compliance and mitigate risks associated with data breaches. The network probe market industry is expected to grow as companies invest in technologies that facilitate adherence to these regulations. In 2025, the market is projected to expand by approximately 15%, driven by the need for compliance solutions. This regulatory landscape compels organizations to integrate advanced monitoring tools, thereby enhancing the overall security posture.

Investment in Network Infrastructure

Investment in network infrastructure is a key driver for the network probe market in Spain. As businesses expand their digital capabilities, there is a growing need for reliable and secure network systems. The network probe market industry is benefiting from this trend, as organizations seek to implement advanced monitoring solutions to optimize network performance. In 2025, it is estimated that spending on network infrastructure in Spain will reach €5 billion, reflecting a commitment to enhancing connectivity and security. This investment is likely to spur demand for network probes, as companies aim to ensure their networks are resilient and capable of supporting increased data traffic.