Increased Network Complexity

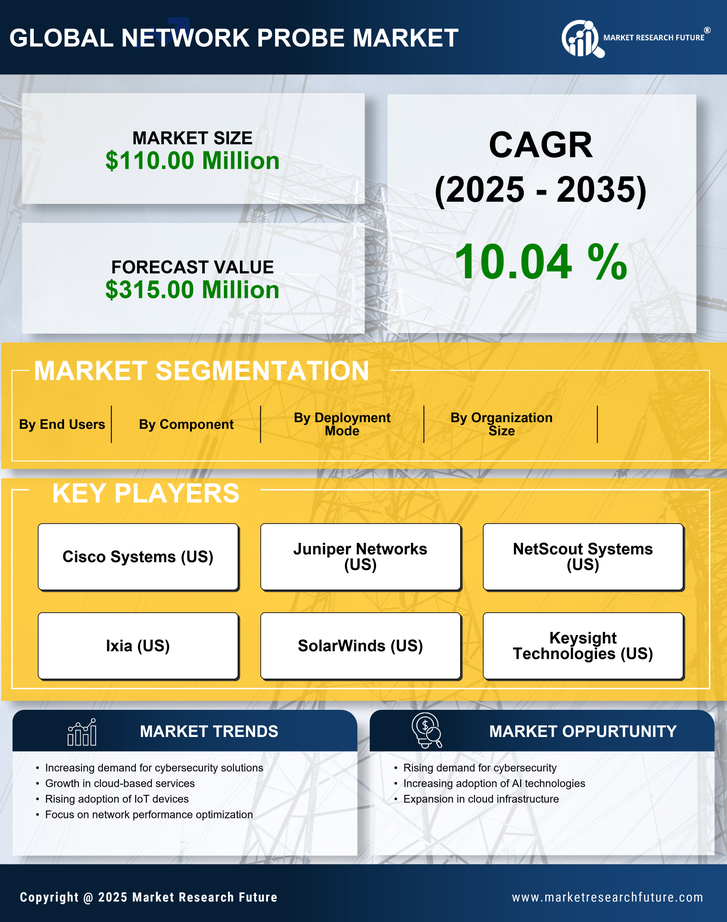

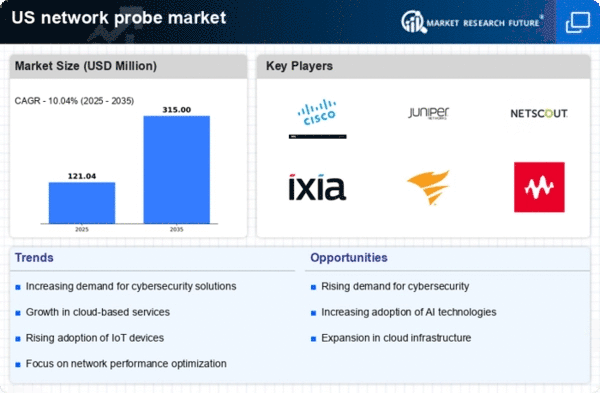

As businesses adopt more sophisticated IT infrastructures, the complexity of networks has surged. The proliferation of cloud services, IoT devices, and remote work arrangements necessitates advanced monitoring tools. In 2025, it is projected that the number of connected devices will exceed 30 billion in the US alone, creating challenges for network management. Network probes are essential for navigating this complexity, providing insights into traffic patterns and performance metrics. The network probe market is likely to benefit from this trend, as organizations require tools that can effectively manage and analyze vast amounts of data across diverse environments.

Rising Cybersecurity Threats

The network probe market is experiencing growth due to the escalating threats posed by cybercriminals. As organizations increasingly rely on digital infrastructure, the need for robust security measures becomes paramount. In 2025, it is estimated that cybercrime will cost businesses over $10 trillion annually, highlighting the urgency for effective monitoring solutions. Network probes play a crucial role in identifying vulnerabilities and detecting intrusions in real-time. This heightened awareness of cybersecurity risks drives demand for advanced network probe technologies, as companies seek to safeguard sensitive data and maintain operational integrity. The network probe market is thus positioned to expand significantly as organizations prioritize investments in security solutions.

Regulatory Compliance Requirements

The network probe market is influenced by stringent regulatory frameworks that mandate data protection and privacy. In the US, regulations such as the CCPA and HIPAA impose strict guidelines on how organizations handle sensitive information. Compliance with these regulations often necessitates the deployment of network probes to monitor data flows and ensure adherence to legal standards. As non-compliance can result in hefty fines, organizations are increasingly investing in network probe technologies to mitigate risks. The network probe market is thus expected to see sustained growth as businesses strive to meet these regulatory demands.

Shift Towards Cloud-Based Solutions

The transition to cloud computing is reshaping the network probe market landscape. Organizations are increasingly migrating their operations to cloud environments, which require specialized monitoring tools to ensure security and performance. In 2025, it is anticipated that cloud spending will reach $500 billion in the US, underscoring the importance of effective network management in these settings. Network probes designed for cloud environments can provide visibility into data traffic and application performance, making them indispensable for businesses. The network probe market is likely to thrive as companies seek solutions that cater to their evolving cloud-based infrastructures.

Growing Demand for Real-Time Analytics

The network probe market is witnessing a surge in demand for real-time analytics capabilities. Organizations are increasingly recognizing the value of immediate insights into network performance and security threats. In 2025, it is estimated that the market for real-time analytics will grow by over 25%, driven by the need for timely decision-making. Network probes equipped with advanced analytics features enable businesses to proactively address issues and optimize performance. This trend indicates a shift towards data-driven strategies, positioning the network probe market for substantial growth as companies seek to leverage real-time data for competitive advantage.