Market Analysis

In-depth Analysis of Military Helmet Market Industry Landscape

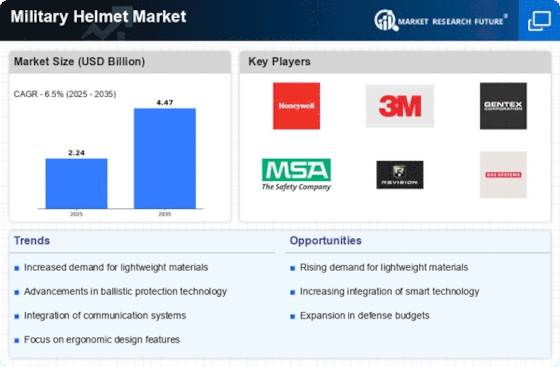

The Military Helmet market is undergoing significant transformations driven by advancements in materials, technology, and a heightened focus on soldier safety and performance. Military helmets play a critical role in protecting the head and enhancing situational awareness for military personnel across various branches. The market is largely influenced by a number of drivers, which involve the technology innovation, potential future threats and high priority of finding safe but lightweight helmets.

Military Helmets market is led by Technological innovation as manufacturers looks to make suitable designs and implement smart features. The application of more sophisticated materials like ballistic fibers, composites, and lightweight alloys is an important factor in creation of a helmets achieving the balance between the protection provided and comfort, mobility, and limited weight. Yet, communication system advancements, night vision, and smart helmet technologies have also been determinants in military technology market’s mechanical structure by meeting the military needs of the 21st century.

The contemporary wars in the modern era with, newer kind of threats significantly affect, the military helmets’ purchase market. Tendency of the Asymmetrical warfare being seen as the major phenomenon already caused the military forces to develop new types of weapons in response to the mentioned threats which are ballistic impact, blast effect and electronic warfare. As a result, a multi-task helmet with ballistic than trauma blasts, then electronic countermeasures, etc. is being brought on the market. In this way, such a flexibility in a variety of threats drives the market trends where manufacturers aim at creating comprehensive and cost effective helmet solutions that are perfectly matched to the up-to-date demands of the military.

Due to reliability of soldiers' and military performance, the military helmets market is influenced by safety factor and performance. Along with the expanded notion of the long-runtime effects of head injuries and the necessity of athletes maintaining cognitive function on the dike, the equipment of helmets with the higher standard of protection, which is lighter and less bulkier, is in higher demand. The demand for the all of the above capabilities result in the ergonomic, ventilation, and customizable design features that enhance comfort and usability thus reflecting the level of soldiers anatomy importance in military helmet design.

Defence budgets have a bearing and directly depend on market dynamics for short and long term budget plans and procurement programs. Governments plus defensive organizations both equipped with the world literally put aside budgets for the stylesover military like helmets that enables their forces to be ready in any circumstances. The procurement activities become a critical segment of the military helmet market, as manufactures strive to win contracts to supply shields that prove to be reliable, secure and of high quality.

The joint activities of the defense industry as a sale tool in the market for military helmets are the main reason for its dynamics. Manufacturers select several ways to cooperate and collaborate to become more skillful in exchanging their professional expertise, splitting the research and development costs, and boosting their helmet system features.

Regulatory issues would likewise be brought into the forefront of the markets for military helmets much like the other considerations. Compliance with international standards and safety regulations is crucial for helmet manufacturers to ensure the reliability and effectiveness of their products. The evolving regulatory landscape shapes the market dynamics by influencing the design, testing, and certification processes of military helmets, with manufacturers adapting to meet or exceed established safety standards.

Leave a Comment