Research Methodology on Military Logistics Market

The research methodology followed for this report is aimed at providing insights into the military logistics market structure and trends, in addition to the secondary and primary data obtained from credible sources. The data collected during the research phase is secured and handled with due care through a comprehensive and comprehensive set of qualitative and quantitative approaches.

Primary Research

The primary research phase focused on data collection from industry experts and key players in the military logistics market. The list of key players and industry experts was identified utilizing industry analysis, which includes analysis of supplier/customer participation and their respective surveys. Primary research was conducted with these industry experts and key players in the form of face-to-face interviews, questionnaires, and email surveys. These were initiated with a set of questions which were related to their understandings and views on the market structure and its growth opportunities, buyers' preferences, and other regional and global market dynamics. These interviews were conducted to gain clarity on the key aspects driving the market, market trends in terms of segments and countries, what are the needs of the buyers in terms of tactical logistics, as well as the strategies for market expansion.

Secondary Research

For the secondary research phase, data is collected from secondary sources like government websites, trade journals, paid databases, and business reports. Sources included Scope (Internet of Things Database), Schwab (Reports on Global Logistics and Supply Chain Solutions), Autoinfo (Reports on Automating the Retail Supply Chain), Smart Technologies (Reports on Logistics Intelligence), and IDC Market Space (Comprehensive Database of Logistics). A detailed analysis of the market was conducted to identify the market size, market dynamics, competitive landscape, and other macroeconomic factors. This enables to identify the size and forecast of the tactical logistics market in different countries/regions/applications covered in the report.

Assumptions

The analysis and forecasting of the global military logistics market is done on the basis of certain assumptions, including:

- Regional and global population growth, economic growth, and political factors are considered while estimating and forecasting the global tactical logistics market.

- The impact of inflation and currency volatility on the global military logistics market has been kept constant for the period of 2023-2030.

Analysis

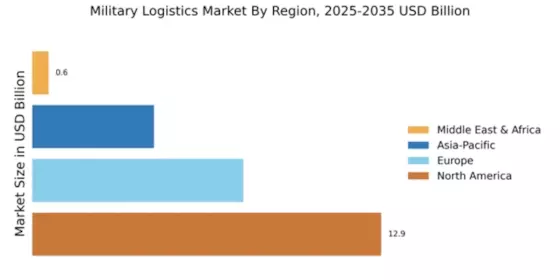

The research on the military logistics market included market sizing, demand and supply assessment, value chain analysis, detailed market segmentation, and forecast market sizing. This is followed by analyzing the market based on market dynamics and regional approaches. In terms of a regional approach, the market was broken down into five broadly-divided regions, namely North America, Europe, Asia-Pacific, South and Central America, and the Middle East and Africa. The regional analysis is conducted further to identify trends in the tactical logistics industry in each of these regions, as well as to map the market size and forecast of the said regions from 2023 to 2030.

Segmentation

The global military logistics market is segmented based on segment type, mode of transport, service type, and region. By segment type, the market was divided into deployment, transportation, maintenance and repairs, and others. By mode of transport, the market was segregated into air, land and sea. By service type, it was cut up into cold chain logistics, hazardous material management and handling, deployment management, and others.

Forecasting

The global military logistics market was estimated and forecasted based on the data collected in the primary and secondary research stages, which was aimed at understanding the market share and size estimates of various technologies in each of the regions mentioned above (North America, Europe, APAC, South America and MEA). The forecasts provided in the report were broken down concerning the various geographies and segment types.