North America : Culinary Innovation Hub

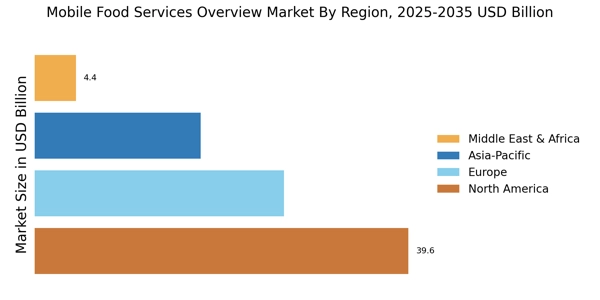

North America leads the Mobile Food Services market, accounting for approximately 45% of the global share. The region's growth is driven by increasing consumer demand for convenience, diverse food options, and the rise of food trucks and pop-up restaurants. Regulatory support for mobile food vendors, including streamlined licensing processes, further fuels this trend. The market is also bolstered by technological advancements in mobile ordering and payment systems.

The United States is the largest market, followed by Canada, with a competitive landscape featuring key players like Aramark, Compass Group, and Delaware North. These companies are innovating to meet consumer preferences, offering gourmet options and unique culinary experiences. The presence of food truck festivals and events enhances visibility and consumer engagement, solidifying North America's position as a leader in mobile food services.

Europe : Diverse Culinary Landscape

Europe is witnessing a significant rise in the Mobile Food Services market, holding approximately 30% of the global share. The growth is driven by changing consumer lifestyles, increased urbanization, and a growing preference for street food. Regulatory frameworks in various countries are evolving to support mobile food vendors, with initiatives aimed at simplifying permits and enhancing food safety standards, which are crucial for market expansion.

Leading countries include the United Kingdom, Germany, and France, where a vibrant street food culture thrives. Key players like Sodexo and Bon Appetit Management Company are adapting their offerings to cater to local tastes and preferences. The competitive landscape is characterized by a mix of established companies and emerging food truck brands, creating a dynamic environment that fosters innovation and culinary diversity.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is rapidly emerging as a key player in the Mobile Food Services market, accounting for about 20% of the global share. The region's growth is fueled by rising disposable incomes, urbanization, and a growing appetite for diverse food options. Regulatory bodies are increasingly recognizing the importance of mobile food services, leading to more favorable policies that support street food vendors and mobile kitchens, enhancing market accessibility.

Countries like China, India, and Australia are at the forefront of this growth, with a burgeoning street food culture. The competitive landscape features a mix of local food trucks and international brands, creating a vibrant market. Key players are focusing on unique culinary offerings and leveraging technology to enhance customer experience, positioning Asia-Pacific as a promising market for mobile food services.

Middle East and Africa : Cultural Culinary Fusion

The Middle East and Africa region is experiencing a gradual expansion in the Mobile Food Services market, holding approximately 5% of the global share. The growth is driven by increasing urbanization, a young population, and a rising interest in diverse culinary experiences. Regulatory frameworks are evolving, with governments recognizing the potential of mobile food services to boost local economies and tourism, leading to more supportive policies for food vendors.

Countries like South Africa, UAE, and Nigeria are leading the charge, with a mix of traditional and modern food offerings. The competitive landscape is characterized by local food trucks and international brands entering the market. Key players are adapting their menus to cater to local tastes, creating a unique fusion of culinary traditions that appeals to a diverse consumer base.