Rising Prevalence of Diabetes

The rising prevalence of diabetes worldwide is a critical driver for the Network Point of Care Glucose Testing Market. According to recent statistics, the number of individuals diagnosed with diabetes is expected to reach approximately 700 million by 2045. This alarming trend necessitates the need for efficient glucose monitoring solutions, as timely and accurate testing is vital for managing diabetes effectively. The increasing burden of diabetes-related complications further emphasizes the importance of point of care testing, as it allows for immediate intervention and management. Consequently, healthcare providers are increasingly adopting point of care testing devices to meet the growing demand for diabetes care.

Patient-Centric Healthcare Models

The shift towards patient-centric healthcare models is significantly influencing the Network Point of Care Glucose Testing Market. As healthcare systems evolve, there is a growing emphasis on empowering patients to take control of their health. Point of care testing aligns with this trend by providing patients with immediate access to their glucose levels, enabling them to make informed decisions regarding their health. This approach not only enhances patient engagement but also improves health outcomes. Furthermore, healthcare providers are recognizing the value of integrating point of care testing into routine care, as it fosters a collaborative environment between patients and providers, ultimately leading to better diabetes management.

Integration of Telehealth Services

The integration of telehealth services into diabetes management is emerging as a significant driver for the Network Point of Care Glucose Testing Market. Telehealth platforms enable healthcare providers to remotely monitor patients' glucose levels, facilitating timely interventions and personalized care. This integration not only enhances patient convenience but also allows for more efficient use of healthcare resources. As telehealth continues to gain traction, the demand for point of care glucose testing devices that can seamlessly connect with these platforms is expected to rise. This trend indicates a shift towards more holistic and accessible diabetes care, ultimately benefiting both patients and healthcare systems.

Technological Advancements in Testing Devices

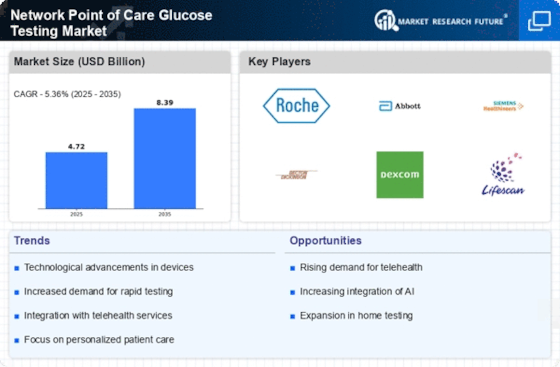

The Network Point of Care Glucose Testing Market is experiencing a surge in technological advancements, particularly in the development of portable and user-friendly glucose testing devices. Innovations such as continuous glucose monitoring systems and smartphone-integrated devices are enhancing the accuracy and convenience of testing. These advancements not only improve patient compliance but also facilitate real-time data sharing with healthcare providers. The market for point of care testing devices is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the increasing demand for rapid and accurate glucose testing solutions, which are essential for effective diabetes management.

Regulatory Support for Innovative Testing Solutions

Regulatory bodies are increasingly supporting the development and approval of innovative testing solutions within the Network Point of Care Glucose Testing Market. Streamlined approval processes and guidelines for point of care devices are encouraging manufacturers to invest in research and development. This regulatory support is crucial for bringing advanced glucose testing technologies to market more rapidly, thereby meeting the urgent needs of patients and healthcare providers. As a result, the market is witnessing a proliferation of new products that offer enhanced accuracy and ease of use. This trend is likely to continue, as regulatory agencies recognize the importance of timely and effective diabetes management.