Research methodology on Next Generation Sequencing market

Abstract

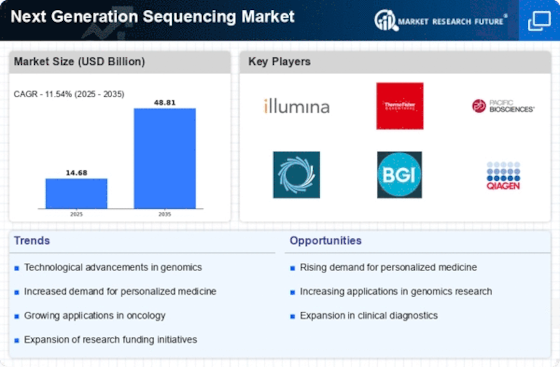

The objective of this research is to provide an in-depth analysis of the Next Generation Sequencing market through a comprehensive assessment of the various components of the market including market trends, current market scenarios, product innovation and other factors providing growth insights. Additionally, the report provides an in-depth analysis of the market dynamics, key strategies adopted by the major players and their competitive environment. It also presents the overall impact of various developments in the Next Generation Sequencing market on the growth of the market.

Introduction

The Next Generation Sequencing (NGS) market is rapidly evolving and is expected to achieve significant growth over the forecast period 2023 to 2030. NGS is a revolutionary step forward in genomic analysis and is leading the way to a new generation of DNA sequencing technologies. With advancements in sequencing technology over the years, NGS has become a more viable option for new applications in research, diagnostics, personalized medicine and more. Through further technological advancements and the increasing use of NGS in research, diagnostics and clinical application development, this field has become one of the most valuable markets in the world. With its rising potential, the market offers several opportunities for stakeholders to gain a superior competitive edge over its competitors. The present report outlines the various research insights into the NGS market.

Research Methodology

The Next Generation Sequencing (NGS) market is researched through a multifaceted research methodology. This includes both primary and secondary research. The primary research portion involves both primary and secondary research such as interviews and market surveys. On the other hand, secondary research is conducted through market research publications, systematic reviews, online databases, news items and industry reports.

For market assessment, the primary research data is supplemented with relevant data such as company profile, market size, revenue growth and application segments. The primary research is based on discussions with various stakeholders including research and development experts, scientists, healthcare professionals, patients and patient groups, distributors, vendors, service providers, industry experts and senior executives from the NGS industry.

Additionally, a comprehensive market analysis of the NGS market is conducted through both primary and secondary research to understand the current trends, competitive dynamics and market size. The market size is calculated by considering the revenue generated within the NGS market across multiple sources for the present and forecast periods. The research also includes desk-based research to gain information about the major contenders in the market, their products and other key developments. Furthermore, secondary data is collected through websites, interviews and press releases to assess the competitive landscape of the market. The report also includes interview-based data to create an understanding of the competitive landscape, industry trends, technological advancements, competitive dynamics and prevailing market conditions.

Data Analysis and Market Size Estimation

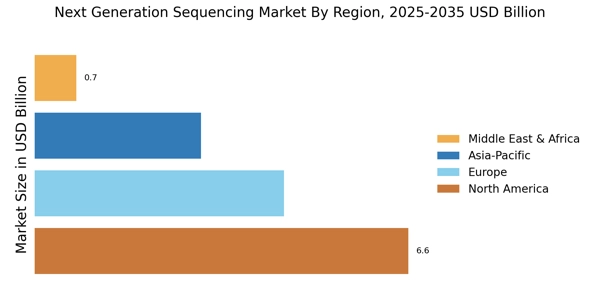

The market size of the global NGS market is estimated using different quantitative methodologies, based on primary research, market survey, desk-based research and industry reports. The data is collected from various contributors and is analyzed and the market size is estimated based on product type, application, end-user and geographical segmentation. The market forecasts for 2023-2030 are provided, considering the expected market growth of the NGS technology and its applications.

Conclusion

Through this comprehensive research methodology, the report endeavours to provide an in-depth and comprehensive understanding of the NGS technology and its various components. The research methodology is expected to provide insights into the current market conditions, technological advancements, market trends and dynamics, competitive landscape, and other market insights. The data collected and analyzed through this process is expected to enable stakeholders to make informed decisions and plan strategies to capitalize on the opportunities prevailing within the NGS market.