Growing Awareness and Education

The rising awareness and education surrounding liver health are pivotal drivers for the Non-alcoholic Steatohepatitis Biomarkers Market. Public health campaigns and educational initiatives are increasingly informing individuals about the risks associated with NAFLD and NASH. This heightened awareness is likely to lead to earlier diagnosis and treatment, thereby increasing the demand for biomarkers. Healthcare professionals are also becoming more knowledgeable about the importance of early detection, which may result in more frequent screenings and assessments. As patients become more proactive about their health, the market for non-invasive biomarkers is expected to expand. This trend indicates a shift towards preventive healthcare, which is anticipated to further stimulate growth within the Non-alcoholic Steatohepatitis Biomarkers Market.

Advancements in Biomarker Research

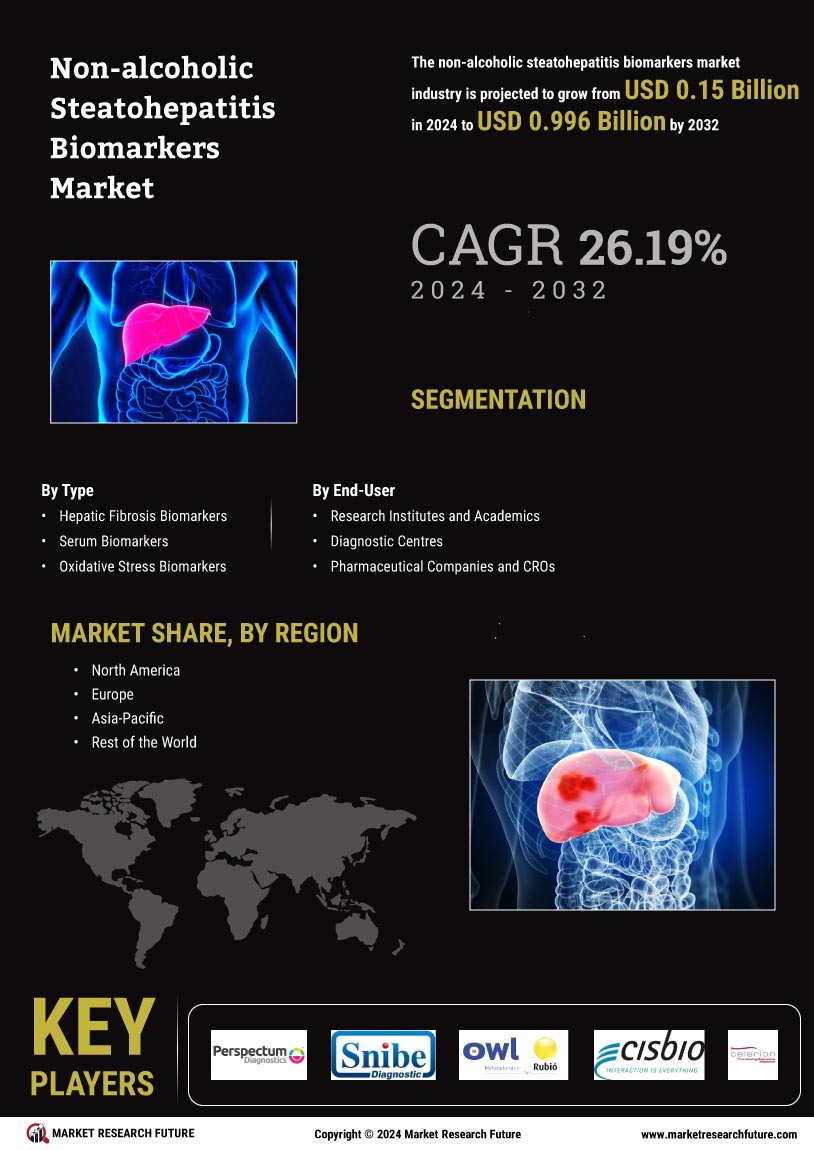

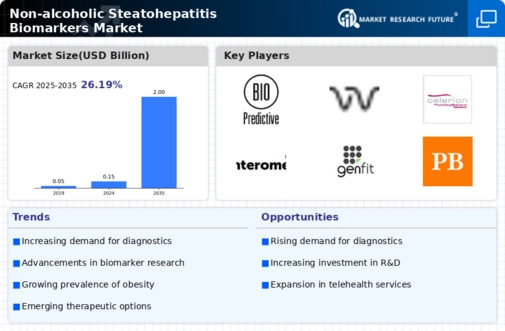

Innovations in biomarker research are significantly influencing the Non-alcoholic Steatohepatitis Biomarkers Market. Recent technological advancements, including high-throughput screening and genomic sequencing, have enhanced the identification and validation of novel biomarkers. These developments facilitate the discovery of non-invasive diagnostic tools, which are increasingly preferred over traditional liver biopsies. The market is witnessing a shift towards the integration of multi-omics approaches, combining genomics, proteomics, and metabolomics to provide comprehensive insights into NASH pathophysiology. As a result, the market is expected to grow, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend underscores the importance of continuous investment in research and development to foster innovation within the Non-alcoholic Steatohepatitis Biomarkers Market.

Regulatory Support for Biomarker Development

Regulatory bodies are playing a crucial role in shaping the Non-alcoholic Steatohepatitis Biomarkers Market through supportive frameworks for biomarker development. Recent initiatives aimed at expediting the approval process for diagnostic tools are encouraging innovation and investment in this sector. The establishment of clear guidelines for biomarker validation is likely to enhance the credibility and acceptance of new diagnostic methods. As regulatory agencies prioritize the need for effective NASH management, the market is expected to benefit from increased funding and resources allocated to research and development. This supportive environment may lead to a surge in the introduction of novel biomarkers, thereby driving growth in the Non-alcoholic Steatohepatitis Biomarkers Market.

Increased Investment in Healthcare Infrastructure

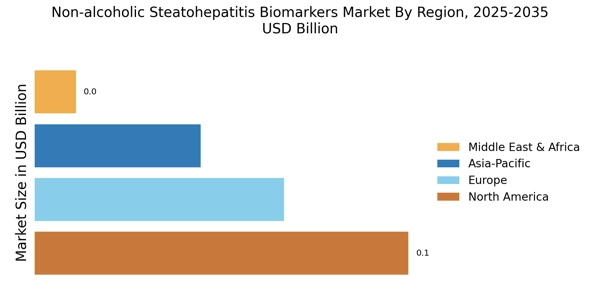

The escalation of investment in healthcare infrastructure is a significant driver for the Non-alcoholic Steatohepatitis Biomarkers Market. Governments and private entities are recognizing the need for enhanced healthcare systems to address the rising burden of liver diseases. This investment is likely to facilitate the establishment of advanced diagnostic laboratories and research facilities, which are essential for the development and implementation of biomarkers. Furthermore, improved healthcare access and resources may lead to increased screening and diagnostic efforts for NASH, thereby expanding the market. As healthcare systems evolve to meet the demands of a growing patient population, the Non-alcoholic Steatohepatitis Biomarkers Market is expected to experience robust growth.

Rising Prevalence of Non-alcoholic Fatty Liver Disease

The increasing incidence of non-alcoholic fatty liver disease (NAFLD) is a primary driver for the Non-alcoholic Steatohepatitis Biomarkers Market. As obesity rates rise, particularly in developed regions, the prevalence of NAFLD is expected to escalate. Reports indicate that approximately 25% of the adult population may be affected by NAFLD, with a significant portion progressing to non-alcoholic steatohepatitis (NASH). This alarming trend necessitates the development of effective biomarkers for early diagnosis and monitoring, thereby propelling market growth. The demand for reliable diagnostic tools is likely to surge as healthcare providers seek to manage and mitigate the risks associated with liver diseases. Consequently, the Non-alcoholic Steatohepatitis Biomarkers Market is poised for expansion as stakeholders respond to this pressing health challenge.