Expansion of Data Centers

The Non-Volatile Dual In-Line Memory Module Market is poised for growth due to the expansion of data centers worldwide. As businesses increasingly rely on cloud computing and big data analytics, the demand for robust memory solutions has intensified. Data centers require high-performance memory modules to manage vast amounts of data efficiently. Reports indicate that the data center market is expected to reach a valuation of over 200 billion dollars by 2026, which could significantly impact the non-volatile memory segment. Non-volatile dual in-line memory modules are particularly suited for data centers, as they provide faster access times and improved energy efficiency. This trend suggests a promising outlook for the Non-Volatile Dual In-Line Memory Module Market as it aligns with the growing infrastructure needs of data centers.

Growing Focus on Data Security

The Non-Volatile Dual In-Line Memory Module Market is increasingly influenced by the growing focus on data security. As cyber threats become more sophisticated, organizations are prioritizing secure data storage solutions. Non-volatile memory modules offer enhanced data protection features, making them an attractive option for businesses concerned about data integrity. The Non-Volatile Dual In-Line Memory Module is projected to exceed 300 billion dollars by 2024, highlighting the importance of secure memory solutions. This trend suggests that the Non-Volatile Dual In-Line Memory Module Market may experience heightened demand as companies seek to implement robust security measures in their data storage strategies. The emphasis on data security is likely to drive innovation and investment in non-volatile memory technologies.

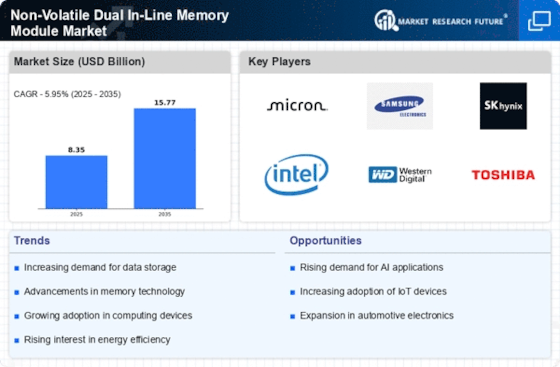

Advancements in Memory Technology

The Non-Volatile Dual In-Line Memory Module Market is witnessing growth driven by advancements in memory technology. Innovations such as 3D NAND and other next-generation memory architectures are enhancing the performance and capacity of non-volatile memory modules. These technological advancements enable manufacturers to produce memory solutions that are faster, more efficient, and capable of storing larger amounts of data. As technology continues to evolve, the demand for high-performance memory solutions is expected to rise. The market for non-volatile memory is projected to grow significantly, with estimates suggesting a potential increase in market size by over 30% in the next five years. This growth indicates a favorable environment for the Non-Volatile Dual In-Line Memory Module Market as it adapts to the latest technological trends.

Rising Demand for Embedded Systems

The Non-Volatile Dual In-Line Memory Module Market is benefiting from the rising demand for embedded systems across various sectors. Embedded systems are integral to modern devices, including home appliances, medical equipment, and industrial machinery. These systems require reliable and efficient memory solutions to function optimally. The embedded systems market is projected to grow at a compound annual growth rate of approximately 10%, indicating a robust demand for non-volatile memory modules. As manufacturers seek to enhance the performance and reliability of embedded devices, the Non-Volatile Dual In-Line Memory Module Market is likely to see increased adoption. This trend underscores the importance of non-volatile memory in supporting the functionality of diverse embedded applications.

Increasing Adoption of Artificial Intelligence

The Non-Volatile Dual In-Line Memory Module Market is experiencing a surge in demand due to the increasing adoption of artificial intelligence technologies. AI applications require substantial memory capacity and speed, which non-volatile memory modules can provide. As organizations integrate AI into their operations, the need for efficient data storage solutions becomes paramount. The market for AI is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 40% in the coming years. This growth is likely to drive the demand for non-volatile memory solutions, as they offer the reliability and performance necessary for AI workloads. Consequently, the Non-Volatile Dual In-Line Memory Module Market stands to benefit from this trend, as manufacturers seek to meet the evolving needs of AI-driven applications.