Research Methodology on Nonchlorinated Polyolefins Market

Introduction

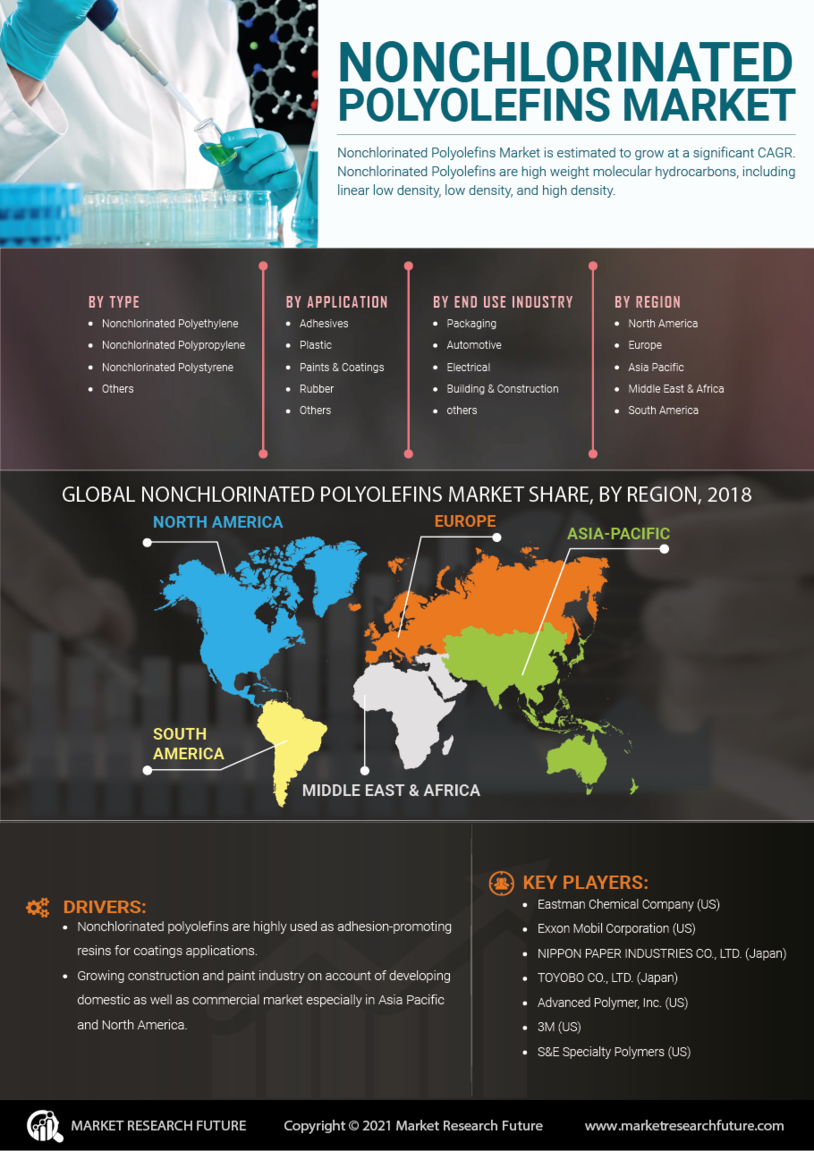

This research methodology covers the detailed approach adopted to provide an exhaustive overview of the Global Nonchlorinated Polyolefins Market. The research report was created by Market Research Future (MRFR). The market has been segmented based on the type of product, end-use industry and region. The present report is based on various primary as well as secondary sources such as trade journals, periodicals, company websites and other similar sources for a deeper understanding.

Research Objectives and Scope

The main objective of this study is to gain a thorough understanding of the Global Nonchlorinated Polyolefins Market in terms of its market segments and sub-segments, market dynamics, and competition landscape. The scope of this research involves the estimation and forecast of the NonChlorinated Polyolefins Market.

Research Methodology

The research report incorporates a comprehensive research framework aiming at understanding various facets of the global nonchlorinated polyolefins market. The in-depth analysis addresses each of the major segments of the market based on type, end-use industry, and region. The following research methodology has been employed in the report:

Primary Research

This is the first stage which consists of interviews and surveys conducted directly with key market players as well as B2B buyers and suppliers. Primary research has been extensively used to validate the market size, market segments, competition landscape, and regional insights.

Secondary Research

Secondary research methodologies include trade journals, periodicals, and other similar sources such as official company websites, press releases, published reports, and industry white papers. Secondary research was the second most important source for collecting market data.

Information was collected from a variety of publicly accessible sources and sources provided by the industry associations. It also incorporated inputs from several industry experts and industry participants who were interviewed extensively. In addition, the valuation of the market size was done based on historical and present market data. The report has deep-dived into each of the segment's demand patterns, market trends, and potential opportunities. It also provides valuable insights into each region’s competitive intensity and attractiveness.

Bottom-up Approach

A bottom-up process involves gathering data for individual companies and then estimating the size of the total market. This approach was used to calculate the market size estimation by aggregating the projected revenues of all the segments and sub-segments together.

Top-down Approach

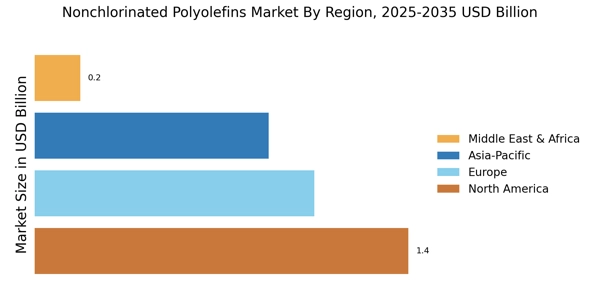

The top-down approach involved estimating the total market size based on the regional or global split using statistical modelling techniques such as time-series analysis, Factor analysis, and Demand-side and Supply-side data triangulation.

Factor Analysis

Another method used in the research was factor analysis to estimate the key drivers influencing the growth of the global nonchlorinated polyolefins market. This enabled us to segment the market efficiently and provide insights into the underlying forces governing market behaviour.

Time-Series Analysis

Time-series analysis was used to accurately estimate the growth rate of the global nonchlorinated polyolefins market. This method involved analyzing the historical data and assessing the current trends to identify the growth rate of the segment over the forecast period.

Demand Side and Supply Side Data Triangulation

This method was used to cross-validate the data collected from different sources and to arrive at conclusive market figures. The data provided by both the demand and supply sides were triangulated to get a detailed understanding of the market dynamics and global nonchlorinated polyolefins market.

Conclusion

This research methodology has helped us in accurately forecasting the global nonchlorinated polyolefins market based on market size, regional estimates, competitive dynamics, and other essential parameters about the market. Furthermore, primary and secondary research has been conducted extensively to generate an accurate estimation of the market. Finally, this demand-side and supply-side data triangulation has enabled us to understand the global nonchlorinated polyolefins market in an efficient and precise manner.