Rising Energy Costs

The escalating costs of traditional energy sources are driving interest in alternative solutions, including biomass. As fossil fuel prices fluctuate, consumers and businesses are increasingly seeking cost-effective energy alternatives. The biomass market in North America is poised to benefit from this trend, as biomass energy can provide a more stable pricing structure. In 2025, the average price of natural gas is projected to reach approximately $4.50 per million BTUs, prompting industries to explore biomass as a viable substitute. This shift not only addresses economic concerns but also aligns with broader sustainability goals, making biomass an attractive option for energy generation.

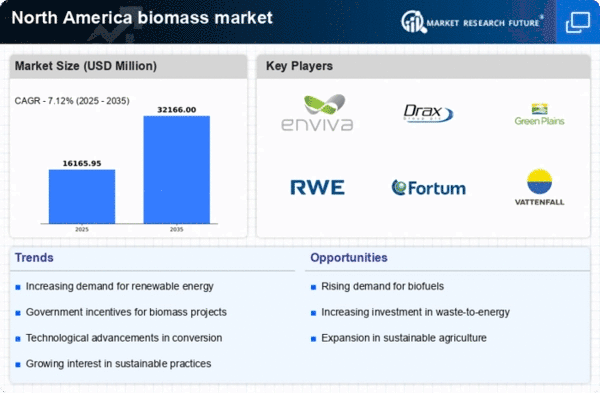

Regulatory Framework Enhancements

The regulatory landscape surrounding renewable energy is evolving, with North American governments implementing more favorable policies for biomass energy production. Recent legislation aims to streamline permitting processes and provide financial incentives for biomass projects. For instance, tax credits and grants are becoming more accessible, encouraging investments in biomass facilities. The biomass market in North America is likely to see increased activity as these regulations create a more conducive environment for growth. In 2025, it is estimated that biomass energy could account for up to 10% of the total renewable energy mix, reflecting the positive impact of these regulatory enhancements.

Increased Awareness of Environmental Impact

There is a growing awareness among consumers and businesses regarding the environmental impact of energy choices. This consciousness is driving demand for cleaner energy sources, including biomass. The biomass market in North America is benefiting from this shift, as stakeholders recognize the potential of biomass to reduce greenhouse gas emissions. In 2025, it is projected that biomass energy could help decrease carbon emissions by up to 20% compared to traditional fossil fuels. This heightened awareness is likely to influence purchasing decisions, further propelling the biomass sector as a preferred energy option.

Investment in Renewable Energy Infrastructure

Investment in renewable energy infrastructure is on the rise, with biomass projects receiving increased funding and support. Financial institutions and private investors are recognizing the long-term potential of biomass energy, leading to a surge in capital directed towards biomass facilities. The biomass market in North America is expected to see substantial growth as these investments materialize. In 2025, it is anticipated that investment in biomass infrastructure could reach $5 billion, reflecting a commitment to expanding renewable energy capabilities. This influx of capital not only enhances production capacity but also fosters innovation within the biomass sector.

Technological Innovations in Biomass Conversion

Advancements in biomass conversion technologies are enhancing the efficiency and viability of biomass energy production. Innovations such as gasification and anaerobic digestion are becoming more prevalent, allowing for higher energy yields from biomass feedstocks. The biomass market in North America is experiencing a surge in interest as these technologies reduce operational costs and improve energy output. In 2025, the efficiency of biomass conversion processes is expected to increase by approximately 15%, making biomass a more competitive energy source. This technological progress not only supports economic growth but also contributes to the overall sustainability of energy systems.

Leave a Comment