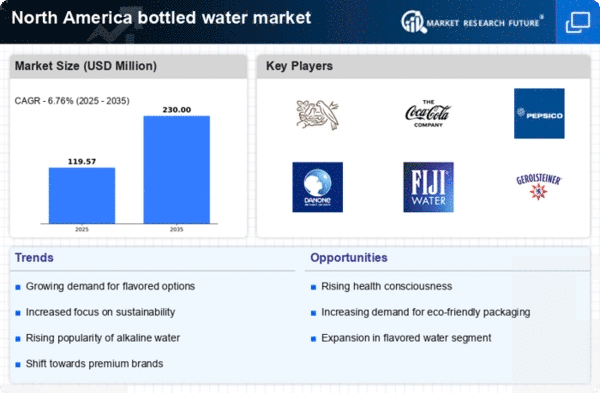

Rising Health Consciousness

The increasing awareness of health and wellness among consumers is a pivotal driver for the bottled water market. As individuals prioritize hydration and seek healthier beverage options, bottled water emerges as a preferred choice. According to recent data, bottled water consumption in North America has surged, with a growth rate of approximately 6% annually. This trend is particularly pronounced among younger demographics, who are more inclined to choose bottled water over sugary drinks. The bottled water market benefits from this shift, as brands innovate to offer enhanced products, such as electrolyte-infused and vitamin-enriched waters, catering to health-conscious consumers. Furthermore, the emphasis on hydration as a key component of a healthy lifestyle reinforces the demand for bottled water, positioning it as a staple in the beverage sector.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of consumers in North America significantly influences the bottled water market. As individuals increasingly seek convenience, bottled water provides an accessible hydration solution. The proliferation of convenience stores, gas stations, and vending machines has made bottled water readily available, contributing to its rising consumption. Market data indicates that on-the-go consumption accounts for a substantial portion of bottled water sales, with estimates suggesting that nearly 40% of bottled water is purchased for immediate consumption. This trend is further supported by the growing popularity of outdoor activities and fitness regimes, where portable hydration options are essential. Consequently, the bottled water market is likely to continue thriving as it aligns with consumer preferences for convenience and accessibility.

Increased Focus on Hydration Education

Education around the importance of hydration is becoming a crucial driver for the bottled water market. As health professionals and organizations emphasize the benefits of proper hydration, consumers are becoming more informed about their water intake. This educational push is reflected in marketing campaigns and public health initiatives that promote bottled water as a convenient and effective way to meet daily hydration needs. Data indicates that consumers who are educated about hydration are more likely to choose bottled water over other beverages. This trend suggests that the bottled water market may see sustained growth as awareness campaigns continue to highlight the significance of hydration in overall health and wellness.

Diverse Flavor Offerings and Product Innovation

The bottled water market is experiencing a wave of innovation, particularly in flavor offerings and product differentiation. As consumers seek variety, brands are introducing flavored and functional waters that cater to diverse tastes and preferences. This trend is evident in the growing popularity of sparkling water and infused options, which have seen a remarkable increase in sales, with flavored bottled water accounting for nearly 20% of the market share. Additionally, the introduction of functional waters, such as those enriched with minerals or antioxidants, appeals to health-conscious consumers looking for added benefits. The bottled water market is thus positioned for continued growth as it embraces creativity and innovation, responding to evolving consumer demands for unique and enjoyable hydration experiences.

Environmental Awareness and Recycling Initiatives

Environmental concerns are increasingly shaping consumer choices, thereby impacting the bottled water market. As awareness of plastic pollution rises, consumers are demanding more sustainable packaging solutions. Many bottled water brands are responding by adopting eco-friendly practices, such as using recycled materials and promoting recycling initiatives. Data suggests that approximately 30% of consumers in North America are willing to pay a premium for bottled water that utilizes sustainable packaging. This shift not only addresses environmental concerns but also enhances brand loyalty among eco-conscious consumers. The bottled water market is thus evolving, with companies investing in innovative packaging solutions that reduce environmental impact while maintaining product integrity. This trend indicates a potential for growth as brands align with consumer values regarding sustainability.