Research Methodology on North America Dental Consumables Market

Introduction

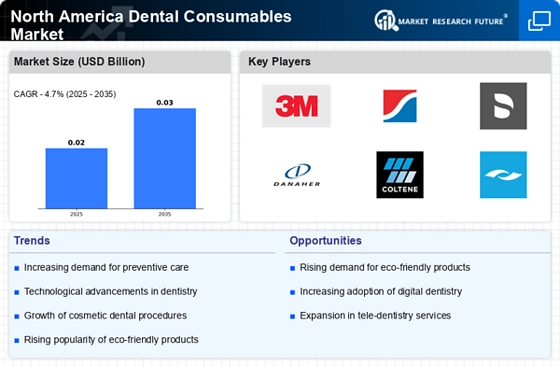

This research report focuses on the analysis of the North America Dental Consumables Market. The market research report provides an in-depth analysis of the market growth potential and potential opportunities within the current North American market. In this report, the market size and estimated revenue of the North American market are discussed. The primary objective of this research is to provide a comprehensive understanding of the market dynamics, trends, and drivers that have shaped and influenced the market over time.

Research Objectives

The primary objective of this research is to provide an accurate and comprehensive assessment of the North American Dental Consumables Market. Specifically, this report investigates the following objectives:

- To analyze the current market size and estimations for the market in terms of value and volume.

- To identify the segments in the North American Dental Consumables market and their respective shares.

- To provide an in-depth analysis of the market drivers, trends, and restraints that impact the market growth.

- To assess the competitive landscape within the North American market and analyze the key players involved.

- To provide an overview of the regulatory and policy framework in North America related to dental consumables.

- To assess potential growth opportunities and make strategic recommendations based on the findings.

Research Methodology

A comprehensive research methodology is adopted, which includes both primary and secondary research to collect the relevant data points of the North America Dental Consumables Market. Primary research includes both online and offline interviews of key players and stakeholders in the North American market. Data is collected from experienced professionals in the industry working in their respective sectors. Online interviews are conducted through emails and telephonic interviews to collect the necessary primary data.

On the other hand, secondary research involves an extensive research of available resources such as press releases and industry reports. A combination of both bottom-up and top-down approaches is adopted to estimate the market size and identify the key players operating in the North American market. The data provided by secondary research is validated using primary research methods.

Data Collection

Data for the report is collected through both primary and secondary research. Primary research includes both online and offline interviews of key players and stakeholders in the North American market. Data is collected from experienced professionals in the industry working in their respective sectors. Online interviews are conducted through emails and telephonic interviews to collect the necessary primary data.

Secondary research comprises extensive research of available resources such as press releases from industry associations and journals, published articles, trade magazines, and statistical databases. The data provided by secondary research is validated using primary research methods.

Data Analysis and Modelling

Data is analyzed using a combination of qualitative and quantitative techniques. The qualitative techniques involve interviewing industry experts, investors, and other stakeholders. Quantitative techniques are adopted to analyze the market size and statistics.

Statistical modelling techniques such as regression analysis and Time series analysis are adopted to assess the North American Dental consumables market. These models are used to predict market performance over the forecast period 2023 to 2030.

Market Estimation

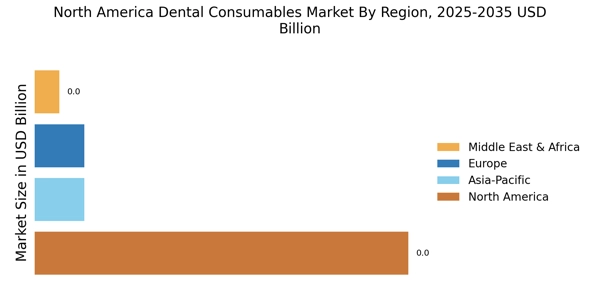

The North American Dental consumables market is estimated by applying a combination of top-down and bottom-up approaches. The market size and forecast for the North American market are derived after an extensive analysis of all the key regions in the North American market.

Base Year

The base year for creating the market estimates for the North American Dental consumables market for the period 2022 to 2030 is 2022.

Currency

The currency used for generating the estimates for the North American Dental consumables market is the US Dollar.

Market Dynamics

The growth for the said market segment is driven by the increasing prevalence of dental diseases, growing awareness about oral hygiene, technological advancements in dental solutions, increasing focus on aesthetics, and rising healthcare expenditure.

However, the market is also expected to face certain restraints, such as the high cost of dental consumables, lack of insurance coverage, and the presence of stringent regulations.

Conclusion

The increasing prevalence of dental diseases, the growing awareness about oral hygiene, advancements in technology, and the increasing focus on aesthetics are the major factors driving growth in the market. However, the high cost of consumables and lack of insurance coverage are the major factors restraining the growth of the North American dental consumables market.