Rising Demand for Renewable Energy

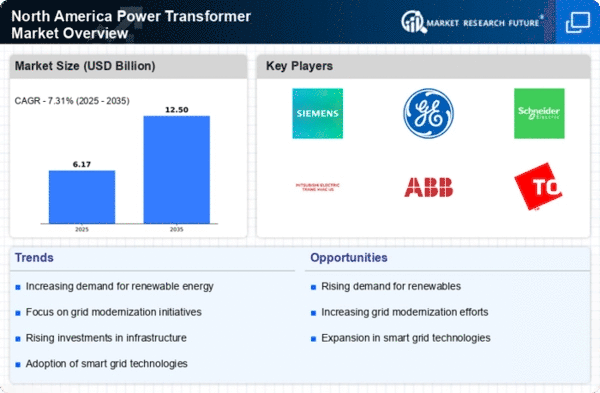

The increasing focus on renewable energy sources in North America is driving the power transformer market. As states and provinces implement policies to transition to cleaner energy, the demand for efficient power transformers is likely to rise. For instance, the integration of wind and solar energy into the grid necessitates advanced transformers that can handle variable loads. The power transformer market is expected to see a growth rate of approximately 6% annually as utilities invest in infrastructure to support renewable energy projects. This shift not only enhances energy security but also aligns with environmental goals, further propelling the market.

Regulatory Compliance and Standards

Regulatory frameworks in North America are becoming increasingly stringent, impacting the power transformer market. Utilities are required to comply with various environmental and safety standards, which necessitates the adoption of advanced transformer technologies. Compliance with regulations such as the Energy Policy Act and various state-level mandates drives the demand for more efficient and environmentally friendly transformers. As a result, manufacturers are likely to innovate and develop products that meet these standards, potentially increasing their market share. The financial implications of non-compliance can be significant, further motivating utilities to invest in compliant technologies.

Growing Electrification of Transportation

The electrification of transportation is emerging as a pivotal driver for the power transformer market in North America. As electric vehicles (EVs) gain popularity, the demand for charging infrastructure is surging, which in turn requires robust power transformers to support increased electricity loads. The market for EV charging stations is projected to grow at a CAGR of over 30% in the coming years, necessitating the installation of efficient transformers. This trend not only supports the transition to cleaner transportation but also creates new opportunities for power transformer manufacturers to cater to the evolving needs of the market.

Aging Infrastructure and Replacement Needs

Much of the electrical infrastructure in North America is aging, leading to an urgent need for replacement and upgrades. The power transformer market is significantly impacted by this trend, as utilities seek to modernize their systems to improve reliability and efficiency. According to estimates, nearly 70% of transformers in operation are over 25 years old, which raises concerns about performance and safety. As utilities allocate budgets for infrastructure renewal, the market for power transformers is projected to expand, with investments reaching upwards of $10 billion in the next five years. This driver highlights the critical need for new technologies to replace outdated equipment.

Increased Investment in Smart Grid Technologies

The transition towards smart grid technologies is reshaping the power transformer market in North America. Smart grids enhance the efficiency and reliability of electricity distribution, necessitating advanced transformers that can support real-time data and automated controls. As utilities invest in smart grid infrastructure, the demand for innovative power transformers is expected to grow. Reports indicate that investments in smart grid technologies could exceed $100 billion by 2030, creating substantial opportunities for manufacturers in the power transformer market. This trend not only improves operational efficiency but also facilitates better integration of renewable energy sources.