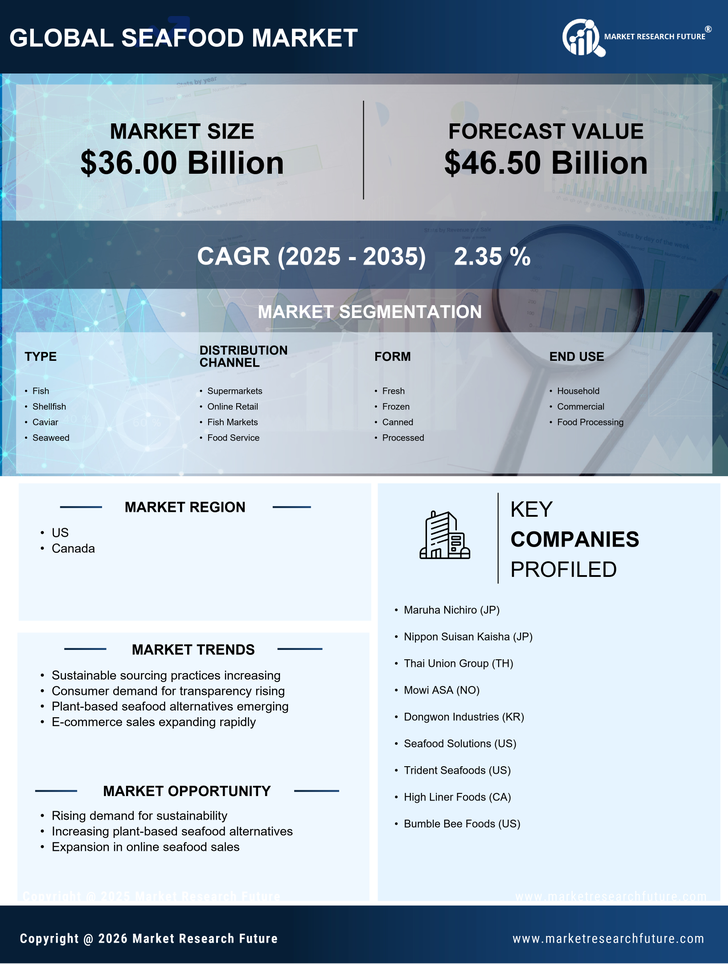

Rising Consumer Demand for Seafood

The seafood market in North America experiences a notable increase in consumer demand, driven by a growing awareness of the health benefits associated with seafood consumption. Recent data indicates that seafood consumption has risen by approximately 15% over the past five years, as consumers increasingly seek protein-rich diets. This trend is further fueled by the popularity of diets such as the Mediterranean diet, which emphasizes fish and shellfish. As a result, the seafood market is witnessing a shift towards more diverse seafood offerings, including exotic species and value-added products. Retailers are responding by expanding their seafood selections, which may lead to increased competition and innovation within the industry. This rising demand is likely to shape the future landscape of the seafood market, prompting stakeholders to adapt their strategies accordingly.

Expansion of Online Seafood Retailing

The seafood market in North America is undergoing a transformation with the expansion of online retailing. E-commerce platforms are increasingly becoming a preferred channel for consumers seeking fresh seafood products. Recent statistics indicate that online seafood sales have surged by over 25% in the past year, reflecting a shift in consumer shopping habits. This trend is particularly pronounced among younger demographics, who favor the convenience of home delivery. As a result, traditional seafood retailers are adapting their business models to include online sales, enhancing their digital presence. The seafood market is likely to benefit from this shift, as it allows for greater reach and accessibility to a broader customer base. However, this also presents challenges, such as ensuring product freshness during transportation and maintaining competitive pricing.

Growing Interest in Sustainable Practices

Sustainability has emerged as a pivotal driver within the seafood market in North America. Consumers are increasingly concerned about overfishing and environmental degradation, prompting a shift towards sustainably sourced seafood. According to recent surveys, approximately 70% of consumers express a preference for seafood products certified by recognized sustainability standards. This trend is influencing purchasing decisions, as retailers and restaurants strive to meet consumer expectations. Consequently, the seafood market is witnessing a rise in partnerships between suppliers and sustainability organizations, fostering responsible fishing practices. This growing interest in sustainability not only enhances the industry's reputation but also opens new market opportunities for businesses that prioritize eco-friendly practices. As awareness continues to grow, the seafood market may see a significant transformation in sourcing and production methods.

Health Regulations and Food Safety Standards

The seafood market in North America is significantly influenced by stringent health regulations and food safety standards. Regulatory bodies, such as the FDA and NOAA, impose rigorous guidelines to ensure the safety and quality of seafood products. Compliance with these regulations is essential for businesses operating within the industry, as failure to meet standards can result in severe penalties and loss of consumer trust. Recent updates to food safety protocols have prompted many companies to invest in enhanced quality control measures and traceability systems. This focus on safety not only protects consumers but also strengthens the overall integrity of the seafood market. As regulations continue to evolve, businesses may need to adapt their practices to remain compliant, which could lead to increased operational costs but ultimately fosters a safer seafood supply chain.

Technological Advancements in Seafood Processing

Technological innovations play a crucial role in enhancing the efficiency and sustainability of the seafood market in North America. Advanced processing techniques, such as high-pressure processing and automated sorting systems, are being adopted to improve product quality and shelf life. These technologies not only reduce waste but also ensure that seafood products meet stringent safety standards. Furthermore, the integration of blockchain technology is gaining traction, providing transparency in the supply chain and allowing consumers to trace the origin of their seafood. As a result, the seafood market is likely to benefit from increased consumer trust and loyalty. The implementation of these technologies may also lead to cost reductions, enabling companies to offer competitive pricing while maintaining high-quality standards.