Health and Wellness Trends

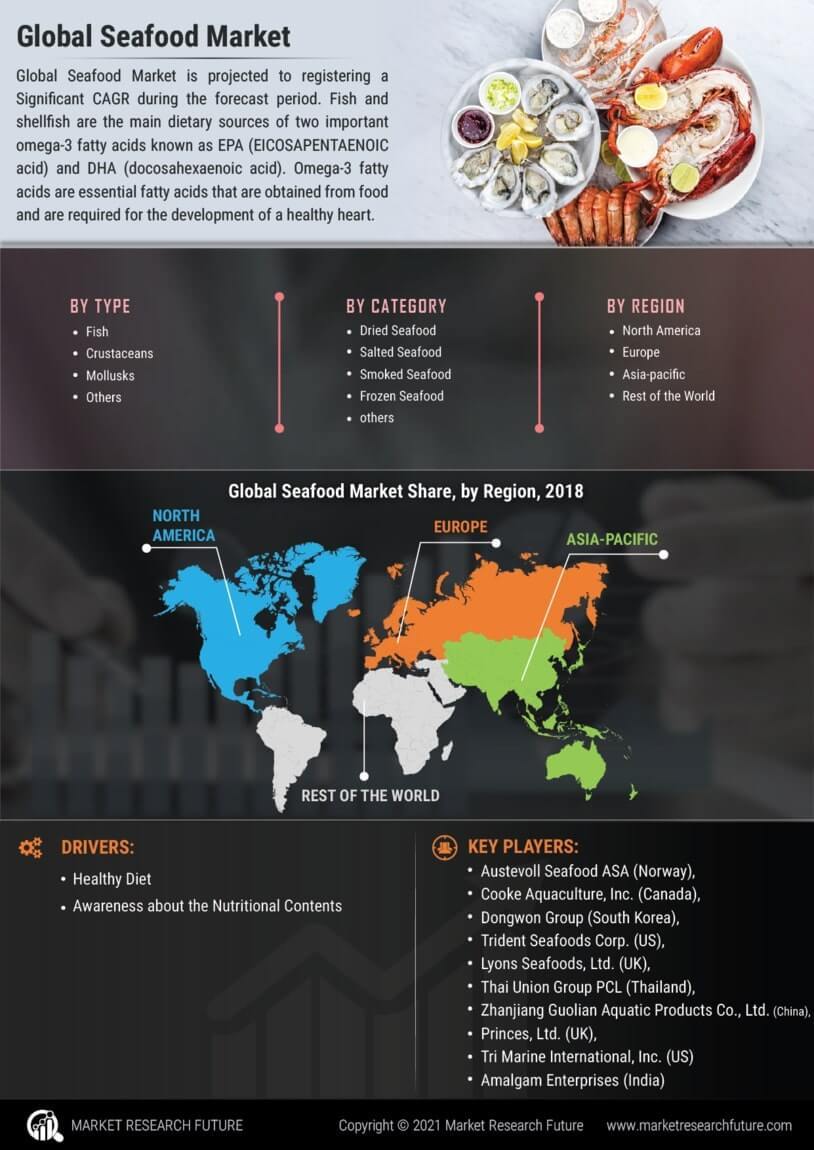

The growing emphasis on health and wellness is significantly influencing The Global Seafood Industry. Seafood Market is recognized for its nutritional benefits, including high protein content and essential fatty acids. As consumers prioritize healthier eating habits, seafood is often viewed as a preferable alternative to red meat. Market Research Future indicates that the demand for seafood products, particularly those rich in omega-3 fatty acids, is expected to rise. This trend is particularly pronounced among millennials and health-conscious consumers who are willing to pay a premium for high-quality seafood. The industry's ability to market these health benefits effectively will be vital for capturing this expanding consumer base.

Expansion of Aquaculture Practices

Aquaculture is playing an increasingly vital role in The Global Seafood Industry, as it provides a sustainable solution to meet the rising demand for seafood. With wild fish stocks declining, aquaculture offers a viable alternative to traditional fishing methods. The global aquaculture production is projected to reach over 100 million metric tons by 2025, reflecting a significant shift towards farmed seafood. This expansion is driven by advancements in breeding techniques, feed efficiency, and disease management. Moreover, aquaculture can help alleviate pressure on wild fish populations, contributing to the sustainability of the seafood supply chain. As consumers become more aware of the benefits of farmed seafood, the industry is likely to see continued growth.

Rising Demand for Seafood Products

The increasing global population and changing dietary preferences are driving the demand for seafood products. As consumers become more health-conscious, they are seeking protein sources that are low in fat and high in omega-3 fatty acids. This trend is particularly evident in regions where seafood consumption has traditionally been lower. According to recent data, seafood consumption is projected to reach 20 kg per capita by 2025, indicating a robust growth trajectory for The Global Seafood Industry. Additionally, the rise of online grocery shopping has made seafood more accessible to consumers, further fueling demand. The industry's ability to adapt to these changing consumer preferences is crucial for sustaining growth.

Sustainability and Environmental Concerns

Sustainability has emerged as a pivotal driver in The Global Seafood Industry. Consumers are increasingly aware of the environmental impact of overfishing and unsustainable fishing practices. This awareness has led to a demand for sustainably sourced seafood, prompting companies to adopt eco-friendly practices. Certifications such as the Marine Stewardship Council (MSC) are gaining traction, as consumers seek assurance that their seafood is sourced responsibly. The market for certified sustainable seafood is expected to grow significantly, with estimates suggesting it could account for over 30% of total seafood sales by 2025. This shift not only benefits the environment but also enhances brand loyalty among consumers.

Technological Innovations in Seafood Processing

Technological advancements are revolutionizing The Global Seafood Industry, particularly in processing and distribution. Innovations such as automated processing lines, advanced freezing techniques, and improved supply chain logistics are enhancing efficiency and product quality. For instance, the use of blockchain technology is gaining popularity for traceability, allowing consumers to verify the origin of their seafood. This transparency is becoming increasingly important as consumers demand higher quality and safety standards. Furthermore, the integration of artificial intelligence in inventory management is optimizing stock levels and reducing waste, which is crucial for maintaining profitability in a competitive market.