Emergence of 5G Technology

The emergence of 5G technology is poised to have a profound impact on the system on-chip market in North America. As telecommunications companies roll out 5G networks, there is a growing need for advanced chips that can support higher data rates and lower latency. System on-chip solutions are essential for enabling the functionalities required by 5G applications, such as enhanced mobile broadband and massive machine-type communications. The 5G infrastructure investment in North America is expected to surpass $100 billion by 2026, creating a substantial market opportunity for system on-chip manufacturers. This technological shift not only drives demand for new chip designs but also encourages innovation in areas such as network security and energy efficiency. As a result, the system on-chip market is likely to experience significant growth as it adapts to the requirements of the 5G era.

Surge in Consumer Electronics

The system on-chip market in North America is significantly influenced by the increasing demand for consumer electronics. With the proliferation of smart devices, including smartphones, tablets, and wearables, manufacturers are seeking efficient and compact solutions to meet consumer expectations. The market for consumer electronics in North America is anticipated to exceed $100 billion by 2025, with a substantial portion attributed to system on-chip technologies. These chips are essential for enabling advanced functionalities, such as high-resolution displays and enhanced connectivity features. As consumer preferences shift towards more integrated and multifunctional devices, the demand for sophisticated system on-chip solutions is likely to rise. This trend not only drives innovation but also encourages manufacturers to invest in research and development, further propelling the growth of the system on-chip market in North America.

Growth of Automotive Electronics

The system on-chip market in North America is witnessing substantial growth driven by the increasing integration of electronics in the automotive sector. As vehicles become more sophisticated, the demand for advanced system on-chip solutions is rising. These chips are integral to various automotive applications, including advanced driver-assistance systems (ADAS), infotainment, and electric vehicle (EV) technologies. The automotive electronics market is projected to reach approximately $50 billion by 2025, with a significant portion attributed to system on-chip innovations. This growth is fueled by the industry's shift towards electrification and automation, necessitating more efficient and reliable chip solutions. Consequently, the system on-chip market is likely to benefit from this trend, as manufacturers strive to meet the evolving demands of the automotive landscape.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the system on-chip market in North America. Various federal and state programs are designed to bolster semiconductor manufacturing and research, aiming to enhance the region's competitiveness in the global market. For instance, recent legislation has allocated billions of dollars to support domestic semiconductor production, which is expected to stimulate innovation and job creation. This influx of funding is likely to encourage collaboration between public and private sectors, fostering advancements in system on-chip technologies. As a result, the system on-chip market is poised for growth, with increased investment leading to the development of cutting-edge solutions that cater to diverse applications, from automotive to healthcare. The proactive stance of the government in supporting this sector is indicative of its importance to the overall economy.

Advancements in Semiconductor Technology

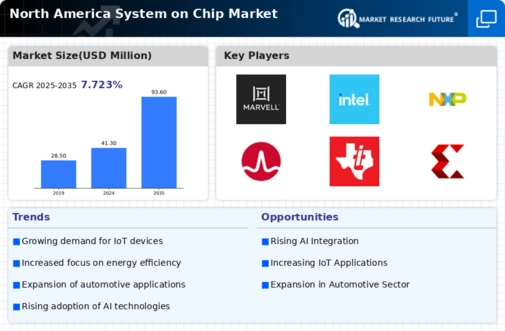

The system on-chip market in North America is experiencing a notable surge due to rapid advancements in semiconductor technology. Innovations in fabrication processes, such as FinFET and SOI technologies, are enabling the production of smaller, more efficient chips. This evolution is crucial as it allows for increased transistor density, which enhances performance while reducing power consumption. According to recent data, the semiconductor market in North America is projected to reach approximately $200 billion by 2026, driven by these technological improvements. Furthermore, the integration of advanced materials, such as graphene and silicon carbide, is likely to enhance the capabilities of system on-chip solutions, making them more appealing for various applications, including automotive and consumer electronics. As a result, the ongoing technological advancements are expected to significantly influence the growth trajectory of the system on-chip market in the region.