-

Report Prologue

-

Market Introduction

-

Definition 13

-

Scope Of The Study 13

- Research Objective

- Assumptions 13

- Limitations 13

-

Research Methodology

-

Introduction 15

-

Primary Research

-

Secondary Research 16

-

Market Size Estimation 16

-

Market Dynamics

-

Introduction 18

-

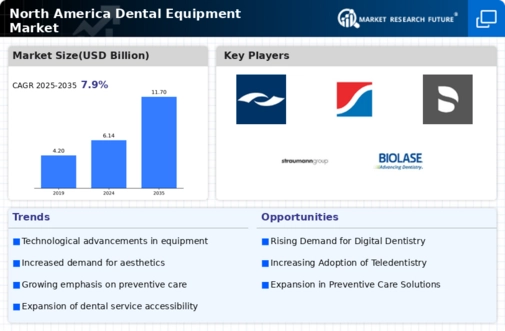

Drivers

- Increasing Use Of CBCT (Cone Beam Computed Tomography) In Orthodontic

- Technological

- Increasing

- Increasing

-

Diagnosis And Treatment Planning (Impact Weightage-30%) 19

-

Development In Dental Equipment (Impact Weightage-35%) 20

-

Cosmetic Dentistry Treatments (Impact Weightage-20%) 21

-

Geriatric Population (Impact Weightage-15%) 22

-

Restraints 23

- Huge Demand For Dental Tourism (Impact Weightage-60%) 23

-

Use Of Refurbished Dental Instruments (Impact Weightage-40%) 24

-

Opportunities

-

Mega Trends 25

-

Macroeconomic Indicators 25

-

Technology Trends & Assessment 26

-

Market Factor Analysis

-

Porters Five Forces Analysis 27

- Bargaining Power Of

- Bargaining Power Of Buyers 28

- Threat

- Threat Of Substitutes 29

- Intensity

-

Suppliers 28

-

Of New Entrants 28

-

Of Rivalry 29

-

Value Chain 29

-

Demand & Supply –

-

Gap Analysis 30

-

Investment Opportunity Analysis 31

-

Price Analysis 31

-

North American Dental Equipment Market, By Product

-

Introduction 32

-

Dental Radiology Equipment 33

-

Digital Sensors 35

-

Dental Hand-Pieces 36

-

CAD/CAM

-

Dental Chairs 38

-

Dental Lasers 39

-

Casting Machine 41

-

North American Dental Equipment Market, By Application

-

Introduction 43

-

Examining The Mouth And Teeth 45

-

Cavity Removal 46

-

Scaling Or Professional Cleaning Of Teeth

-

Carving And Finishing Dental Fillings 47

-

Placing

-

And Condensing Filling Materials 47

-

North America Dental Equipment

-

North American Dental Equipment Market, By End User

-

Introduction 48

-

Hospital 49

-

Dental Clinics 50

-

Dental Laboratories 50

-

North American Dental Equipment Market, By Country

-

Introduction 51

-

U.S. 53

-

North American Dental Equipment Market, By Product

-

North American Dental Equipment Market, By Application

-

North America

-

North American Dental Equipment Market, By End User

-

Canada 57

-

North America

-

North American Dental Equipment Market, By Product

-

North American Dental Equipment Market,

-

By Application

-

North American Dental Equipment Market, By End User

-

Company Landscape

-

Introduction 62

-

Company

-

Share Analysis 62

-

Competitive Landscape 63

- Product

- Partnerships & Collaborations 64

- Acquisition 65

-

Launch/Development 63

-

Company Profiles

-

3M

- Company Overview 66

- Financials 66

- Products 66

- Strategy 66

- Key Developments

-

Danaher Corporation 67

- Company Overview 67

- Financials 67

- Products 67

- Strategy

- Key Developments 67

-

Dentsply Sirona 68

- Company Overview 68

- Financials 68

- Products

- Strategy 68

- Key Developments 68

-

Carestream Health, Inc. 69

- Company Overview 69

- Financials 69

- Products 69

- Strategy

- Key Developments 69

-

Biolase, Inc. 70

- Company Overview 70

- Financials 70

- Products

- Strategy 70

- Key Developments 70

-

Patterson Dental 71

- Company Overview 71

- Products 71

- Strategy 71

- Key Developments 71

-

Financials 71

-

Henry Schein 72

- Company

- Financials 72

- Products 72

- Strategy 72

- Key Developments 72

-

Overview 72

-

Straumann

- Company Overview 73

- Financials 73

- Products 73

- Strategy 73

- Key Developments

-

List Of Tables

-

NORTH AMERICA DENTAL EQUIPMENT

-

North American Dental Equipment Market, BY PRODUCT, 2020 TO 2027 (USD MILLION) 33

-

NORTH AMERICA

-

North American Dental Equipment Market, BY PRODUCT, 2020 TO 2027 (USD MILLION) 34

-

North American Dental Equipment Market, BY COUNTRY, 2020

-

TO 2027 (USD MILLION) 34

-

NORTH AMERICA DIGITAL SENSORS EQUIPMENT

-

MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 35

-

NORTH AMERICA

-

DIGITAL SENSORS EQUIPMENT MARKET BY COUNTRY, 2020 TO 2027 (USD MILLION) 35

-

NORTH AMERICA DENTAL HAND-PIECES MARKET BY PRODUCT, 2020 TO 2027 (USD

-

MILLION) 36

-

NORTH AMERICA DENTAL HAND-PIECES MARKET BY COUNTRY,

-

NORTH AMERICA DENTAL CAD/CAM MARKET

-

BY PRODUCT, 2020 TO 2027 (USD MILLION) 37

-

NORTH AMERICA DENTAL

-

CAD/CAM MARKET BY COUNTRY, 2020 TO 2027 (USD MILLION) 37

-

NORTH

-

AMERICA DENTAL CHAIRS MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 38

-

NORTH AMERICA DENTAL CHAIRS MARKET BY COUNTRY, 2020 TO 2027 (USD MILLION)

-

NORTH AMERICA DENTAL LASERS MARKET BY PRODUCT, 2020 TO 2027

-

(USD MILLION) 39

-

NORTH AMERICA DENTAL LASERS MARKET BY COUNTRY,

-

NORTH AMERICA DENTAL CASTING MACHINES

-

MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 41

-

NORTH AMERICA

-

DENTAL CASTING MACHINES MARKET BY COUNTRY, 2020 TO 2027 (USD MILLION) 42

-

NORTH AMERICA DENTAL EQUIPMENT MARKET BY APPLICATION, 2020 TO 2027 (USD

-

MILLION) 44

-

NORTH AMERICA DENTAL EQUIPMENT MARKET FOR EXAMINING

-

THE MOUTH AND TEETH BY COUNTRY, 2020 TO 2027 (USD MILLION) 45

-

TABLE 18

-

NORTH AMERICA DENTAL EQUIPMENT MARKET FOR CAVITY REMOVAL BY COUNTRY, 2020 TO 2027

-

(USD MILLION) 46

-

NORTH AMERICA DENTAL EQUIPMENT MARKET FOR SCALING

-

OR PROFESSIONAL CLEANING OF TEETH BY COUNTRY, 2020 TO 2027 (USD MILLION) 46

-

NORTH AMERICA DENTAL EQUIPMENT MARKET FOR CARVING & FINISHING DENTAL

-

FILLINGS BY COUNTRY, 2020 TO 2027 (USD MILLION) 47

-

NORTH AMERICA

-

DENTAL EQUIPMENT MARKET FOR PLACING & CONDENSING FILLING MATERIALS BY COUNTRY,

-

NORTH AMERICA DENTAL EQUIPMENT

-

MARKET BY END USER (2020 TO 2027) 49

-

NORTH AMERICA DENTAL EQUIPMENT

-

MARKET FOR HOSPITALS BY COUNTRY, 2020 TO 2027 (USD MILLION) 49

-

TABLE

-

NORTH AMERICA DENTAL EQUIPMENT MARKET FOR DENTAL CLINICS BY COUNTRY, 2020 TO

-

NORTH AMERICA DENTAL EQUIPMENT MARKET

-

FOR DENTAL LABORATORIES BY COUNTRY, 2020 TO 2027 (USD MILLION) 50

-

TABLE

-

NORTH AMERICA DENTAL EQUIPMENT MARKET BY COUNTRY, 2020 TO 2027 (USD MILLION)

-

U.S. North American Dental Equipment Market, BY PRODUCT, 2020 TO 2027 (USD

-

MILLION) 53

-

U.S. North American Dental Equipment Market, BY PRODUCT,

-

U.S. DIGITAL SENSORS EQUIPMENT

-

MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 54

-

U.S. DENTAL

-

HAND-PIECES MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 54

-

TABLE 31

-

U.S. DENTAL CAD/CAM MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 54

-

TABLE

-

U.S. DENTAL CHAIRS MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 55

-

U.S. DENTAL LASERS MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 55

-

U.S. DENTAL CASTING MACHINES MARKET BY PRODUCT, 2020 TO 2027 (USD

-

MILLION) 55

-

U.S. DENTAL EQUIPMENT MARKET BY APPLICATION, 2020

-

TO 2027 (USD MILLION) 56

-

U.S. DENTAL EQUIPMENT MARKET BY END

-

USER (2020 TO 2027) 56

-

North American Dental Equipment Market, BY PRODUCT,

-

CANADA DENTAL RADIOLOGY EQUIPMENT

-

North American Dental Equipment Market, BY PRODUCT, 2020 TO 2027 (USD MILLION) 58

-

CANADA DIGITAL

-

SENSORS EQUIPMENT MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 58

-

TABLE

-

CANADA DENTAL HAND-PIECES MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION) 58

-

CANADA DENTAL CAD/CAM MARKET BY PRODUCT, 2020 TO 2027 (USD MILLION)

-

CANADA DENTAL CHAIRS MARKET BY PRODUCT, 2020 TO 2027 (USD

-

MILLION) 59

-

CANADA DENTAL LASERS MARKET BY PRODUCT, 2020 TO

-

CANADA DENTAL CASTING MACHINES MARKET

-

BY PRODUCT, 2020 TO 2027 (USD MILLION) 60

-

CANADA DENTAL EQUIPMENT

-

MARKET BY APPLICATION, 2020 TO 2027 (USD MILLION) 60

-

CANADA

-

DENTAL EQUIPMENT MARKET BY END USER (2020 TO 2027) 61

-

-

List Of Figures

-

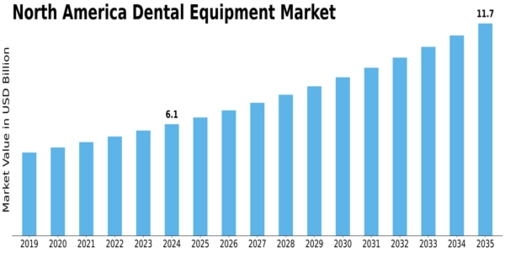

NORTH AMERICA DENTAL EQUIPMENT MARKET SHARE

-

BY PRODUCT, 2020 (%) 11

-

NORTH AMERICA DENATL EQUIPMENT MARKET

-

SHARE BY APPLICATIONS, 2020 (%) 11

-

NORTH AMERICA DENTAL EQUIPMENT

-

MARKET SHARE BY END USERS, 2020 (%) 12

-

MARKET STRUCTURE 14

-

RESEARCH PROCESS 15

-

FORECAST MODEL 17

-

PORTERS FIVE FORCES ANALYSIS OF NORTH AMERICA DENTAL EQUIPMENT MARKET

-

VALUE CHAIN:DENTAL EQUIPMENT MARKET 30

-

FIGURE

-

North American Dental Equipment Market, BY PRODUCT, 2020 & 2027 (USD MILLION)

-

NORTH AMERICA DENTAL EQUIPMENT MARKET BY APPLICATION, 2020

-

& 2027 (USD MILLION) 43

-

NORTH AMERICA DENTAL EQUIPMENT

-

MARKET BY END USER, 2020 & 2027 (USD MILLION) 48

-

NORTH

-

AMERICA DENTAL EQUIPMENT MARKET BY COUNTRY, 2020 & 2027 (USD MILLION) 51

-

NORTH AMERICA DENTAL EQUIPMENT MARKET: COMPANY SHARE ANALYSIS,

Leave a Comment