Growing Focus on Patient-Centric Care

The shift towards patient-centric care is reshaping the OEM Patient Monitoring and Vital Sign OEM Module Market. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, leading to a demand for monitoring solutions that empower patients to take an active role in their health management. This trend is reflected in the rising adoption of user-friendly monitoring devices that provide real-time feedback and data sharing capabilities. As patients become more involved in their care, the need for effective monitoring solutions that align with their preferences and lifestyles grows. Consequently, the OEM Patient Monitoring and Vital Sign OEM Module Market is likely to expand, driven by innovations that enhance patient experience and outcomes.

Rising Prevalence of Chronic Diseases

The OEM Patient Monitoring and Vital Sign OEM Module Market is significantly influenced by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions. As these diseases become more common, the demand for effective monitoring solutions increases. Data indicates that chronic diseases account for approximately 70% of all deaths worldwide, underscoring the urgent need for continuous monitoring and management. This trend is prompting healthcare providers to invest in OEM patient monitoring solutions that facilitate early detection and intervention. Consequently, the OEM Patient Monitoring and Vital Sign OEM Module Market is likely to see sustained growth as healthcare systems adapt to the challenges posed by chronic disease management.

Increasing Demand for Remote Patient Monitoring

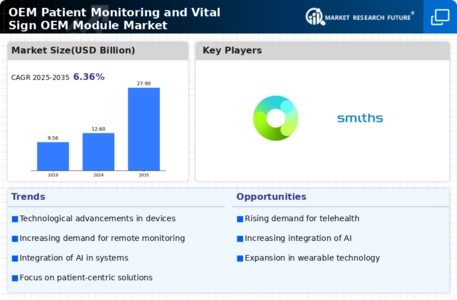

The OEM Patient Monitoring and Vital Sign OEM Module Market is experiencing a notable surge in demand for remote patient monitoring solutions. This trend is largely driven by the need for continuous health monitoring, particularly among chronic disease patients. According to recent data, the market for remote patient monitoring devices is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is indicative of a broader shift towards proactive healthcare management, where patients can be monitored in real-time, reducing the need for frequent hospital visits. As healthcare providers increasingly adopt these technologies, the OEM Patient Monitoring and Vital Sign OEM Module Market is likely to expand, offering innovative solutions that enhance patient care and operational efficiency.

Regulatory Support for Advanced Monitoring Technologies

Regulatory bodies are increasingly supporting the development and adoption of advanced monitoring technologies within the OEM Patient Monitoring and Vital Sign OEM Module Market. Initiatives aimed at streamlining the approval process for innovative medical devices are encouraging manufacturers to invest in research and development. For instance, recent regulatory changes have expedited the pathway for digital health solutions, making it easier for new products to enter the market. This supportive regulatory environment is expected to foster innovation and competition, ultimately benefiting healthcare providers and patients alike. As a result, the OEM Patient Monitoring and Vital Sign OEM Module Market is likely to experience accelerated growth, driven by the introduction of cutting-edge monitoring solutions.

Integration of Artificial Intelligence in Monitoring Systems

The integration of artificial intelligence (AI) into the OEM Patient Monitoring and Vital Sign OEM Module Market is transforming how patient data is analyzed and utilized. AI algorithms can process vast amounts of data from monitoring devices, providing healthcare professionals with actionable insights. This capability not only improves diagnostic accuracy but also enhances predictive analytics, allowing for timely interventions. The market for AI in healthcare is expected to reach USD 36 billion by 2025, reflecting the growing recognition of AI's potential in patient monitoring. As healthcare systems increasingly adopt AI-driven solutions, the OEM Patient Monitoring and Vital Sign OEM Module Market is poised for significant advancements, potentially leading to improved patient outcomes and reduced healthcare costs.