Regulatory Pressures

Regulatory pressures play a crucial role in shaping the Oil And Gas Asset Integrity Management Service Market. Governments and regulatory bodies are increasingly enforcing stringent safety and environmental regulations to mitigate risks associated with oil and gas operations. Compliance with these regulations necessitates robust asset integrity management practices, which in turn drives demand for specialized services. Companies that fail to adhere to these regulations may face substantial fines and operational shutdowns. As a result, the market for asset integrity management services is expected to expand as organizations invest in compliance measures to avoid penalties and ensure safe operations.

Sustainability Initiatives

Sustainability initiatives are becoming a driving force in the Oil And Gas Asset Integrity Management Service Market. As environmental concerns gain prominence, companies are compelled to adopt practices that minimize their ecological footprint. This shift towards sustainability often involves the implementation of asset integrity management systems that ensure safe and environmentally responsible operations. By investing in these systems, companies not only comply with environmental regulations but also enhance their corporate image. The market is expected to grow as organizations increasingly align their asset management strategies with sustainability goals, reflecting a broader commitment to responsible resource management.

Technological Advancements

The Oil And Gas Asset Integrity Management Service Market is experiencing a surge in technological advancements that enhance operational efficiency and safety. Innovations such as predictive analytics, Internet of Things (IoT) devices, and advanced robotics are being integrated into asset management practices. These technologies facilitate real-time monitoring and data analysis, which can lead to proactive maintenance strategies. According to recent estimates, the adoption of these technologies could reduce operational costs by up to 30%. As companies strive to optimize their asset integrity management, the demand for these advanced solutions is likely to increase, driving growth in the market.

Increasing Demand for Energy

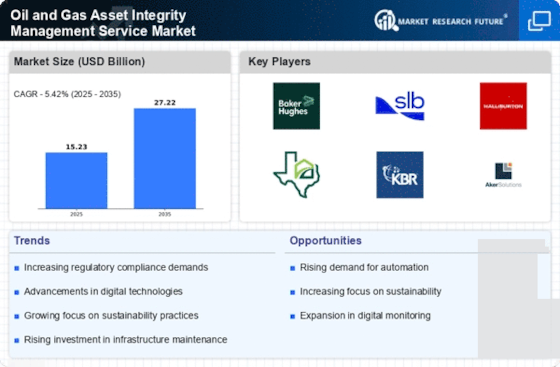

The Oil And Gas Asset Integrity Management Service Market is significantly influenced by the rising global demand for energy. As economies expand and populations grow, the need for reliable energy sources intensifies. This demand compels oil and gas companies to ensure the integrity of their assets to maintain production levels and meet regulatory standards. In recent years, the industry has seen a notable increase in investments aimed at enhancing asset integrity management systems. It is projected that the market will continue to grow as companies prioritize the maintenance and safety of their operations to meet this escalating energy demand.

Focus on Operational Efficiency

The Oil And Gas Asset Integrity Management Service Market is witnessing a pronounced focus on operational efficiency. Companies are increasingly recognizing that effective asset integrity management can lead to significant cost savings and improved productivity. By implementing comprehensive integrity management programs, organizations can minimize downtime, reduce maintenance costs, and extend the lifespan of their assets. Recent studies indicate that companies that prioritize asset integrity management can achieve up to a 20% increase in operational efficiency. This emphasis on efficiency is likely to propel the market forward as firms seek to optimize their operations and enhance profitability.