Ethical Sourcing

Ethical sourcing is emerging as a vital driver for The Global Organic Chocolate Industry, as consumers increasingly demand transparency in the supply chain. The awareness of fair trade practices and the conditions under which cocoa is produced is prompting brands to adopt more responsible sourcing strategies. This shift is not only beneficial for farmers but also resonates with consumers who are willing to pay a premium for products that support ethical practices. Recent data suggests that the market for fair trade certified organic chocolate has expanded significantly, with a growth rate of around 10% annually. As more companies commit to ethical sourcing, The Global Organic Chocolate Industry is likely to experience sustained growth, driven by consumer trust and loyalty.

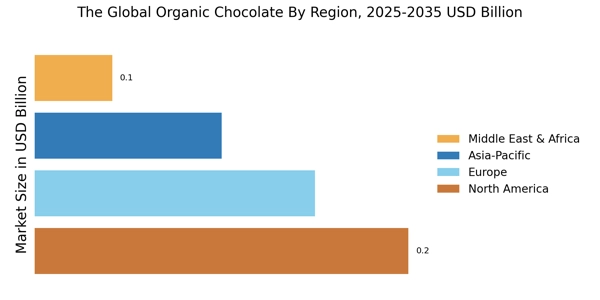

E-commerce Growth

The rapid growth of e-commerce is transforming The Global Organic Chocolate Industry, providing consumers with greater access to a diverse range of products. Online shopping platforms are increasingly featuring organic chocolate brands, allowing consumers to explore and purchase products from the comfort of their homes. This trend has been accelerated by the convenience and variety offered by online retailers, which cater to the growing demand for organic options. Recent statistics indicate that online sales of organic chocolate have increased by over 20% in the past year, highlighting the shift in consumer purchasing behavior. As e-commerce continues to expand, it is likely to play a pivotal role in shaping the future of The Global Organic Chocolate Industry, enabling brands to reach a wider audience.

Flavor Innovation

Flavor innovation serves as a crucial driver for The Global Organic Chocolate Industry, as manufacturers strive to differentiate their products in a competitive landscape. The introduction of unique flavor combinations and exotic ingredients is becoming increasingly popular, appealing to adventurous consumers. Recent market analysis indicates that the demand for dark chocolate varieties, infused with spices or superfoods, has surged, reflecting a shift in consumer preferences towards more complex taste profiles. This trend not only enhances the sensory experience but also aligns with the growing interest in gourmet and artisanal products. As brands continue to experiment with flavors, the potential for growth in The Global Organic Chocolate Industry appears promising, with consumers eager to explore new and exciting offerings.

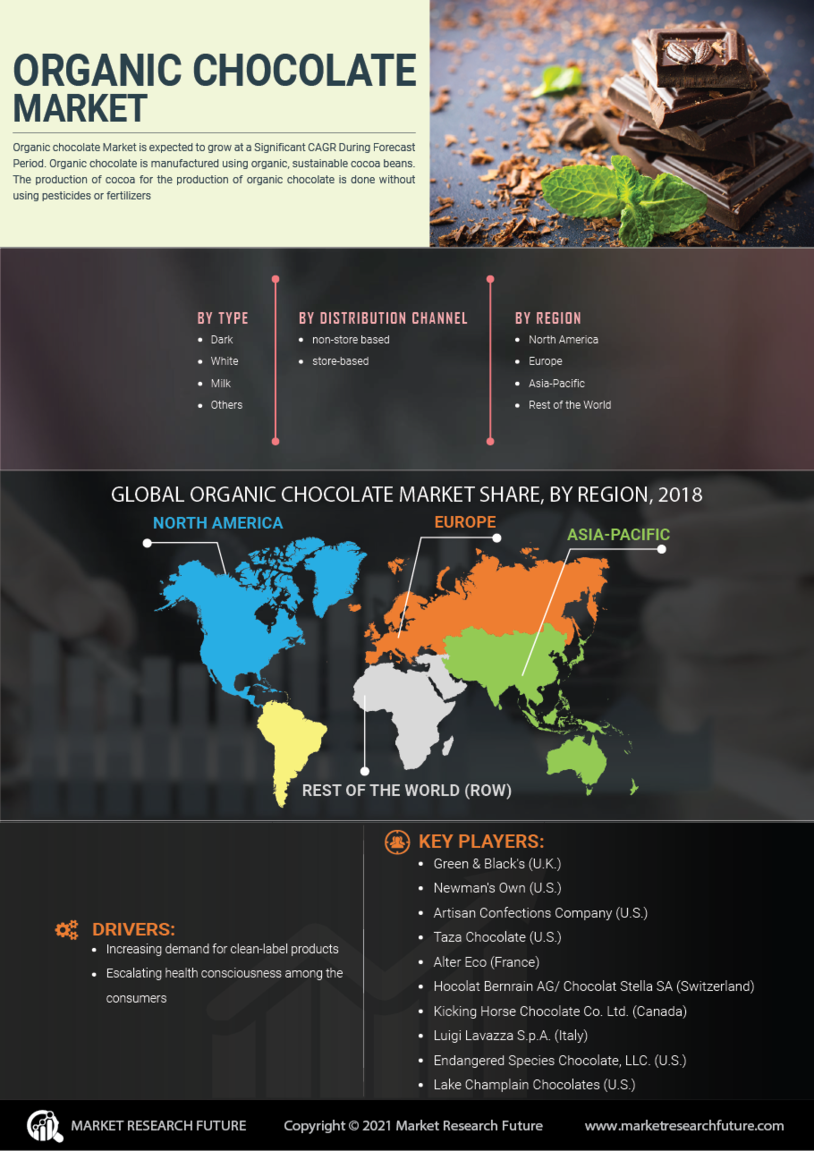

Sustainability Focus

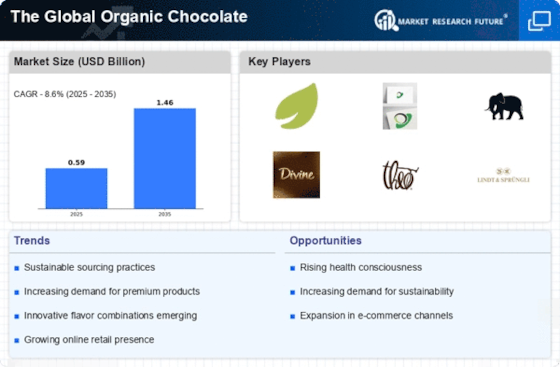

The increasing emphasis on sustainability is a pivotal driver for The Global Organic Chocolate Industry. Consumers are becoming more aware of the environmental impact of their purchases, leading to a surge in demand for products that are ethically sourced and produced. This trend is reflected in the growing number of certifications for organic chocolate, which often include sustainable farming practices. According to recent data, the organic chocolate segment has seen a compound annual growth rate of approximately 8% over the past few years, indicating a robust market response to sustainability initiatives. As brands adopt eco-friendly packaging and transparent supply chains, they are likely to attract a more conscientious consumer base, further propelling the growth of The Global Organic Chocolate Industry.

Health-Conscious Choices

The rising trend of health-conscious choices among consumers is significantly influencing The Global Organic Chocolate Industry. With an increasing number of individuals prioritizing their health and wellness, organic chocolate, which is often perceived as a healthier alternative to conventional chocolate, is gaining traction. The market has witnessed a notable increase in demand for products that are free from artificial additives and high in antioxidants. Recent statistics suggest that organic chocolate sales have risen by over 15% in the last year, as consumers seek indulgent yet healthier options. This shift towards health-oriented products is likely to continue, as more brands innovate to meet the evolving preferences of health-conscious consumers, thereby enhancing the appeal of The Global Organic Chocolate Industry.