Technological Advancements in Robotics

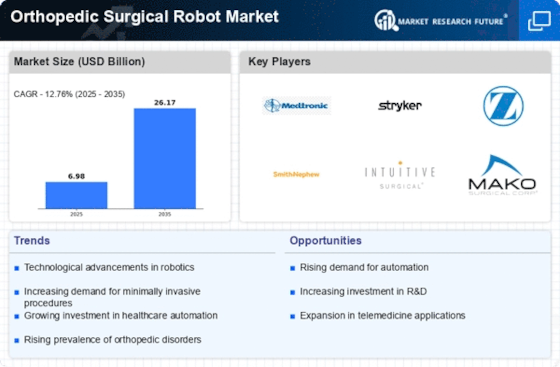

The Orthopedic Surgical Robot Market is experiencing a surge in technological advancements, which are enhancing the precision and efficiency of surgical procedures. Innovations such as artificial intelligence and machine learning are being integrated into robotic systems, allowing for improved preoperative planning and intraoperative navigation. These advancements are not only streamlining surgical workflows but also reducing the risk of complications. According to recent data, the market for orthopedic surgical robots is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is indicative of the increasing reliance on advanced technologies in orthopedic surgeries, as healthcare providers seek to improve patient outcomes and operational efficiencies.

Investment in Healthcare Infrastructure

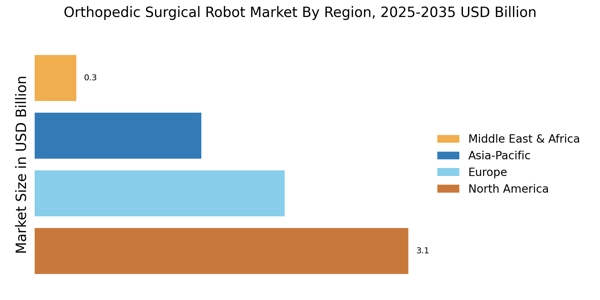

The Orthopedic Surgical Robot Market is benefiting from increased investment in healthcare infrastructure, particularly in developing regions. Governments and private entities are recognizing the importance of advanced surgical technologies in improving healthcare delivery. This investment is facilitating the acquisition of orthopedic surgical robots, which are becoming integral to modern surgical suites. Market data suggests that healthcare spending is projected to rise significantly, with a focus on innovative technologies that enhance surgical capabilities. As healthcare facilities upgrade their infrastructure, the demand for robotic-assisted surgeries is likely to increase, further driving the growth of the orthopedic surgical robot market.

Rising Demand for Minimally Invasive Surgeries

The Orthopedic Surgical Robot Market is witnessing a rising demand for minimally invasive surgical techniques, which are associated with reduced recovery times and lower complication rates. As patients increasingly prefer procedures that minimize trauma and expedite healing, orthopedic surgical robots are becoming essential tools in achieving these goals. The market data suggests that minimally invasive surgeries are expected to account for a significant portion of orthopedic procedures in the coming years. This trend is driving the adoption of robotic systems that facilitate precision and control during surgery, thereby enhancing the overall patient experience and satisfaction.

Collaborative Research and Development Initiatives

The Orthopedic Surgical Robot Market is being propelled by collaborative research and development initiatives among medical institutions, technology companies, and academic organizations. These partnerships are fostering innovation in robotic technologies, leading to the development of more sophisticated and effective surgical systems. The emphasis on research is evident, as numerous studies are being conducted to explore the efficacy of robotic-assisted surgeries in various orthopedic applications. This collaborative approach not only accelerates technological advancements but also enhances the credibility and acceptance of robotic systems in clinical settings. As a result, the orthopedic surgical robot market is likely to expand, driven by the continuous evolution of surgical robotics.

Aging Population and Increased Orthopedic Disorders

The Orthopedic Surgical Robot Market is significantly influenced by the aging population, which is more susceptible to orthopedic disorders such as arthritis and osteoporosis. As the demographic shifts towards an older population, the demand for orthopedic surgeries is expected to rise correspondingly. Data indicates that by 2030, the number of individuals aged 65 and older will reach approximately 1.5 billion, leading to an increased need for surgical interventions. This demographic trend is propelling the adoption of orthopedic surgical robots, as they offer enhanced precision and improved surgical outcomes, thereby addressing the growing healthcare needs of the elderly.