Growth in E-commerce and Retail Sectors

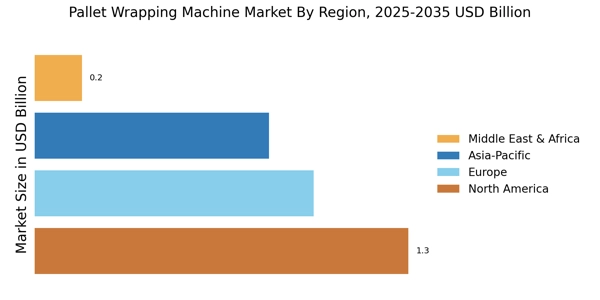

The Pallet Wrapping Machine Market is significantly influenced by the expansion of the e-commerce and retail sectors. As online shopping continues to gain traction, the demand for efficient packaging solutions that can handle high volumes of products is increasing. Retailers are increasingly investing in automated packaging systems to streamline their operations and meet consumer expectations for quick delivery. The e-commerce sector alone has seen a remarkable increase in sales, which in turn propels the need for pallet wrapping machines to ensure that products are securely packaged for shipment. This trend suggests a robust future for the pallet wrapping machine market as it aligns with the growth trajectory of these sectors.

Rising Demand for Efficient Packaging Solutions

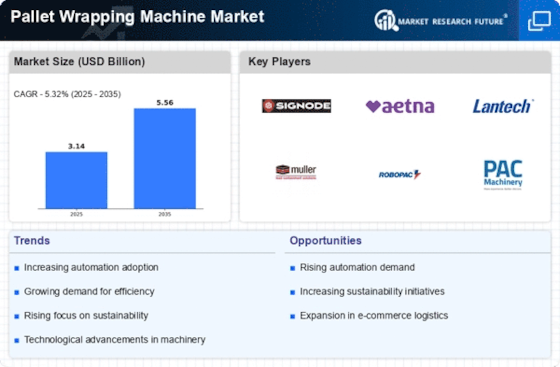

The Pallet Wrapping Machine Market is experiencing a surge in demand for efficient packaging solutions. As businesses strive to optimize their supply chains, the need for reliable and effective packaging methods becomes paramount. The increasing focus on reducing operational costs while enhancing productivity drives the adoption of pallet wrapping machines. According to recent data, the market for pallet wrapping machines is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. This growth is indicative of the industry's response to the evolving needs of manufacturers and distributors who require robust packaging solutions to ensure product integrity during transportation.

Technological Advancements in Packaging Machinery

The Pallet Wrapping Machine Market is benefiting from rapid technological advancements in packaging machinery. Innovations such as automated wrapping systems, smart sensors, and IoT integration are enhancing the efficiency and effectiveness of pallet wrapping processes. These advancements not only improve the speed of operations but also reduce material waste, contributing to cost savings for businesses. The introduction of advanced features, such as adjustable wrapping tension and programmable settings, allows for greater flexibility in packaging operations. As manufacturers continue to invest in state-of-the-art technology, the pallet wrapping machine market is likely to witness substantial growth, driven by the demand for more sophisticated packaging solutions.

Focus on Sustainability and Eco-friendly Practices

The Pallet Wrapping Machine Market is increasingly aligning with sustainability and eco-friendly practices. As environmental concerns gain prominence, businesses are seeking packaging solutions that minimize waste and utilize recyclable materials. The shift towards sustainable packaging is prompting manufacturers to develop pallet wrapping machines that use biodegradable films and reduce plastic consumption. This trend is not only beneficial for the environment but also appeals to consumers who prefer brands that prioritize sustainability. The growing emphasis on eco-friendly practices is expected to drive innovation within the pallet wrapping machine market, as companies strive to meet regulatory requirements and consumer expectations for sustainable packaging.

Expansion of Manufacturing and Logistics Industries

The Pallet Wrapping Machine Market is closely tied to the expansion of manufacturing and logistics industries. As these sectors grow, the demand for efficient packaging solutions that can handle increased production volumes becomes critical. The rise in global trade and the need for effective supply chain management are further propelling the adoption of pallet wrapping machines. With manufacturers seeking to enhance their operational efficiency, the integration of automated packaging solutions is becoming a strategic priority. This trend indicates a promising outlook for the pallet wrapping machine market, as it aligns with the broader growth of manufacturing and logistics operations.