Regulatory Support

Regulatory frameworks promoting the use of lightweight and recyclable materials are influencing the PET Foam Market positively. Governments worldwide are implementing policies aimed at reducing plastic waste and encouraging the adoption of sustainable materials. These regulations often favor the use of PET foam due to its recyclability and lower environmental impact compared to traditional materials. In 2025, the market is likely to benefit from these supportive policies, as industries seek compliance with environmental standards. Furthermore, incentives for using eco-friendly materials may drive manufacturers to invest in PET foam technologies, enhancing production capabilities and product offerings. This regulatory support not only fosters market growth but also encourages innovation within the PET Foam Market sector, as companies strive to meet evolving standards and consumer expectations.

Diverse Application Range

The versatility of PET foam is a significant driver for the PET Foam Market. Its applications span various sectors, including automotive, aerospace, construction, and packaging. In 2025, the automotive sector is expected to account for a substantial share of the market, as manufacturers increasingly utilize PET foam for lightweight components that enhance fuel efficiency. Additionally, the construction industry is adopting PET foam for insulation and structural applications, given its excellent thermal properties. The packaging sector also benefits from PET foam's lightweight and durable characteristics, making it an ideal choice for protective packaging solutions. This diverse application range not only broadens the market's reach but also mitigates risks associated with reliance on a single industry. As industries continue to explore innovative uses for PET foam, the market is poised for sustained growth.

Technological Innovations

Technological advancements play a crucial role in propelling the PET Foam Market forward. Innovations in manufacturing processes, such as improved polymerization techniques and enhanced production efficiency, have led to higher quality products at reduced costs. In recent years, the introduction of advanced composite materials has expanded the application scope of PET foam, particularly in aerospace and automotive sectors. The market is expected to grow as these sectors increasingly adopt lightweight materials to improve fuel efficiency and performance. Furthermore, ongoing research and development efforts are likely to yield new formulations of PET foam that offer superior properties, such as enhanced thermal resistance and mechanical strength. This continuous evolution in technology is anticipated to create new opportunities within the PET Foam Market, driving demand and fostering competitive advantages.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the PET Foam Market. As industries strive to reduce their carbon footprint, the demand for eco-friendly materials has surged. PET foam, being recyclable and lightweight, aligns well with these sustainability goals. In 2025, the market is projected to witness a growth rate of approximately 5.2%, driven by the rising adoption of sustainable practices across various sectors. Companies are increasingly opting for PET foam in applications such as packaging and construction, where environmental impact is a significant concern. This shift not only enhances brand reputation but also meets regulatory requirements aimed at reducing plastic waste. The focus on sustainability is likely to continue shaping the PET Foam Market, as consumers and businesses alike prioritize environmentally responsible choices.

Growing Demand in Emerging Markets

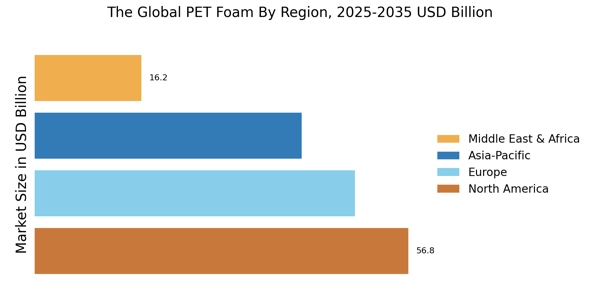

Emerging markets are becoming increasingly important for the PET Foam Market, as economic growth and urbanization drive demand for lightweight and durable materials. Countries in Asia-Pacific and Latin America are witnessing a surge in construction and automotive activities, leading to heightened interest in PET foam applications. In 2025, the market in these regions is expected to expand significantly, fueled by rising disposable incomes and changing consumer preferences. The automotive industry, in particular, is likely to adopt PET foam for its lightweight properties, which contribute to improved fuel efficiency. Additionally, the construction sector is embracing PET foam for insulation and structural applications, aligning with global sustainability trends. This growing demand in emerging markets presents substantial opportunities for manufacturers, as they seek to establish a foothold in these rapidly developing economies.

Leave a Comment