Growing Environmental Regulations

The Pigging Service Market is increasingly influenced by growing environmental regulations aimed at reducing the ecological impact of pipeline operations. Regulatory bodies are imposing stricter guidelines on emissions and waste management, compelling operators to adopt more sustainable practices. This shift is driving the demand for pigging services, which play a crucial role in minimizing leaks and ensuring compliance with environmental standards. The market for environmental compliance solutions is projected to grow, with estimates indicating a potential increase of 15% annually. As companies strive to meet these regulations, the Pigging Service Market is likely to see heightened demand for services that support environmental stewardship and operational compliance.

Increasing Demand for Pipeline Integrity

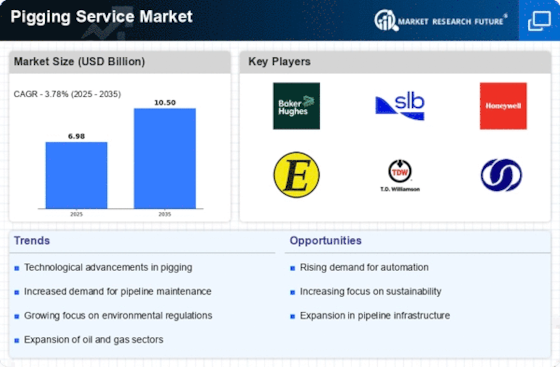

The Pigging Service Market is experiencing a notable surge in demand for pipeline integrity management. As industries such as oil and gas, water, and chemicals expand, the need for maintaining pipeline efficiency and safety becomes paramount. According to recent data, The Pigging Service Market is projected to reach USD 20 billion by 2026, indicating a robust growth trajectory. This growth is largely driven by the increasing focus on preventing leaks and ensuring compliance with safety regulations. Consequently, pigging services, which facilitate the cleaning and inspection of pipelines, are becoming essential. The Pigging Service Market is thus positioned to benefit from this trend, as operators seek to enhance the reliability and longevity of their pipeline systems.

Technological Innovations in Pigging Solutions

The Pigging Service Market is witnessing a wave of technological innovations that enhance the efficiency and effectiveness of pigging operations. Advancements in smart pigging technologies, such as the integration of IoT and AI, are revolutionizing the way pipelines are monitored and maintained. These innovations allow for real-time data collection and analysis, enabling operators to make informed decisions regarding pipeline integrity. The market for smart pigging solutions is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% through 2027. As these technologies become more prevalent, the Pigging Service Market is likely to expand, driven by the demand for more sophisticated and reliable pigging services.

Expansion of Oil and Gas Exploration Activities

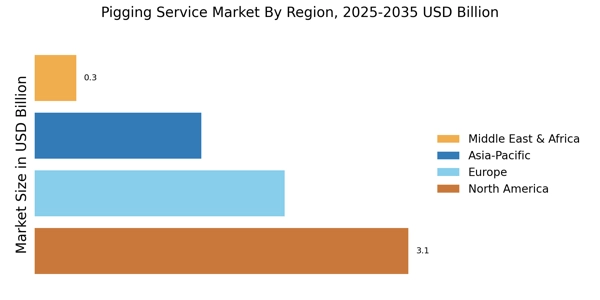

The Pigging Service Market is benefiting from the expansion of oil and gas exploration activities, particularly in untapped regions. As energy companies seek to discover new reserves, the need for efficient pipeline systems becomes critical. The U.S. Energy Information Administration has reported that global oil production is expected to rise by 10% by 2027, necessitating enhanced pipeline infrastructure. This growth in exploration activities is likely to drive demand for pigging services, as operators require effective solutions for maintaining pipeline integrity and performance. The Pigging Service Market is thus positioned to capitalize on this trend, as the expansion of exploration efforts creates a greater need for reliable pigging solutions.

Rising Investment in Infrastructure Development

The Pigging Service Market is poised for growth due to rising investments in infrastructure development across various sectors. Governments and private entities are increasingly allocating funds for the construction and maintenance of pipelines, particularly in emerging economies. For instance, the International Energy Agency has reported that investment in oil and gas infrastructure is expected to exceed USD 1 trillion by 2025. This influx of capital is likely to drive demand for pigging services, as operators require efficient solutions for pipeline maintenance and optimization. The Pigging Service Market stands to gain from this trend, as enhanced infrastructure necessitates advanced pigging technologies to ensure operational efficiency and safety.