Regulatory Compliance and Safety Standards

The Pipeline Pigging Equipment Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are imposing rigorous guidelines to ensure the safe operation of pipelines, particularly in the oil and gas sector. Compliance with these regulations necessitates the use of advanced pigging equipment to detect leaks, corrosion, and other potential hazards. The market is expected to witness a steady increase as companies prioritize safety and environmental protection. In fact, the investment in pigging technologies is projected to reach USD 1.5 billion by 2026, driven by the need to adhere to these regulations. This trend underscores the critical role of pigging equipment in maintaining pipeline integrity and operational safety.

Growing Focus on Environmental Sustainability

The Pipeline Pigging Equipment Market is increasingly influenced by a growing focus on environmental sustainability. As industries face mounting pressure to reduce their carbon footprint and minimize environmental impact, the role of pigging equipment becomes crucial. Efficient pigging operations contribute to reduced product loss and lower emissions, aligning with sustainability goals. Companies are investing in eco-friendly pigging solutions that not only enhance operational efficiency but also support environmental compliance. The market is expected to see a rise in demand for sustainable pigging technologies, with projections indicating a potential growth rate of 5.5% over the next few years. This trend reflects a broader commitment within the industry to adopt practices that promote environmental stewardship.

Technological Innovations in Pigging Solutions

The Pipeline Pigging Equipment Market is benefiting from technological innovations that enhance pigging solutions. Advancements in materials, design, and automation are leading to the development of more efficient and effective pigging equipment. For instance, the introduction of smart pigs equipped with advanced sensors allows for real-time monitoring of pipeline conditions, significantly improving maintenance strategies. This technological evolution is expected to drive market growth, as companies increasingly adopt these innovative solutions to optimize their operations. The market is projected to grow by approximately 6% annually, driven by the demand for enhanced performance and reliability in pigging operations. Such innovations are likely to redefine industry standards and practices.

Rising Investments in Oil and Gas Infrastructure

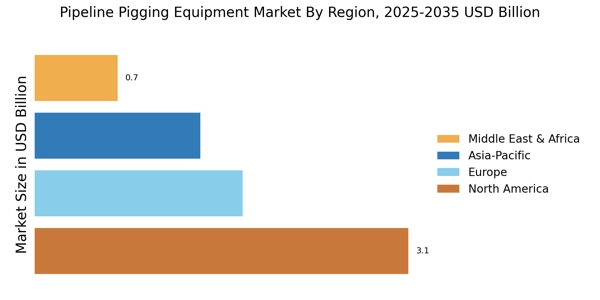

The Pipeline Pigging Equipment Market is poised for growth due to rising investments in oil and gas infrastructure. As countries seek to enhance their energy security and meet growing energy demands, substantial capital is being allocated to develop and maintain pipeline networks. This trend is particularly evident in emerging markets, where infrastructure development is accelerating. The market for pipeline pigging equipment is anticipated to expand as operators seek to ensure the reliability and efficiency of their systems. With an estimated investment of over USD 200 billion in pipeline infrastructure expected in the next five years, the demand for pigging solutions is likely to increase, reflecting the industry's commitment to maintaining operational excellence.

Increasing Demand for Efficient Pipeline Operations

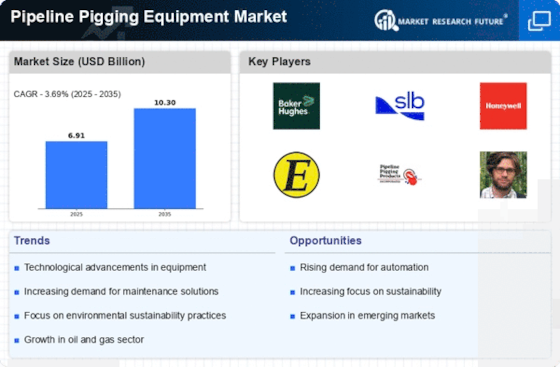

The Pipeline Pigging Equipment Market is experiencing a surge in demand for efficient pipeline operations. As industries strive to enhance productivity and reduce operational costs, the need for effective cleaning and maintenance solutions becomes paramount. The market is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. This growth is driven by the increasing complexity of pipeline systems and the necessity for regular maintenance to prevent costly downtimes. Companies are investing in advanced pigging technologies to ensure optimal flow rates and minimize product loss. Consequently, the demand for innovative pigging equipment is likely to rise, reflecting a broader trend towards operational efficiency in the pipeline sector.