North America : Defense Innovation Leader

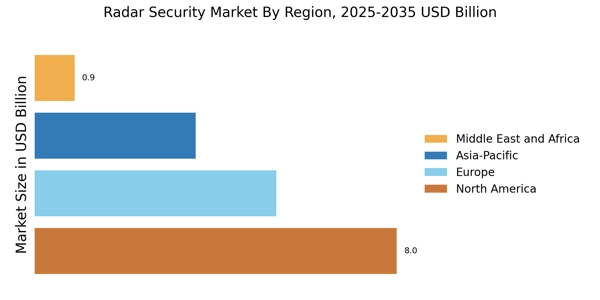

North America is the largest market for radar security, holding approximately 45% of the global share. The region's growth is driven by increasing defense budgets, technological advancements, and a focus on national security. Regulatory support from government agencies, including the Department of Defense, further catalyzes market expansion. The demand for advanced radar systems is also fueled by rising threats and the need for enhanced surveillance capabilities.

The United States is the leading country in this region, with major players like Lockheed Martin, Northrop Grumman, and Raytheon Technologies dominating the landscape. These companies are at the forefront of innovation, developing cutting-edge radar technologies. The competitive environment is characterized by significant investments in R&D and strategic partnerships, ensuring that North America remains a hub for radar security advancements.

Europe : Emerging Defense Collaborations

Europe is witnessing a significant increase in radar security investments, holding around 30% of the global market share. The region's growth is driven by collaborative defense initiatives among EU nations, rising geopolitical tensions, and a focus on enhancing border security. Regulatory frameworks, such as the European Defense Fund, are pivotal in supporting research and development in radar technologies, fostering innovation and cooperation among member states.

Key players in Europe include Thales Group, BAE Systems, and Leonardo S.p.A., which are actively involved in developing advanced radar systems. Countries like France, Germany, and the UK are leading the charge, with substantial investments in defense technology. The competitive landscape is marked by partnerships and joint ventures aimed at enhancing capabilities and addressing emerging security challenges.

Asia-Pacific : Rapidly Growing Defense Sector

Asia-Pacific is emerging as a significant player in the radar security market, accounting for approximately 20% of the global share. The region's growth is driven by increasing military expenditures, territorial disputes, and the modernization of defense systems. Countries are investing heavily in advanced radar technologies to enhance surveillance and reconnaissance capabilities, supported by favorable government policies and initiatives aimed at boosting domestic manufacturing.

Leading countries in this region include China, India, and Japan, with a competitive landscape featuring key players like Elbit Systems and Hensoldt. The market is characterized by rapid technological advancements and a focus on indigenous development. As nations prioritize national security, the demand for sophisticated radar systems is expected to rise, further solidifying Asia-Pacific's position in the global market.

Middle East and Africa : Strategic Defense Investments

The Middle East and Africa region is increasingly prioritizing radar security, holding about 5% of the global market share. The growth is driven by rising security threats, regional conflicts, and a focus on modernizing defense capabilities. Governments are investing in advanced radar systems to enhance surveillance and border security, supported by international partnerships and defense collaborations aimed at improving regional stability.

Countries like the UAE, Saudi Arabia, and South Africa are leading the market, with significant investments in defense technology. The competitive landscape includes key players such as Saab AB and other local firms. As nations in this region seek to bolster their defense capabilities, the demand for radar security solutions is expected to grow, reflecting a strategic shift towards enhanced security measures.