Increased Focus on Home Aesthetics

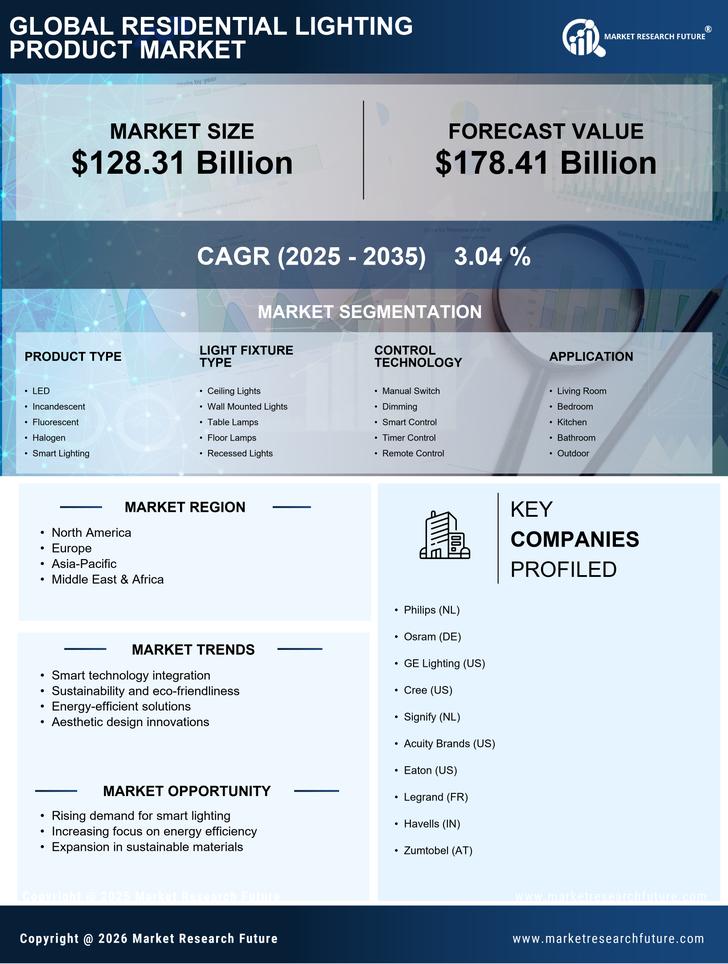

The Residential Lighting Product Market is witnessing a heightened focus on home aesthetics, as consumers increasingly prioritize the visual appeal of their living spaces. Lighting is recognized not only for its functional role but also for its ability to enhance the ambiance and design of a home. Market data indicates that decorative lighting products, such as chandeliers and pendant lights, are experiencing a surge in popularity, with sales projected to rise by 15% by 2025. This trend is further fueled by the influence of social media platforms, where home decor trends are rapidly disseminated. As consumers seek to create personalized and visually appealing environments, the demand for stylish and innovative lighting solutions is likely to grow, positively impacting the Residential Lighting Product Market.

Government Initiatives and Regulations

Government initiatives and regulations aimed at promoting energy efficiency and sustainability are significantly influencing the Residential Lighting Product Market. Various countries have implemented policies to phase out incandescent bulbs and encourage the adoption of energy-efficient lighting solutions. For instance, regulations mandating minimum energy performance standards for lighting products are becoming increasingly common. These initiatives not only drive consumer awareness but also create a favorable environment for manufacturers to innovate and invest in energy-efficient technologies. Market data suggests that regions with stringent regulations are witnessing faster growth in the adoption of LED lighting solutions. Consequently, government initiatives and regulations are likely to play a pivotal role in shaping the future of the Residential Lighting Product Market, fostering a transition towards more sustainable lighting practices.

Growing Demand for Sustainable Products

The Residential Lighting Product Market experiences a notable shift towards sustainability, driven by increasing consumer awareness regarding environmental issues. As more individuals seek eco-friendly solutions, manufacturers are responding by developing energy-efficient lighting options, such as LED bulbs, which consume significantly less energy compared to traditional incandescent bulbs. This trend is reflected in market data, indicating that the LED segment is projected to account for over 60% of the total residential lighting market by 2025. The emphasis on sustainability not only aligns with consumer preferences but also supports regulatory initiatives aimed at reducing carbon footprints. Consequently, the growing demand for sustainable products is likely to propel the Residential Lighting Product Market forward, fostering innovation and competition among manufacturers.

Rising Urbanization and Housing Developments

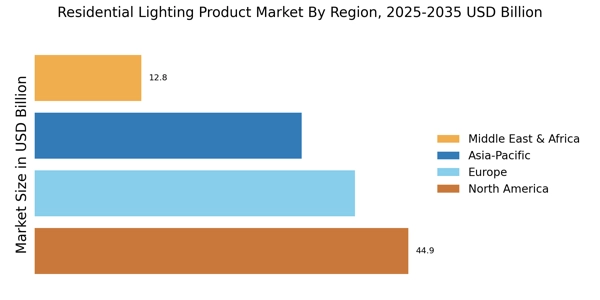

The ongoing trend of urbanization significantly impacts the Residential Lighting Product Market. As populations migrate towards urban areas, the demand for housing and, consequently, residential lighting products increases. Recent statistics indicate that urban areas are expected to house nearly 70% of the global population by 2050, leading to a surge in new residential constructions. This growth in housing developments creates opportunities for lighting manufacturers to supply innovative and aesthetically pleasing lighting solutions. Furthermore, builders and developers are increasingly incorporating energy-efficient lighting into their projects to meet consumer expectations and regulatory standards. Thus, the rising urbanization trend is likely to drive the Residential Lighting Product Market, fostering growth and diversification in product offerings.

Technological Advancements in Lighting Solutions

Technological advancements play a crucial role in shaping the Residential Lighting Product Market. Innovations such as smart lighting systems, which allow users to control their lighting remotely via smartphones or voice-activated devices, are gaining traction. The integration of Internet of Things (IoT) technology into lighting solutions enhances user experience and energy management. Market data suggests that the smart lighting segment is expected to grow at a compound annual growth rate of over 20% through 2025. This rapid growth indicates a shift in consumer preferences towards more interactive and customizable lighting options. As technology continues to evolve, the Residential Lighting Product Market is likely to witness an influx of new products that cater to the demands of tech-savvy consumers.