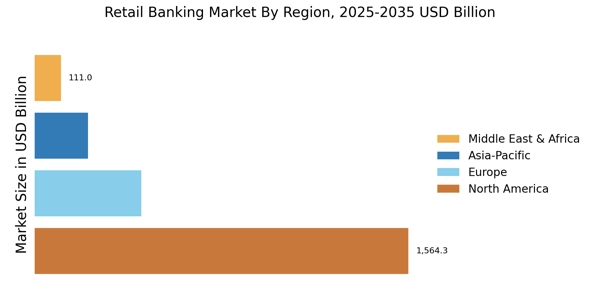

North America : Market Leader in Retail Banking Market

North America remains the largest market for retail banking, driven by a robust economy, high consumer spending, advanced technological adoption and strong banks market share concentration. The U.S. holds approximately 70% of the market share, with Canada following at around 15%. Regulatory frameworks, such as the Dodd-Frank Act, ensure consumer protection and promote transparency, further enhancing market stability. The competitive landscape is characterized by major players like JPMorgan Chase, Bank of America, and Wells Fargo, which dominate the sector. These institutions leverage technology to offer innovative services, such as mobile banking and personalized financial solutions. The presence of these key players fosters a dynamic environment, encouraging smaller banks to enhance their offerings to remain competitive.

Europe : Evolving Banking Landscape

Europe's retail banking market is evolving, with a focus on digital transformation and regulatory compliance. The region is the second largest market, holding approximately 20% of the global share. Key drivers include the European Central Bank's policies promoting financial stability and the rise of fintech companies, which are reshaping traditional banking models. Countries like Germany and the UK lead the market, with significant investments in technology and customer experience. The competitive landscape features established banks like HSBC, BNP Paribas, and Deutsche Bank, alongside emerging fintech firms. This blend of traditional and innovative players fosters a dynamic environment, enhancing customer choice and service quality. The European Banking Authority emphasizes the importance of adapting to digital trends, ensuring that banks remain competitive in a rapidly changing market.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing rapid growth in retail banking, driven by increasing urbanization, rising disposable incomes, and a growing middle class. This region holds approximately 10% of the global market share, with China and India being the largest contributors. Regulatory support, such as the Reserve Bank of India's initiatives to promote financial inclusion, is catalyzing market expansion and innovation. Leading countries in this region include China, India, and Japan, where traditional banks are increasingly adopting digital solutions to enhance customer engagement. Key players like HSBC and UBS are expanding their presence, while local banks are also innovating to capture market share. The competitive landscape is vibrant, with a mix of established banks and agile fintech startups driving the evolution of retail banking services.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region presents significant opportunities in retail banking, with a focus on financial inclusion and technological advancement. This region holds about 5% of the global market share, with countries like South Africa and the UAE leading the way. Regulatory bodies are increasingly promoting policies that encourage banking access for underserved populations, driving demand for retail banking services. In this region, key players include local banks and international institutions, which are expanding their services to cater to a diverse customer base. The competitive landscape is characterized by a mix of traditional banks and fintech companies, which are innovating to provide tailored solutions. The emphasis on digital banking and mobile payment solutions is reshaping the market, making banking more accessible to the population.