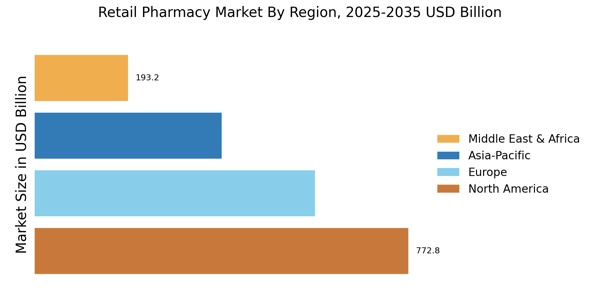

North America : Market Leader in Retail Pharmacy Market

North America is the largest market for retail pharmacy, holding approximately 40% of the global market share. Key growth drivers include an aging population, increasing chronic diseases, and a shift towards personalized medicine. Regulatory support, such as the Affordable Care Act, has also catalyzed growth by expanding access to healthcare services. The U.S. remains the largest market, followed by Canada, which contributes around 10% to the overall market share. The competitive landscape is dominated by major players like CVS Health, Walgreens Boots Alliance, and Rite Aid. These companies leverage extensive networks and advanced technology to enhance customer experience and operational efficiency. The presence of large retail chains, such as Walmart and Ahold Delhaize, further intensifies competition. The market is characterized by a trend towards consolidation, with mergers and acquisitions shaping the future landscape.

Europe : Emerging Market Dynamics

Europe is witnessing significant growth in the retail pharmacy sector, driven by increasing healthcare expenditure and a rising demand for over-the-counter medications. The region holds approximately 30% of the global market share, with Germany and the UK being the largest contributors, accounting for about 12% and 10% respectively. Regulatory frameworks, such as the European Medicines Agency guidelines, are facilitating market expansion by ensuring safety and efficacy in pharmaceutical products. Leading countries in this region include Germany, the UK, and France, with a competitive landscape featuring key players like Boots UK and Ahold Delhaize. The market is characterized by a mix of independent pharmacies and large chains, fostering a diverse competitive environment. Innovations in digital health and e-pharmacy services are also gaining traction, enhancing customer access and convenience.

Asia-Pacific : Rapid Growth and Expansion

The Asia-Pacific region is emerging as a powerhouse in the retail pharmacy market, with a growth rate projected to surpass 10% annually. This region holds approximately 20% of the global market share, with China and India leading the way, contributing around 8% and 5% respectively. Key growth drivers include increasing urbanization, rising disposable incomes, and a growing awareness of health and wellness. Regulatory initiatives aimed at improving healthcare access are also propelling market growth. China's retail pharmacy sector is characterized by a mix of traditional and modern retail formats, while India is witnessing a surge in e-pharmacy services. Major players like Cigna and local chains are expanding their footprints, enhancing competition. The market is also seeing increased investment in technology and logistics to improve service delivery and customer experience, positioning the region for sustained growth.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region presents significant growth opportunities in the retail pharmacy market, driven by increasing healthcare investments and a rising prevalence of chronic diseases. This region holds approximately 10% of the global market share, with South Africa and the UAE being the largest markets, contributing around 4% and 3% respectively. Regulatory reforms aimed at improving healthcare infrastructure are catalyzing market growth, making it an attractive destination for investment. The competitive landscape is evolving, with both local and international players vying for market share. Key players include local chains and multinational corporations, which are expanding their presence through strategic partnerships and acquisitions. The market is also witnessing a shift towards digital health solutions, enhancing accessibility and convenience for consumers, thereby driving further growth in the sector.