Research Methodology on Pharmacy Management System

1. Introduction

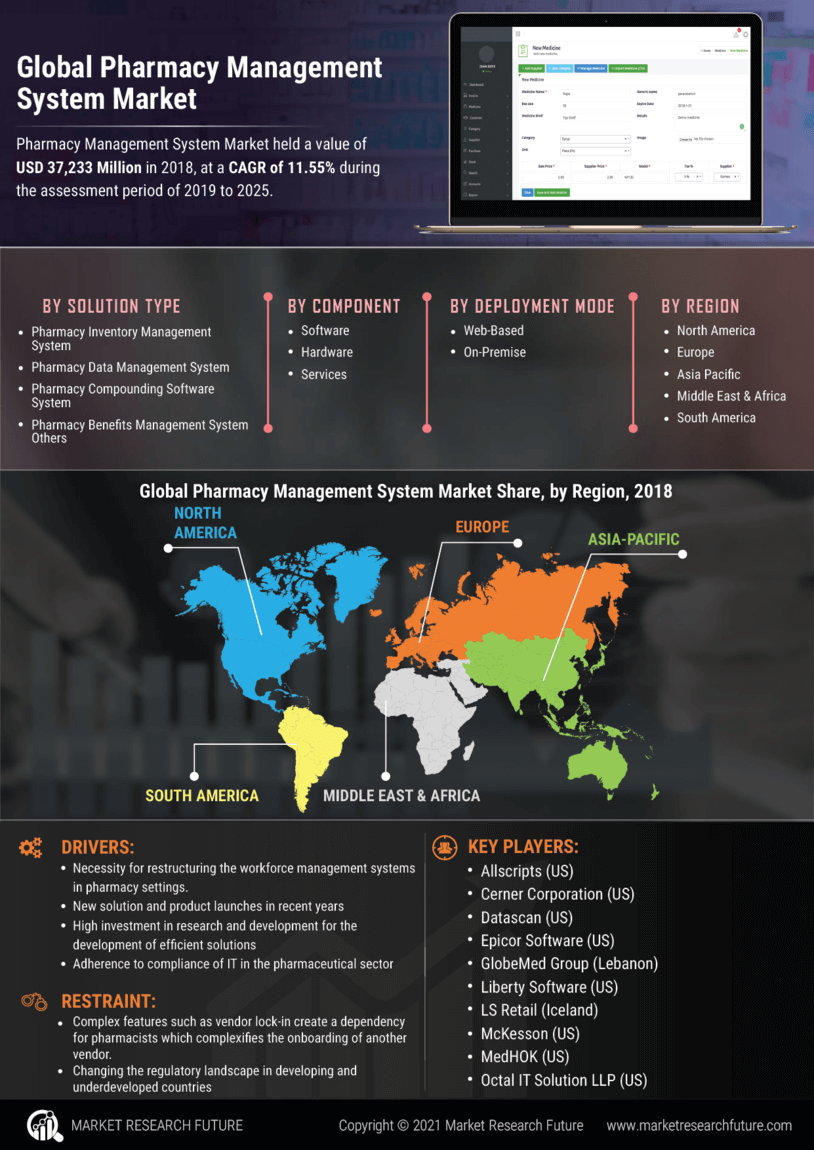

This research report takes into account the dynamics of the global pharmacy management system market. It presents a comprehensive overview of current market trends, drivers, restraints, and opportunities that shape the future of this market. The research report also focuses on the factors that contribute the most to its growth, apart from offering extended detail on the various segments of this market. Historical data and projected data about the market's market size, revenue, and contributing factors have been included in the report.

2. Primary Research

Primary research is conducted to gain comprehensive insights into the global pharmacy management system market. To collect primary data, interviews were conducted with pharmaceutical professionals, pharmacy system vendors, and healthcare professionals across the globe. The primary research also includes an online survey and analysis of economic reports, white papers, and other healthcare industry archives.

3. Secondary Research

Secondary research has been carried out to gain meaningful insights into the global market. Published sources such as market studies and periodicals, industry trade journals, and published articles have been scanned thoroughly to gain a detailed understanding of the market. Statistical data regarding the past, present and forecasted market size and trends, drivers and restraints of the market, and regional market analysis, were obtained from paid industry databases, government websites, and regulatory bodies such as the International Association of Pharmacy System Vendors (IAPV).

4. Market Sizing

The market size and forecast of the global pharmacy management system market were estimated using a top-down and bottom-up approach after data triangulation. The bottom-up approach was used to calculate the market size from the revenue generated by the key players operating in the market. The top-down approach was used to validate the data gathered from the bottom-up approach.

5. Market Segmentation

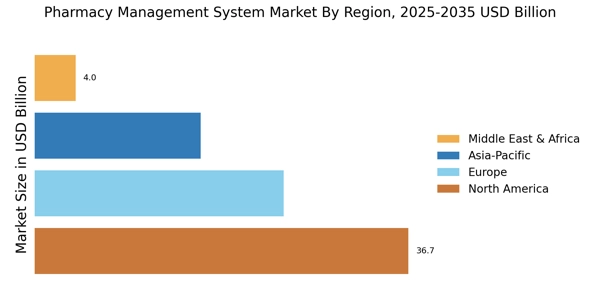

The global market has been segmented according to product types and geographic regions. The product type includes ambulatory pharmacy systems, retail pharmacy systems, hospital pharmacy systems, and others. The geographic regions include North America, Europe, Asia-Pacific, and the Rest of the World.

6. Data Validation and Triangulation

Data is triangulated by studying the various elements from both the supply and demand sides. The research process also included a validation process to check the accuracy of the data obtained from the primary and secondary research.

7. Modelling and Forecasting

The market forecasting model employed in this research paper was subject to a series of validation exercises to test for statistical significance and accuracy. The market size estimated for the various segments of the market was validated using both qualitative and quantitative methods. The quantitative methods used the revenue generated from the product types and geographic regions. The qualitative methods included attended industry and quarter-on-quarter surveys to gauge the reliability of the generated data.

8. Assumptions

The research process was subject to several assumptions and limitations. Additionally, the research was subjected to certain assumptions such as the current market trend, size, and market growth are likely to continue in the forecast period.