Government Initiatives and Support

The India pharmacy management system market is significantly influenced by various government initiatives aimed at improving healthcare infrastructure. The Indian government has been actively promoting digital health solutions through policies such as the National Digital Health Mission (NDHM). This initiative encourages the adoption of technology in healthcare, including pharmacy management systems. By providing financial incentives and support for technology integration, the government is fostering an environment conducive to the growth of the pharmacy management system market. Furthermore, the government's focus on enhancing healthcare accessibility and quality is likely to propel the demand for advanced pharmacy management solutions, thereby driving the industry forward.

Increasing Competition Among Pharmacies

The India pharmacy management system market is also being driven by increasing competition among pharmacies. As the number of pharmacies continues to rise, there is a pressing need for these establishments to differentiate themselves through superior service and operational efficiency. Pharmacy management systems provide the tools necessary for pharmacies to enhance their service offerings, manage customer relationships, and streamline operations. This competitive landscape is pushing pharmacies to adopt advanced management systems to remain relevant and profitable. Consequently, the increasing competition among pharmacies is a vital driver for the growth of the pharmacy management system market in India.

Technological Advancements in Healthcare

The India pharmacy management system market is witnessing rapid technological advancements that are reshaping the landscape of pharmacy operations. Innovations such as artificial intelligence, machine learning, and data analytics are being integrated into pharmacy management systems, enhancing their functionality and efficiency. These technologies enable pharmacies to optimize inventory management, predict demand, and improve customer service. The adoption of such advanced technologies is expected to increase, with the market projected to reach a valuation of USD 500 million by 2028. This trend indicates that technological advancements are a significant driver of growth in the India pharmacy management system market.

Rising Demand for Efficient Pharmacy Operations

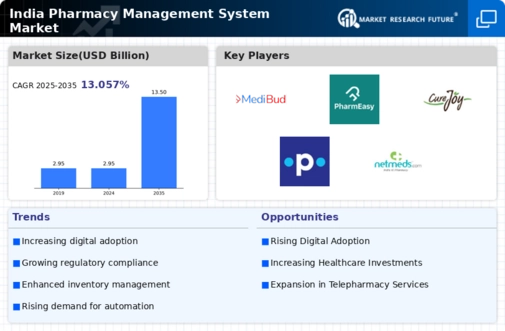

The India pharmacy management system market is experiencing a notable surge in demand for efficient pharmacy operations. As the healthcare sector expands, pharmacies are increasingly seeking solutions that streamline their processes. This demand is driven by the need to reduce operational costs and enhance service delivery. According to recent estimates, the pharmacy management software market in India is projected to grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years. This growth is indicative of the industry's shift towards automation and digital solutions, which are essential for managing inventory, prescriptions, and patient records effectively. Consequently, the rising demand for efficient pharmacy operations is a key driver in the India pharmacy management system market.

Growing Emphasis on Patient Safety and Compliance

In the India pharmacy management system market, there is an increasing emphasis on patient safety and regulatory compliance. Pharmacies are under pressure to adhere to stringent regulations set forth by the Central Drugs Standard Control Organization (CDSCO) and other regulatory bodies. This has led to a heightened need for pharmacy management systems that ensure compliance with these regulations while also safeguarding patient data. The integration of features such as electronic prescriptions and automated reporting can significantly enhance compliance and reduce the risk of errors. As a result, the focus on patient safety and compliance is a critical driver for the growth of the pharmacy management system market in India.