Increasing Urbanization

The rapid pace of urbanization is a pivotal driver for the Road Construction Machinery Market. As populations migrate to urban areas, the demand for infrastructure development intensifies. This trend necessitates the construction of roads, bridges, and other essential facilities, thereby propelling the need for advanced road construction machinery. According to recent data, urban areas are expected to house nearly 68% of the world's population by 2050, which could lead to a substantial increase in infrastructure projects. Consequently, manufacturers of road construction machinery are likely to experience heightened demand for their products, as urban planners and governments prioritize efficient and durable construction solutions to accommodate growing populations.

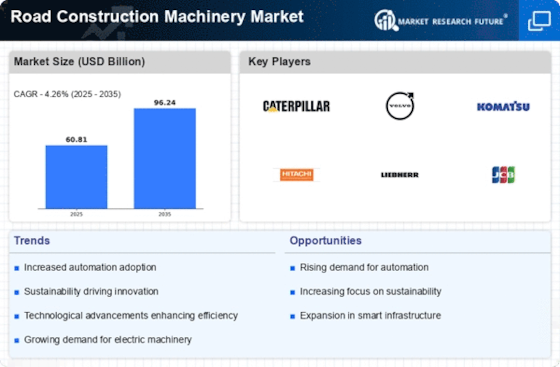

Technological Innovations

Technological innovations are transforming the Road Construction Machinery Market, leading to enhanced efficiency and productivity. The integration of advanced technologies such as automation, telematics, and artificial intelligence in road construction machinery is becoming more prevalent. These innovations not only improve operational efficiency but also reduce labor costs and construction time. For example, the adoption of smart machinery equipped with sensors allows for real-time monitoring and data analysis, which can optimize construction processes. As a result, companies that invest in these technologies are likely to gain a competitive edge, thereby driving the overall growth of the road construction machinery market.

Global Supply Chain Dynamics

The dynamics of The Road Construction Machinery Industry. Fluctuations in material costs, availability of components, and logistics challenges can impact the production and distribution of road construction machinery. Recent trends indicate that supply chain disruptions have led to increased lead times and costs for manufacturers. However, companies that adapt to these challenges by diversifying their supply sources and optimizing their logistics are likely to maintain a competitive advantage. As the demand for road construction machinery continues to rise, addressing supply chain issues will be crucial for manufacturers aiming to meet market needs effectively.

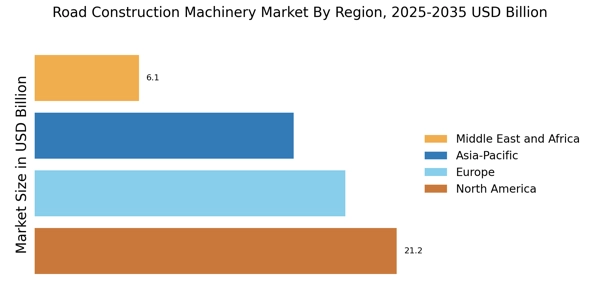

Government Initiatives and Funding

Government initiatives aimed at enhancing infrastructure are crucial for the Road Construction Machinery Market. Various countries are allocating significant budgets to improve transportation networks, which includes road construction and maintenance. For instance, recent reports indicate that infrastructure spending in several regions is projected to reach trillions of dollars over the next decade. This influx of funding is likely to stimulate demand for road construction machinery, as contractors and construction firms seek to upgrade their equipment to meet the requirements of large-scale projects. Furthermore, public-private partnerships are becoming increasingly common, further driving investments in road construction and, by extension, the machinery market.

Rising Demand for Sustainable Solutions

The increasing emphasis on sustainability is reshaping the Road Construction Machinery Market. As environmental concerns gain prominence, there is a growing demand for machinery that minimizes ecological impact. This includes the development of equipment that utilizes alternative fuels, reduces emissions, and enhances energy efficiency. Recent studies suggest that the market for eco-friendly construction machinery is expanding, as companies seek to comply with stricter environmental regulations and meet consumer expectations for sustainable practices. Consequently, manufacturers are likely to invest in research and development to create innovative solutions that align with these sustainability goals, thereby driving market growth.

.png)