Aging Population

The aging population is a significant driver for the Robotic Pet Dog Market, as more elderly individuals seek companionship and emotional support. Robotic pets can provide comfort and interaction without the physical demands of caring for a live animal. Studies indicate that robotic pets can help reduce feelings of loneliness and depression among seniors, making them an attractive option for this demographic. As the global population ages, the demand for robotic companions is expected to rise. Market analysts project that by 2027, the segment of robotic pets designed specifically for elderly care could account for over 25% of total sales in the industry. This trend highlights the potential for robotic pet dogs to play a crucial role in enhancing the quality of life for older adults, thereby expanding the market's reach.

Environmental Concerns

Environmental concerns are increasingly influencing consumer choices, thereby impacting the Robotic Pet Dog Market. As awareness of sustainability grows, many consumers are looking for alternatives to traditional pets that require significant resources, such as food, water, and space. Robotic pets offer a sustainable option, as they do not contribute to the ecological footprint associated with live animals. Additionally, advancements in eco-friendly materials used in the production of robotic pets are appealing to environmentally conscious consumers. Market Research Future indicates that around 40% of potential buyers are motivated by the desire to reduce their environmental impact when considering robotic pets. This shift in consumer values is likely to drive innovation in the industry, as manufacturers strive to create more sustainable products that align with the growing demand for environmentally friendly solutions.

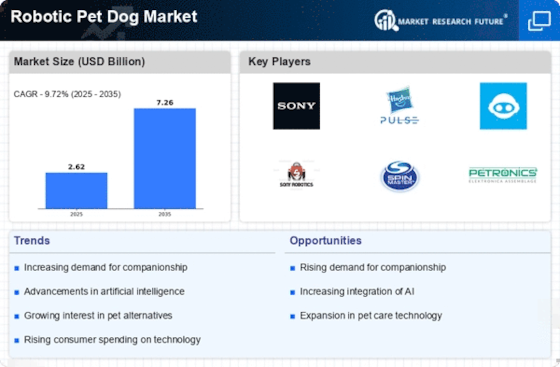

Technological Advancements

The Robotic Pet Dog Market is experiencing rapid growth due to continuous technological advancements. Innovations in artificial intelligence, machine learning, and robotics are enhancing the capabilities of robotic pets, making them more interactive and lifelike. For instance, the integration of advanced sensors allows these robotic companions to respond to human emotions and behaviors, creating a more engaging experience. According to recent data, the market is projected to grow at a compound annual growth rate of 15% over the next five years, driven by these technological improvements. As manufacturers invest in research and development, the features of robotic pet dogs are expected to expand, appealing to a broader audience. This trend indicates a shift towards more sophisticated robotic pets that can provide companionship and entertainment, thereby solidifying their place in the market.

Changing Consumer Preferences

Consumer preferences are shifting towards robotic pets as alternatives to traditional pets, significantly impacting the Robotic Pet Dog Market. Many individuals are seeking companionship without the responsibilities associated with live animals, such as feeding, grooming, and veterinary care. This trend is particularly evident among urban dwellers and busy professionals who may not have the time or space for a real pet. Market data suggests that approximately 30% of consumers are considering robotic pets for their ability to provide companionship without the associated upkeep. Furthermore, the appeal of robotic pets extends to families with children, as these devices can serve as educational tools while also offering entertainment. As consumer attitudes evolve, the demand for robotic pet dogs is likely to increase, prompting manufacturers to innovate and diversify their offerings to meet these changing needs.

Increased Investment in Robotics

Increased investment in robotics is a pivotal factor driving the Robotic Pet Dog Market. As venture capital and corporate funding pour into robotics research and development, the capabilities of robotic pets are expanding rapidly. This influx of capital enables companies to enhance the technology behind robotic pets, leading to improved functionality and user experience. Recent data shows that investment in the robotics sector has surged by over 20% in the past year, indicating a strong belief in the future potential of robotic companions. As these investments yield new innovations, the market is likely to see a wider variety of robotic pet dogs that cater to diverse consumer needs. This trend not only fosters competition among manufacturers but also encourages the development of more advanced and appealing products, further propelling market growth.