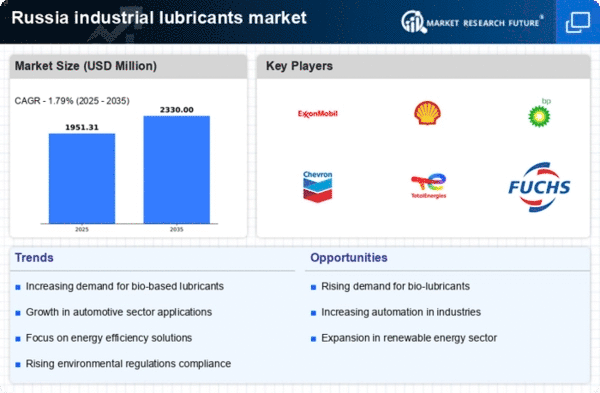

The industrial lubricants market in Russia is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as ExxonMobil (US), Shell (GB), and TotalEnergies (FR) are actively pursuing strategies that emphasize technological advancements and eco-friendly product lines. ExxonMobil (US) has focused on enhancing its product portfolio with high-performance lubricants that cater to the evolving needs of various industries, while Shell (GB) has been investing in digital transformation initiatives to optimize its supply chain and improve customer engagement. TotalEnergies (FR) appears to be leveraging its commitment to sustainability by developing bio-based lubricants, which aligns with global trends towards greener solutions. Collectively, these strategies not only enhance their market positioning but also contribute to a more competitive environment where innovation and sustainability are paramount.The business tactics employed by these companies reflect a nuanced understanding of the market's structure, which is moderately fragmented yet dominated by a few key players. Localizing manufacturing operations has become a common tactic, allowing companies to reduce costs and improve supply chain efficiency. For instance, Shell (GB) has established several local production facilities to better serve the Russian market, thereby enhancing its competitive edge. This localized approach, combined with supply chain optimization, enables these companies to respond swiftly to market demands and fluctuations, reinforcing their market presence.

In October BP (GB) announced a strategic partnership with a leading Russian technology firm to develop advanced lubricants tailored for the automotive sector. This collaboration is expected to leverage local expertise and innovation, potentially leading to the introduction of cutting-edge products that meet specific regional requirements. The strategic importance of this partnership lies in BP's ability to enhance its product offerings while simultaneously strengthening its foothold in the Russian market.

In September Fuchs Petrolub (DE) launched a new line of biodegradable lubricants aimed at reducing environmental impact. This initiative not only aligns with global sustainability goals but also positions Fuchs as a leader in eco-friendly solutions within the industrial lubricants sector. The introduction of these products is likely to attract environmentally conscious consumers and businesses, thereby expanding Fuchs' market share.Moreover, in August 2025, Chevron (US) expanded its distribution network in Russia by acquiring a local lubricant distributor. This strategic move is anticipated to enhance Chevron's market penetration and improve its service delivery capabilities. By integrating local distribution channels, Chevron can better meet customer needs and respond to market dynamics, which is crucial in a competitive landscape.

As of November the competitive trends in the industrial lubricants market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Companies are forming strategic alliances to enhance their technological capabilities and drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident. Moving forward, competitive differentiation will likely hinge on the ability to innovate and adapt to changing market conditions, with a strong emphasis on sustainable practices and advanced technologies.